Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

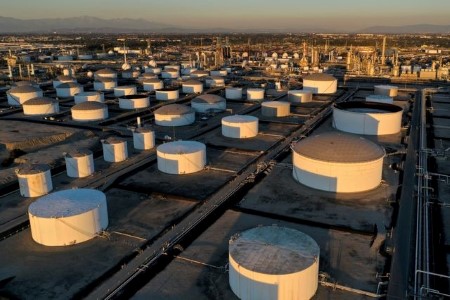

Oil slips as US crude stockpiles rise

KUALA LUMPUR, Aug 10 (Reuters) – Oil prices eased on Wednesday after industry data showed US crude inventories unexpectedly rose last week, signaling a potential hiccup in demand, though concerns over supply kept losses in check.

Brent crude futures fell 23 cents, or 0.2%, to USD 96.08 a barrel at 0323 GMT.

US West Texas Intermediate crude futures declined 28 cents, or 0.3%, to USD 90.22 a barrel.

US crude stocks rose by about 2.2 million barrels for the week ended Aug. 5, according to market sources citing American Petroleum Institute figures.

Analysts polled by Reuters had forecast that crude inventories would rise by around 100,000 barrels.

Official government data is due on Wednesday at 10:30 a.m. EDT.

“Whatever crude demand destruction that occurs from a weakening global economy won’t be able to drag down oil prices much lower given how low the supply outlook remains,” said Edward Moya, senior market analyst at OANDA.

“Much attention is falling on Iran nuclear deal talks and that could be a wildcard in providing much needed supplies.”

The European Union on Monday put forward a “final” text to revive the 2015 Iran nuclear deal which would boost Iran’s crude exports. A senior EU official said he expected a final decision on the proposal within “very, very few weeks”.

Both oil benchmarks were volatile on Tuesday, both rising and falling by more than USD 1 a barrel during the session, but they settled slightly lower as investors weighed recessionary concerns with news that some oil exports had been suspended on the Russia-to-Europe Druzhba pipeline that transits Ukraine.

Ukraine halted oil flows on the Druzhba oil pipeline to parts of central Europe because Western sanctions had prevented a payment from Moscow for transit fees from going through.

Flows along the southern route of the Druzhba pipeline have been affected while the northern route serving Poland and Germany was uninterrupted.

The Czech Republic’s pipeline company MERO said it expected Russian oil supplies through the Druzhba pipeline to the Czech Republic to restart within several days.

Adding to supplies, the operator of the giant Kashagan oilfield in Kazakhstan has started gradually restoring output after an emergency shutdown last week caused by a gas leak. The Kashagan oilfield produces about 300,000 barrels per day.

Though concerns over a potential global recession have weighed on oil futures recently, US oil refiners and pipeline operators expect energy consumption to be strong for the second half of 2022, according to a Reuters review of company earnings calls.

(Reporting by Emily Chow in Kuala Lumpur and Stephanie Kelly in New York; Editing by Shri Navaratnam and Kim Coghill)

This article originally appeared on reuters.com

By Reuters

By Reuters