January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

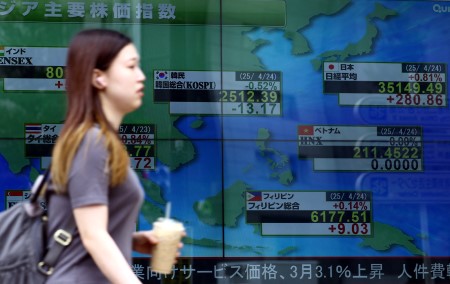

Asia draws USD 100 billion in capital as investors diversify beyond US, Goldman executive says

SINGAPORE – Asia excluding China has attracted about USD 100 billion in capital inflows over the past nine months as global investors diversify beyond the United States, Kevin Sneader, Goldman Sachs’ GS.N president for Asia-Pacific ex-Japan, said on Wednesday.

Japan has been a key beneficiary of the trend, while China’s equity rally since late last year has been driven mainly by domestic investors and interest in the technology sector, with foreign funds now taking another look at China, he said.

“There is incremental flow in this part of the world,” Sneader said at the Milken Institute Asia Summit 2025 in Singapore. “I think it’s important to put it in the context of a diversification movement, not an exit movement.”

“I think we should be cautious and not get too excited because part of that money is what I call global hedge fund money, the faster money,” he said.

“The mutual funds, longer investors, that money’s still not flowing back into China. But they’re certainly taking a hard look at Asia,” he added.

Sneader said the technology, consumer discretionary and industrial sectors are attracting strong interest in Asia, with healthcare gaining traction in private markets.

The chief executive of Singapore state-owned investor Temasek, Dilhan Pillay, speaking at the same event, said that “globalization as we have known it is gone,” as geopolitics, tariffs and energy constraints have reshaped returns.

“Reconfiguration of supply chains to (prioritize) resilience over efficiency, there’s a cost for resilience,” he said.

Pillay added that artificial intelligence is “the most pervasive thing across the political, social, and economic spectrum.”

Temasek, which manages a S$ 434 billion (USD 340 billion) portfolio, reported an 11.6% rise in net portfolio value to a record high as of March 31, with the US continuing to be its largest destination for capital.

Singapore sovereign wealth fund GIC’s Head of Funds and Co-investments, Asia, Private Equity Ankur Meattle said China is seeing more deal activity, including multinationals exploring capital options and succession driven sales, alongside innovation in sectors from biotech to electric vehicles.

“With the capital markets in a better place, one is likely to see some exits also. So there is a pipeline of exits building up that we should see in the next six months,” he said.

(Reporting by Yantoultra Ngui and Jun Yuan Yong; Editing by Thomas Derpinghaus and Kim Coghill)

This article originally appeared on reuters.com

By Reuters

By Reuters