Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

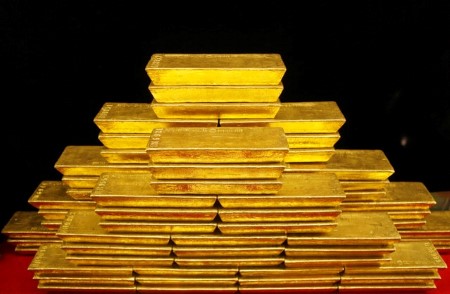

Gold ticks lower after Fed officials call for more rate hikes

Aug 10 (Reuters) – Gold reversed course to trade lower on Wednesday as hawkish remarks from US Federal Reserve officials dampened hopes of a let-up in aggressive policy tightening after tame inflation data.

Spot gold was down 0.3% to USD 1,788.39 per ounce by 3:34 p.m. ET (1934 GMT). It had risen to its highest since July 5 after the consumer price index (CPI) data.

US gold futures settled up nearly 0.1% at USD 1,813.7.

Data showed US consumer prices did not rise in July due to a drop in gasoline costs, the first notable sign of a pause in inflation that has climbed over the past two years.

“Gold initially had a knee-jerk reaction after tamer inflation data as investors expected a less aggressive Fed. But, then they realised the data is tamer not tame,” said Jim Wyckoff, senior analyst at Kitco Metals.

The metal, which tends to do well in a low-interest rate environment, came under pressure after Minneapolis Fed President Neel Kashkari and Chicago Fed President Charles Evans reaffirmed an aggressive path for interest rate hikes.

Kashkari said the US central bank will need to raise its policy rate to 3.9% by year-end and to 4.4% by the end of 2023 to tame inflation.

Meanwhile, Goldman Sachs cut its price forecasts for the metal, saying that “structurally, gold is likely to remain range-bound as growth and tightening factors continue to offset each other.”

Spot silver rose 0.2% to USD 20.53 per ounce, platinum was up 0.7% to USD 939.97 while palladium XPD= jumped 1.5% to USD 2,249.14.

(Reporting by Ashitha Shivaprasad and Seher Dareen in Bengaluru; Editing by Shinjini Ganguli and Aditya Soni)

This article originally appeared on reuters.com

By Reuters

By Reuters