January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

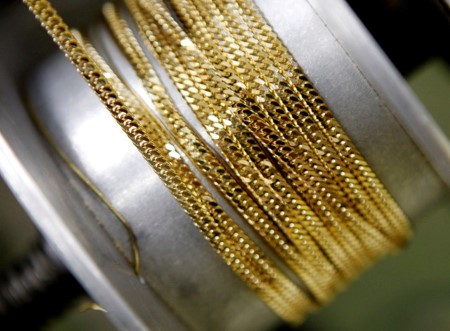

Gold slips after Powell dashes hopes on Fed rate hike pause

Nov 2 (Reuters) – Gold turned negative on Federal Reserve Chair Jerome Powell’s remarks on Wednesday that it was premature to discuss pausing rate hikes, after prices jumped over 1% as the US central bank signalled future interest rate increases could be made smaller.

Spot gold fell 0.5% to USD 1,640.05 per ounce by 3:45 p.m. EDT (1945 GMT). US gold futures settled up 0.02% at USD 1,650 ahead of the Fed decision.

Prices had jumped over 1% after the Fed raised interest rates by 75 basis points, as widely expected, but signaled future increases in borrowing costs could be made in smaller steps to account for the “cumulative tightening of monetary policy” it has enacted so far.

Later, Powell cautioned against any sense the central bank will soon move to the sidelines with interest rate rises. “It is very premature to be thinking about pausing.”

Fed Chair Powell de-emphasizing speed yet stating that it was premature to consider a pause set a fairly hawkish tone for the presser, said Tai Wong, a senior trader at Heraeus Precious Metals in New York.

“Powell is giving the Fed the option of decelerating to 50 bps but preventing a mad market rally by emphasizing how high rates will be and how long they will stay there while taking the focus off the speed of rate hikes.”

Gold is highly exposed to interest rates, as higher rates increase the opportunity cost of holding non-yielding assets.

The dollar index and benchmark 10-year Treasury yields rebounded after Powell’s comments.

Gold prices will average USD 1,712.50 an ounce next year, per a Reuters poll, rising from current levels.

Elsewhere, spot silver fell 1.6% to USD 19.3 per ounce, after climbing to a three-week peak on Tuesday.

Platinum dipped 0.7% to USD 936.28, while palladium slipped 1.3% to USD 1,856.50.

Analysts and traders downgraded their forecasts for platinum and palladium prices next year, according to a Reuters poll.

(Reporting by Seher Dareen and Swati Verma in Bengaluru; Editing by Shailesh Kuber and Diane Craft)

This article originally appeared on reuters.com

By Reuters

By Reuters