February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

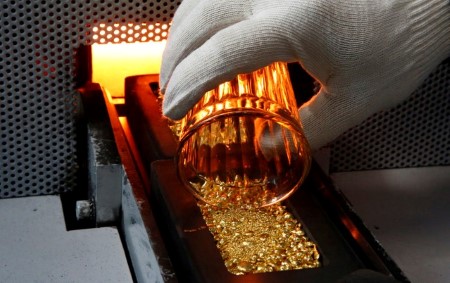

Gold rises on dollar dip, banking optimism limits gains

March 28 (Reuters) – Gold prices rose on Tuesday, drawing support from a weaker US dollar even as higher bond yields and easing worries about a full-blown banking crisis limited gains for the safe-haven asset.

Following two sessions of declines, spot gold gained 0.7% to USD 1,970.88 per ounce by 1:40 p.m. EDT (1740 GMT). US gold futures settled 1% higher at USD 1,973.50.

The US dollar index retreated about 0.4%, making the greenback-denominated precious metal less expensive for holders of other currencies.

“The weaker US dollar index today is adding to some buying interest in the gold market. However, solid buying interest is being squelched by the fact that the banking crisis, at least for the moment, seems to have stabilized,” said Jim Wyckoff, senior analyst at Kitco Metals.

In the first congressional hearing into the sudden collapse of two US regional lenders and the ensuing chaos in markets, a top US regulator criticized Silicon Valley Bank over its risk management, as lawmakers demanded to know why warning signs of trouble were missed.

“The marketplace is still tentative in that regard, and that’s going to keep risk appetite contained for at least the next couple weeks until we think we’ve moved past this crisis,” added Wyckoff.

Wall Street struggled for direction as investors weighed receding concerns about a banking crisis, while Treasury yields rose amid focus on Federal Reserve’s interest rate trajectory.

In the near term, gold prices could slip to USD 1,933, but the outlook for gold remains bullish with fast approaching peak in US rates and a danger of hitting a recession in coming months, said Ole Hansen, head of commodity strategy at Saxo Bank.

Spot silver rose 0.6% to USD 23.23 per ounce, platinum shed 0.7% to USD 965.19, while palladium was up 1% at USD 1,422.61.

(Reporting by Deep Vakil in Bengaluru; Editing by Marguerita Choy and Shilpi Majumdar)

This article originally appeared on reuters.com

By Reuters

By Reuters