Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

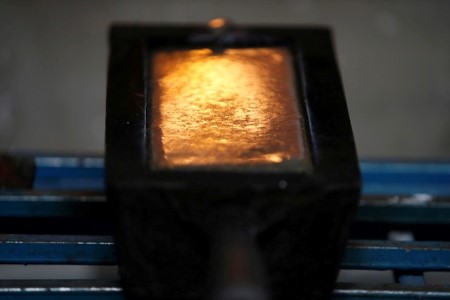

Gold rallies to 1-year peak as economic worries mount

April 13 (Reuters) – Gold surged on Thursday as more weak US economic readings bolstered bets for a pause in interest rate hikes, with prospects of a mild recession also sending investors scurrying for the safe-haven.

Spot gold was up 1.4% at USD 2,042.50 per ounce by 1:40 p.m. EDT (17:40 GMT), its highest since March 2022, and about USD 30 shy of its record high hit in 2020. US gold futures settled 1.5% higher at USD 2,055.30.

Treasury yields dropped and the dollar dipped after data showed a moderation in the rise in producer prices last month and an uptick in jobless claims, suggesting the Federal Reserve’s aggressive tightening over the past year was taking a toll on the economy.

“These economic data have reinforced the market’s assessment that the cycle of interest rate hikes is nearing its end, which makes gold attractive to investors as it does not pay interest itself,” said Alexander Zumpfe, a precious metals dealer at Heraeus.

Further, US consumer prices barely rose in March as the cost of gasoline declined, but stubbornly high rents kept underlying inflation pressures simmering.

“That’s an underlying positive environment for gold where the Fed is done with their interest rate hike cycle, yet inflation overall remains higher than they would like,” said David Meger, director of metals trading at High Ridge Futures.

This comes after US Fed minutes on Wednesday indicated that several policymakers considered pausing rate increases and projected that recent banking sector stress would tip the economy into recession.

Safe-haven gold tends to gain during times of economic or financial uncertainty, while lower rates also lift the appeal of the zero-yield asset.

Spot silver rose 1.6% to a one-year high of USD 25.88. Platinum jumped 3.7% to USD 1,052.70 and palladium gained 3.8% to USD 1,515.95.

(Reporting by Deep Vakil and Ashitha Shivaprasad in Bengaluru; Editing by Sharon Singleton, Shilpi Majumdar and Shweta Agarwal)

This article originally appeared on reuters.com

By Reuters

By Reuters