Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

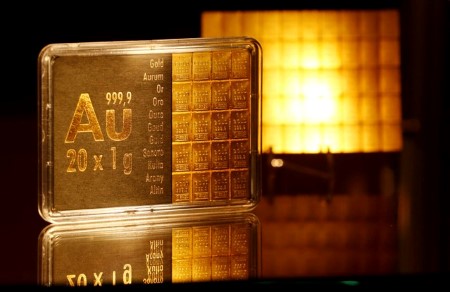

Gold gains on lower yields, traders await more US data

Gold edged higher on Tuesday lifted by retreating Treasury yields, while investors cautiously awaited more data that could offer fresh clues on the Federal Reserve’s monetary easing cycle.

Spot gold rose 0.5% to USD 2,663.83 per ounce at 2:00 p.m. ET (1800 GMT). US gold futures settled 0.5% higher at USD 2,678.9.

The Benchmark 10-year note yields slipped following a soft reading of manufacturing activity in New York State, making non-yielding gold more attractive, while the dollar hovered near its highest in more than two months.

“We’re seeing a little pullback in yields as bond prices rally here. That’s offering a little stability, a little support to the gold market,” said David Meger, director of metals trading at High Ridge Futures.

“There is an expectation that gold would be going through a bit of a pause or a bit of a consolidation. We’re leaning now more towards a sideways to higher uptrend as we do think that yields are going to retrace a bit. We’re going to see a little bit of a pullback in the dollar.”

Currently, traders see about a 90% chance of a 25-basis-point cut in November, according to the CME FedWatch tool.

Markets’ attention will be on upcoming US retail sales, industrial production data, and weekly jobless claims due later this week.

Gold, which yields no interest on its own, also gains in times of political and economic uncertainties.

Should the media reports prove to be true and Israel refrains from targeting Iran’s oil and nuclear sites in the expected retaliatory strike, geopolitical risks would decrease, and support for the gold price from this side would also fade, Commerzbank said in a note.

“We see slight downside risks for the gold price and expect the gold price to be USD 2,600 at the end of the year.”

Spot silver rose 1% to USD 31.49 per ounce and platinum fell 0.5% to USD 988.45. Palladium was down 1.6% to USD 1,012.98.

(Reporting by Anushree Mukherjee in Bengaluru, Editing by Franklin Paul, Vijay Kishore, and Shailesh Kuber)

This article originally appeared on reuters.com

By Reuters

By Reuters