February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

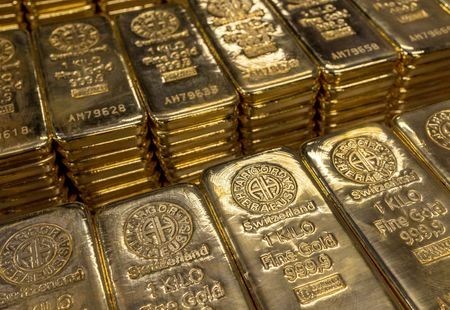

Gold extends gains on Fed pause bets, dollar retreat

Nov 28 – Gold rose for a fourth consecutive session on Tuesday and hit a more than six-month high, driven by a retreating dollar and expectations that the US Federal Reserve has finished hiking interest rates.

Spot gold gained 1.4% at USD 2,041.55 per ounce by 3:00 p.m. ET (2000 GMT), the highest since May 10.

US gold futures for December delivery settled 1.4% higher at USD 2,040.

The near-term outlook for gold remains bullish, with the dollar index in a downtrend on hopes the Fed will no longer raise interest rates and will maybe even cut them by springtime, said Jim Wyckoff, senior analyst at Kitco Metals.

However, “if (US) GDP numbers and inflation indicators are stronger than expected, it will dent traders’ enthusiasm in bullion,” Wyckoff added.

Fed policymakers look increasingly comfortable closing out the year with interest rates on hold and waiting before cutting them. Lower rates reduce the opportunity cost of holding non-interest-bearing bullion.

Fed Governor Christopher Waller said he is “increasingly confident” that policy is in the right spot.

Making bullion less expensive for overseas buyers, the dollar index touched its lowest since mid-August.

Investors will monitor Thursday’s US Personal Consumption Expenditures (PCE) data, the Fed’s preferred inflation indicator. The focus is also on the revised US third-quarter GDP figures scheduled for Wednesday.

“A sense of caution ahead of another busy week for global financial markets is also lending support to the precious metal. Given how the USD 2,000 level proved an extremely tough resistance to conquer, gold could end up dipping without a potent fundamental catalyst,” FXTM senior research analyst Lukman Otunuga said.

Silver rose 1.4% to USD 24.97 per ounce, platinum XPT= was up 2.3% at USD 939.80. Palladium fell 1.4% to USD 1,055.59 per ounce.

(Reporting by Anushree Mukherjee in Bengaluru; Editing by Krishna Chandra Eluri, Barbara Lewis, and Richard Chang)

This article originally appeared on reuters.com

By Reuters

By Reuters