February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

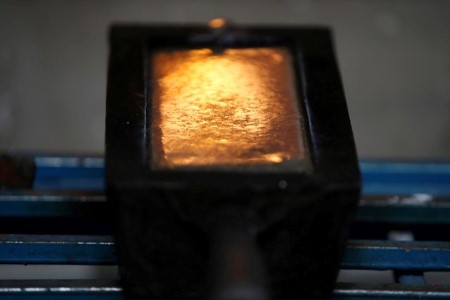

Gold beats sharp retreat as dollar bounces, rate hike bets grow

April 14 (Reuters) – Gold prices pulled back sharply on Friday after surging to a more than one-year peak in the last session, as the dollar bounced and a Federal Reserve official flagged the need for another interest rate hike.

Spot gold was down 1.8% at USD 2,003.60 per ounce by 01:52 EDT (17:51 GMT). US gold futures settled 1.9% lower at USD 2,015.80.

The dollar index bounced off a one-year low and Treasury yields rose after a key Fed official warned that the central bank needs to continue hiking rates to tame inflation.

Gold competes with the dollar as a safe haven amid economic or political turmoil, while gains in the US currency also dim appetite for bullion among overseas buyers.

Also holding back zero-yield gold, the CME FedWatch tool showed traders were now pricing in a 80.2% chance of a 25 basis-point hike in May compared with a 70% chance at the beginning of the week.

The metals market will likely weaken as we go into the “blackout period” ahead of the Fed decision in May with a 25 bps hike expected, said Daniel Pavilonis, senior market strategist at RJO Futures.

“Prices will stabilize somewhere around USD 2,000.”

But analysts said bullion’s outlook remained positive, following the stellar run over the past couple of sessions amid growing recession worries that could prompt the Fed to eventually end its rate-hike cycle.

“I still expect prices to hit record highs and extend gains to USD 2,100,” said Phillip Streible, chief market strategist at Blue Line Futures in Chicago.

On the physical front, rally in prices made physical gold buying unattractive across major Asian hubs this week.

Silver was down 1.8% at USD 25.34 per ounce, after rising to a year’s high of USD 26.07 earlier in the session, and is set for a fifth weekly gain.

Platinum fell 0.6% to USD 1,040.42, while palladium slipped 0.4% to USD 1,493.61, but both were on track for weekly rises.

(Reporting by Ashitha Shivaprasad in Bengaluru; Editing by Christina Fincher, Shailesh Kuber and Shweta Agarwal)

This article originally appeared on reuters.com

By Reuters

By Reuters