February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

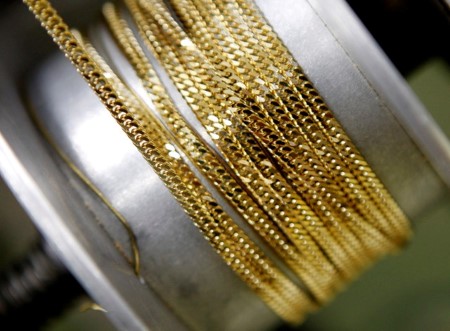

Gold attempts relief rally as dollar decelerates

Sept 28 (Reuters) – Gold rose about 2% on Wednesday as a retreat in the dollar rekindled some of its safe-haven appeal, although prospects of sharp rate hikes kept the non-yielding precious metal near a 2-1/2-year trough.

Spot gold climbed 2% to USD 1,660.62 per ounce by 1:49 p.m. EDT (1749 GMT), to recoup some losses from a slide to its lowest since April 2020 earlier in the day.

US gold futures settled 2.1% higher at USD 1,670.00.

A pullback in the dollar and yields have “seen gold move off those lows,” said David Meger, director of metals trading at High Ridge Futures.

“The factors in regards to Russia and the discussion of annexation… that probably gave a bid to the (gold) market from a safe-haven perspective,” Meger added.

The dollar retreated after scaling a new two-decade high, making bullion less expensive for overseas buyers, while Treasury yields eased.

Moscow was poised on Wednesday to annex a swath of Ukraine, releasing what it called vote tallies showing support in four partially occupied provinces to join Russia, after what Kyiv and the West denounced as illegal sham referendums held at gunpoint.

Moreover, “gold is seeing some relief as the UK’s plan to buy long-end Gilts sees yields weaken,” TD Securities said in a note.

Gold, however, has failed to benefit from the recent rout in equities and faces headwinds from looming rate hikes that would raise the opportunity cost of holding non-yielding bullion.

“This oscillation between dollar headwinds and growth concerns should keep gold in a rangebound market torn between growth fears and higher rates,” Goldman Sachs said in a note.

Meanwhile, silver gained 2.7% to USD 18.92 per ounce, after hitting a three-week low of USD 17.94 earlier in the session.

Platinum advanced 1.5% to USD 861.32 and palladium jumped 3.2% to USD 2,153.51.

(Reporting by Kavya Guduru in Bengaluru; Editing by Shinjini Ganguli, Shailesh Kuber and Krishna Chandra Eluri)

This article originally appeared on reuters.com

By Reuters

By Reuters