January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

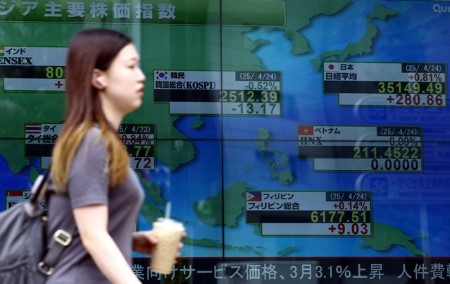

Nikkei ends five-day winning run as US-Japan trade talks weigh

TOKYO – Japan’s Nikkei share average snapped a five-day winning streak to fall more than 1% on Tuesday, as investors sold stocks amid uncertainty over US-Japan trade talks.

The Nikkei fell 1.24% to 39,986.33, slipping from the highest level since mid-July, which it reached in the previous session.

The broader Topix slipped 0.73% to 2,832.07.

“The market was overheated, but there were some factors that boosted demand last month,” said Hiroyuki Ueno, chief strategist at Sumitomo Mitsui Trust Asset Management.

Japanese equities mirrored a rally in US stocks in the past several sessions, but demand was also supported by dividend payouts investors received after corporate shareholders’ meetings in June, as well as corporate share buybacks, said Ueno.

The Nikkei rose 6.6% in June, marking its biggest monthly gain since February 2024. In the last five sessions of June, the index gained 5.5%.

The Relative Strength Index (RSI), a technical measure for investment momentum, dropped to 66.6 on Tuesday from the “overbought” condition of 74.5.

Meanwhile, US President Donald Trump expressed frustration with US-Japan trade negotiations on Monday, casting clouds over ongoing trade talks between the two countries.

US Treasury Secretary Scott Bessent also warned that countries could be notified of sharply higher tariffs as a July 9 deadline approaches despite good-faith negotiations.

“Investors weighed trade factors, but if the outlook of the talks becomes clear, then the market gauges stocks with fundamentals and the Nikkei has the potential to rise further,” said Ueno.

Uniqlo-brand owner Fast Retailing fell 4.16% to drag the Nikkei the most. Chip-equipment maker Tokyo Electron slipped 2.2%.

Bucking the trend, utility Tokyo Electric Power Holdings jumped 9.98% to become the biggest percentage gainer on the Nikkei.

(Reporting by Junko Fujita; Editing by Harikrishnan Nair and Vijay Kishore)

This article originally appeared on reuters.com

By Reuters

By Reuters