February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Central banks on pause patrol

April 19 (Reuters) – Whisper it, but Wednesday could be a pretty quiet day in Asia after Wall Street closed little changed on Tuesday and with Malaysian trade and Australian leading indicators the only potential market-moving releases on the regional data calendar.

In fact, the main cue could come late in the session from Europe – UK and euro zone consumer price inflation figures for March could go a long way to molding Bank of England and European Central Bank rate expectations for the coming months.

Unlike a growing number of central banks in Asia who have pressed the pause button or are close to doing so, the BoE and ECB are both expected to continue raising rates in their battle to get inflation back down towards target.

The Fed is also close to the end of its cycle if you believe current market pricing, with one more quarter point hike expected next month. St Louis Fed president James Bullard is much more hawkish though, as he confirmed in an interview with Reuters.

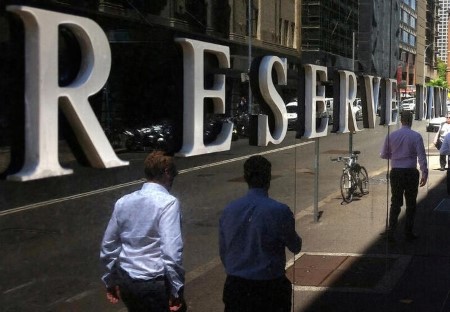

Having marched up the hill last year, some policymakers in Asia are taking a breather. The central banks of Australia, Indonesia, India, Singapore, and South Korea have all paused, and the Philippine central bank governor signaled a pause in May.

Research from the Bank for International Settlements shows that the global tightening cycle since the start of last year is the most synchronized and strongest over the past 50 years, with more than 95% of central banks raising their policy rates.

Historically, this share rarely exceeded 50%.

One notable absentee from that band is the People’s Bank of China (PBOC). It cut rates in 2020, 2021 and 2022, and is expected to maintain a supportive stance this year even though the economy grew at a faster-than-expected pace in the first quarter.

Figures on Tuesday showed that GDP grew 4.5% in Jan-March year-on-year, the strongest in a year, faster than 2.9% the prior quarter, and comfortably above consensus 4.0% forecasts.

But the road ahead looks bumpy, and other indicators for March were mixed – retail sales smashed forecasts, but investment fell short.

The PBOC sets its one- and five-year loan prime rates on Thursday. They have been anchored at 3.65% and 4.30%, respectively, since last August.

Here are three key developments that could provide more direction to markets on Wednesday:

– Malaysia trade (March)

– Australia composite leading indicator index (March)

– UK inflation, euro zone revised inflation (March)

(By Jamie McGeever)

This article originally appeared on reuters.com

By Reuters

By Reuters