January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Breaking point?

Oct 4 – Another crushing selloff in US Treasuries, one of the biggest falls in world stocks this year, suspected currency market intervention from Japan, and political turmoil in Washington as House of Representatives speaker Kevin McCarthy was booted from his job.

It’s safe to say Tuesday was a volatile day across world markets. It’s probably also safe to say Asian markets will open on the defensive and investors will be running for cover on Wednesday.

The trouble is, with the apparently safest asset on the planet at the epicenter of the storm, there doesn’t appear to be anywhere obvious to take shelter.

The heavy selling across the US government bond curve accelerated on Tuesday after strong US jobs data, pushing the 10-year yield up to a new 16-year high of 4.80%. It is up almost 25 basis points in barely 48 hours.

The 2s/10s yield curve inversion is now only 35 basis points, the smallest this year, and the inflation-adjusted 10-year ‘real’ yield is up at 2.45%, the highest since 2008.

‘Bond King’ Bill Gross, formerly of PIMCO fame, tweeted that a 30-year mortgage rate of 7.7% “shuts down” the US housing market. Fears are growing that something somewhere in the investment universe will soon break, such is the blistering rise in bond yields.

But where can investors turn?

Gold? It fell only 0.2% on Tuesday but the fact it failed to rise at all in such a febrile ‘risk-off’ environment is telling. Gold is at a seven-month low and has fallen seven days in a row, its longest losing streak since 2018.

The Swiss franc? It weakened against the mighty dollar.

The Japanese yen? Yes, it rallied on Tuesday but only thanks to suspected intervention from Japanese authorities after briefly slipping below 150.00 per dollar.

The greenback snapped back almost three yen then settled around 149.00 yen at the close of US trading. A senior Japanese ministry of finance official declined to comment and the New York Fed did not respond to requests for comment.

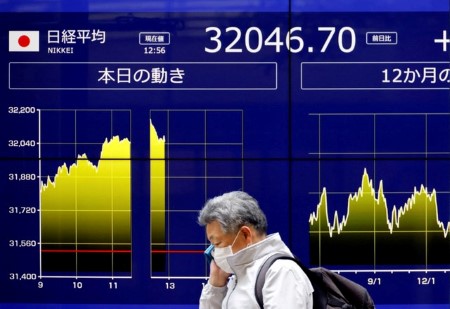

Japanese stocks had already slumped to a four-month low before the yen’s sudden burst of strength. The Nikkei – and stocks across Asia – will likely fall further on Wednesday.

In this climate, the regional data and policy calendar is of much less significance. Purchasing managers index reports from Japan, Australia and South Korea will be released, and the Reserve Bank of New Zealand will announce its latest interest rate decision on Wednesday.

The RBNZ is widely seen holding its key interest rate at 5.50% – the highest in nearly 15 years – and keeping it there at least until March before lowering it shortly after.

Here are key developments that could provide more direction to markets on Wednesday:

– New Zealand interest rate decision

– US Fed’s Schmid, Bowman, Goolsbee all speak

– South Korea industrial output, retail sales (August)

(By Jamie McGeever; Editing by Josie Kao)

This article originally appeared on reuters.com

By Reuters

By Reuters