February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

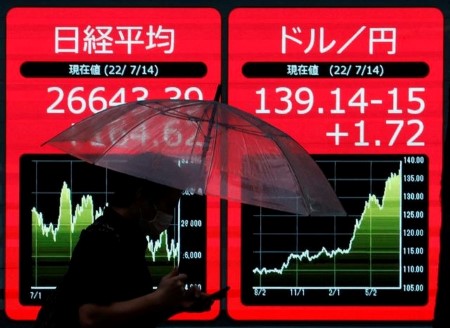

Japan’s Nikkei falls as chip stocks track US peers lower

TOKYO, Aug 10 (Reuters) – Japan’s Nikkei fell on Wednesday, dragged down by chip-related shares after Micron Technology led US tech heavyweights lower overnight, while investors awaited US inflation data that could influence the Federal Reserve’s tightening path.

The Nikkei share average closed 0.65% lower at 27,819.33, while the broader Topix edged 0.17% lower to 1,933.65.

The Nasdaq closed lower on Tuesday after a dismal forecast from Micron Technology (MU) pulled down chip makers and tech stocks.

Chip-making equipment maker Tokyo Electron fell 2.75% and chip-testing equipment maker Advantest lost 3.8%.

Other heavyweights also lost ground, with Uniqlo clothing shop owner Fast Retailing shedding 2.75% and medical services platform sliding 3.5%.

Companies that reported robust earnings gained. Sumitomo Forestry jumped 8.34% after the home builder forecast a full-year profit compared to its earlier estimate of a loss.

Rohto Pharmaceutical surged 14.1% after the drug maker raised its annual profit forecast.

“The market responded to stocks with positive earnings,” said Maki Sawada, a strategist at Nomura Securities.

But investors were cautious ahead of a local holiday on Thursday and as they awaited US inflation data that could guide the Federal Reserve’s rate-hike pace, she said.

There were 139 advancers on the Nikkei index against 84 decliners.

The volume of shares traded on the Tokyo Stock Exchange’s main board was 1.11 billion, compared with the average of 1.19 billion in the past 30 days.

(Reporting by Junko Fujita; editing by Uttaresh.V and Subhranshu Sahu)

This article originally appeared on reuters.com

By Reuters

By Reuters