Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

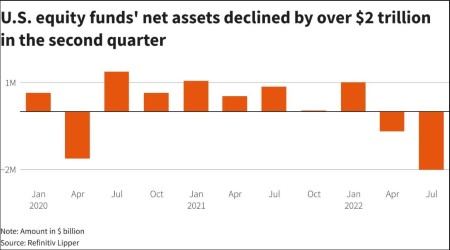

US equity funds’ net assets shrank by $2 trillion in second quarter

July 18 (Reuters) – US equity funds witnessed a record erosion in their net assets in the second quarter of this year, as stocks slumped due to soaring inflation and rising expectations of aggressive rate hikes by major central banks.

Data from Refinitiv Lipper showed US equity funds’ net assets shrank by USD 2.1 trillion to USD 9.2 trillion in the quarter ended June, the biggest quarterly drop ever.

The decliners were led by Vanguard Total Stock Market Index Fund and SPDR S&P 500 ETF Trust SPY which lost USD 77.5 billion and USD 70.5 billion of their net assets respectively, while Vanguard 500 Index Fund gave up USD 69.3 billion.

The tech-heavy Nasdaq Composite and the broader S&P 500 Composite index declined 22.4% and 16.45% respectively in the second quarter, marking their biggest January-June percentage drop since the financial crisis.

US equity mutual funds also registered an average fall of 15.3% in their net assets values between April and June this year.

The Federal Reserve has already lifted interest rates three times this year, and is expected to do another 75 basis points later this month.

Those expectations of aggressive rate hikes have given rise to fears of a global recession as corporates are hit by higher borrowing costs and lower profit margins.

Goldman Sachs said in a note a recession could cause the S&P 500 index to fall by 19% to 3,150 by the end of 2022, and a sharp contraction in the price-earnings ratio.

“This peak to trough price decline of 34% would be slightly more severe than the historical average recession decline of 30%.”

The weekly data from Lipper showed US equity funds witnessed outflows for the third week in a row in the week ended July 13.

(Reporting By Patturaja Murugaboopathy; Editing by Vidya Ranganathan)

This article originally appeared on reuters.com

By Reuters

By Reuters