January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

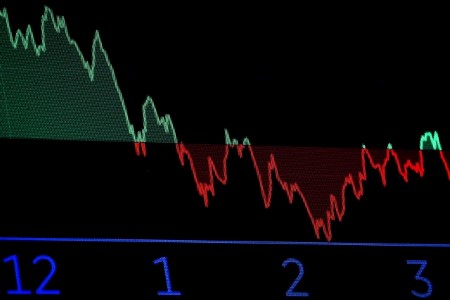

Global equity funds post their biggest weekly outflow in six weeks

Global equity funds have seen weekly outflows for the first time in six weeks, pressured by rising US Treasury yields and mounting concerns over the US debt burden and tax-cut legislation, following Moody’s downgrade of the US sovereign credit rating.

According to LSEG Lipper, global equity funds saw USD 9.4 billion in net outflows, a sharp reversal from more than USD 20 billion in inflows the previous week.

US equity funds led the retreat, with USD 11 billion in redemptions, followed by USD 4.6 billion from Asian funds. European equity funds, on the other hand, received USD 5.4 billion in inflows.

“We suspect investors will be more cautious about piling into the US stock market after the turmoil in April, especially given concerns around fiscal policy,” said John Higgins, chief markets economist at Capital Economics.

“Those worries have coincided with another surge in long-dated Treasury yields this week following Moody’s downgrade of the US’ sovereign credit rating and a poorly received 20-year auction,” he said.

The 30-year Treasury yield climbed to a 19-month high on Thursday, coming within a few basis points of its highest level since 2007, after the House of Representatives passed a tax-and-spending package that intensified debt concerns.

In contrast to equities, global bond funds attracted USD 21.6 billion in inflows, indicating that investors see bonds as appealing at current yield levels. US bond funds took in USD 7.6 billion, European bond funds added USD 11 billion, and Asian bond funds saw USD 1.8 billion in net inflows.

By category, US government bond funds received USD 2.8 billion, US high-yield bond funds drew USD 1.2 billion, and European corporate bond funds gained USD 1.5 billion.

Money market funds also rebounded, taking in USD 18.1 billion, following USD 34 billion in outflows the previous week.

However, gold and precious metals commodity funds saw USD 1.7 billion in outflows, marking their third consecutive week of redemptions.

Emerging market (EM) bond funds extended their winning streak with a fourth straight week of inflows, adding USD 403 million, while EM equity funds posted minor outflows. Still, EM equity funds have attracted USD 10.6 billion year-to-date, a 43% increase from the same period last year.

“The renewed interest in EM is partially due to the concern people have about the end of US exceptionalism and lack of visibility with regards to US ambition,” said Alison Shimada, portfolio manager at Allspring Global Investments.

(Reporting By Patturaja Murugaboopathy in Bengaluru)

This article originally appeared on reuters.com

By Reuters

By Reuters