Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

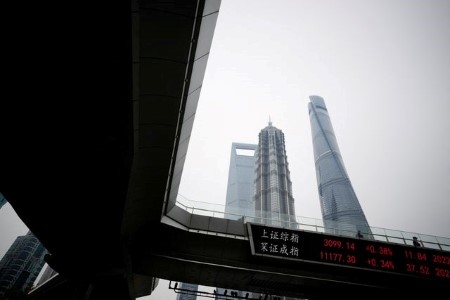

Global equity funds face weekly outflows on growth worries

Nov 25 (Reuters) – Global equity funds saw outflows in the week ended Nov. 23 on worries over a recession due to higher interest rates and fresh lockdowns as COVID cases rise in China.

According to Refinitiv Lipper data, investors withdrew USD 8.6 billion and USD 840 million respectively from US and European equity funds but invested USD 470 million in Asian equity funds.

Among equity sector funds, financials, tech, and real estate funds had outflows of USD 751 million, USD 429 million, and USD 390 million, respectively, although consumer staples received USD 600 million worth of inflows.

Meanwhile, global bond funds posted outflows for a third straight week, amounting to USD 2.52 billion.

Global short- and mid-term bond funds saw withdrawals of USD 4.84 billion, the biggest weekly outflow in five weeks, but high-yield bond funds lured inflows for a second successive week, to the value of USD 2.35 billion.

Meanwhile, global government bond funds received inflows worth USD 809 million in a third straight week of net buying.

Global money market funds saw much bigger inflows, with investors bracing for the release of the Federal Reserve’s meeting minutes.

The data showed investors accumulated global money market funds worth USD 26.4 billion, compared with an outflow of USD 9.4 billion in the previous week.

Energy funds remained in demand for the fifth consecutive week as they received net investment of USD 149 million. Investors also purchased about USD 18 million of precious metal funds after five weeks of net selling in a row.

According to data available for 24,768 emerging market (EM) funds, EM equity funds received USD 1.11 billion but EM bond funds had outflows of USD 201 million after USD 233 million worth of net purchases the previous week.

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru;Editing by Elaine Hardcastle)

This article originally appeared on reuters.com

By Reuters

By Reuters