January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

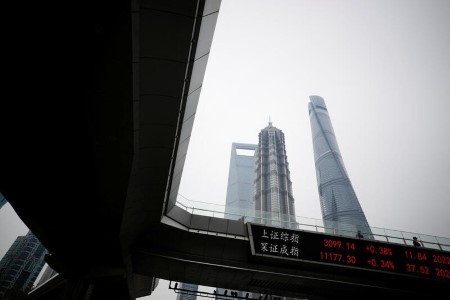

China leads global equity IPO volumes this year

Nov 22 (Reuters) – Chinese companies are at the forefront of global stock offerings this year, with their issuances being facilitated by easy monetary settings at home and a lack of clarity on access to offshore capital markets.

According to Refinitiv data, Chinese companies have raised USD 71.2 billion through initial public offerings (IPOs) in the domestic and overseas markets this year, which is lower than the USD 98.48 billion raised in the same period last year.

But it’s much higher compared to the US companies’ issuance of USD 17.3 billion and Europe’s USD 16.4 billion so far.

The increase in mainland IPOs comes as companies and dealmakers await final rules from the China Securities Regulatory Commission and Cyberspace Administration of China that will govern overseas listings, especially for firms that handle data.

“China’s domestic market is less impacted by global volatilities. Internally, China has a lower inflation environment and loosening monetary policy, equity market valuation is more resilient,” said Mandy Zhu, head of China Global Banking – UBS.

While global central banks are grappling with a surge in inflation, price pressures are rather benign in China, with interest rates there being cut.

Shanghai United Imaging Healthcare Co Ltd. led China’s IPO issuance this year, raising USD 1.63 billion, followed by Hygon Information Technology Co Ltd. and Jiangxi Jinko Pv Material Co Ltd, raising USD 1.6 billion and USD 1.58 billion, respectively.

While a surge in volatility has prompted global investors to exit riskier equity markets in the last few months, Chinese markets have been relatively resilient.

According to Refinitiv Lipper, global equity funds witnessed outflows of USD 144 billion since April, while Chinese equity funds received inflows worth USD 21.3 billion.

OVERSEAS LISTINGS DROP

However, Chinese companies’ listings overseas have dropped sharply this year.

The data showed that IPO issuances on the mainland fell just 11%, while Chinese listings in US and Europe slumped 97% and 81%, respectively.

Analysts said the declines in overseas listings are due to concerns over China’s COVID-19 lockdowns, growth worries, ongoing audit disputes with the United States, and uncertainties over offshore listing rules.

“We expect international issuance volume to recover, too, led by valuation re-rating in secondary markets. Hong Kong has accumulated a strong IPO pipeline, which will see a surge of issuance when the market recovers to a supportive level,” said UBS’ Zhu.

She added that a recovery in the US market listings will take a longer time, given the uncertainty over US-China relations.

(Reporting By Patturaja Murugaboopathy; Editing by Rashmi Aich)

This article originally appeared on reuters.com

By Reuters

By Reuters