Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

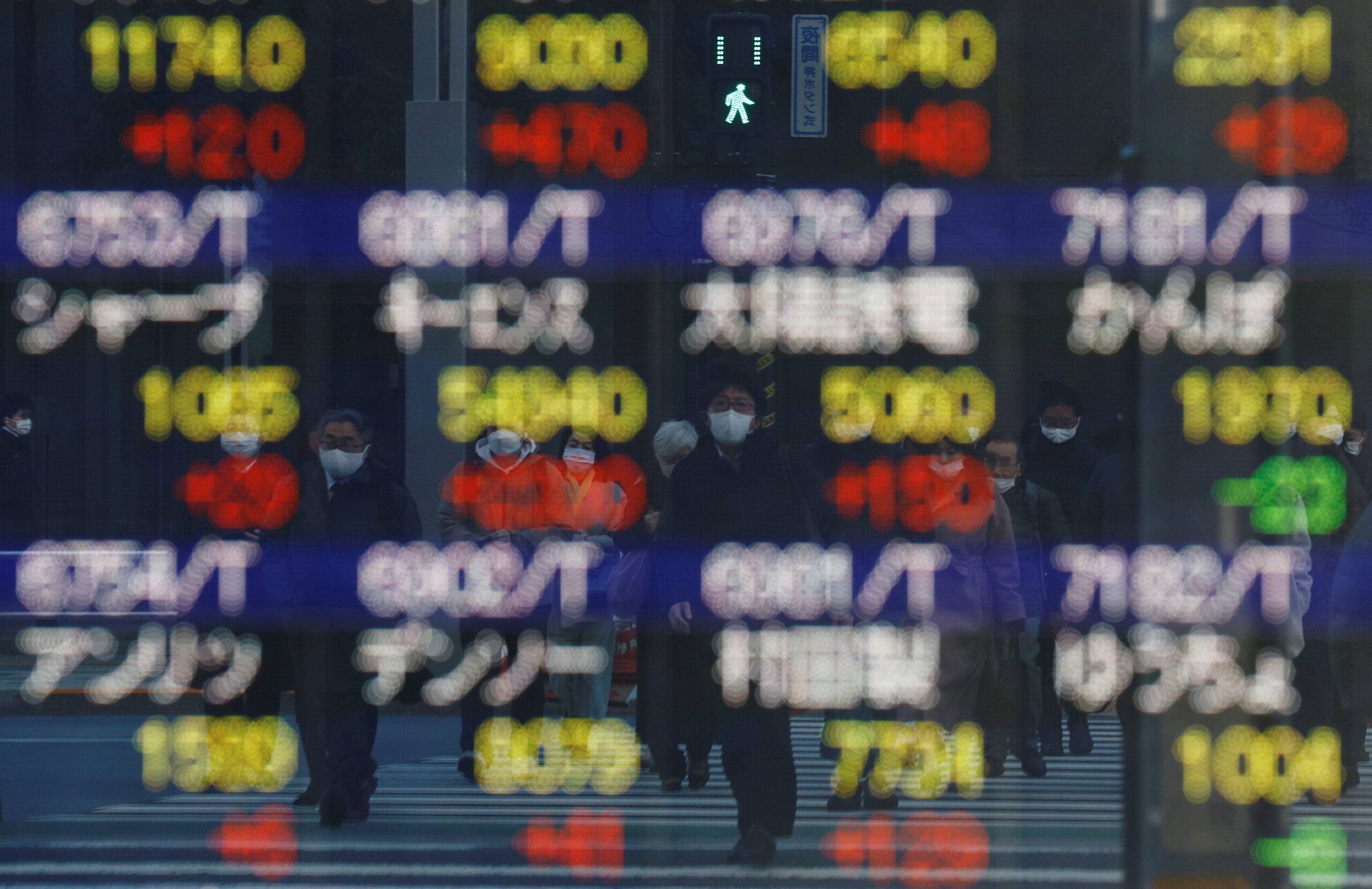

US stocks slip, crude slides as soft data feed recession jitters

NEW YORK, Aug 1 (Reuters) – Wall Street ended a three-day winning streak and crude prices plunged on Monday as economic data from the US, Europe and China showed demand weakening under inflation pressures, while the looming possibility of recession curbed risk appetite.

All three major US indexes ended the choppy session modestly lower on the first day of August, on the heels of the S&P 500’s and the Nasdaq’s largest monthly percentage gains since 2020.

“It’s a consolidation,” said Chuck Carlson, chief executive officer at Horizon Investment Services in Hammond, Indiana. “Investors are waiting to see if we get follow through or continue it’s downward trend.”

The Institute for Supply Management’s (ISM) purchasing managers’ index (PMI) showed US factory activity decelerated in July to its lowest level since August 2020, but remained in expansion territory and long-running supply restraints appeared to be easing.

The report follows a swath of data from Europe and Asia that showed factory activity slowing or contracting in the face of dampened global demand and persistent inflation.

“There seems to be a comfort level that economy is slowing but demand isn’t going to collapse,” Carlson said. “Is the Fed going to take its foot off the gas pedal and stop raising rates?” That would appear to be what the market is watching.”

“It’s a tug-of-war between those that think the market has already fully discounted the economic slowdown and those that feel it hasn’t,” Carlson added.

The Dow Jones Industrial Average .DJI fell 46.73 points, or 0.14%, to 32,798.4, the S&P 500 .SPX lost 11.68 points, or 0.28%, to 4,118.61 and the Nasdaq Composite .IXIC dropped 21.71 points, or 0.18%, to 12,368.98.

The energy sector pulled European stocks lower after disappointing data from the eurozone and China fueled fears of weakening demand and economic contraction. nL4N2ZD1M5

The pan-European STOXX 600 index lost 0.19% and MSCI’s gauge of stocks across the globe gained 0.06%.

Emerging market stocks lost 0.06%. MSCI’s broadest index of Asia-Pacific shares outside Japan closed 0.11% higher, while Japan’s Nikkei .N225 rose 0.69%.

Crude prices headed lower as global factory data weighed on the demand outlook, and as market participants braced for this week’s meeting of OPEC and other oil producers concerning world crude supply.

US crude fell 4.73% to settle at 93.89USD per barrel, and Brent settled at USD 100.03 per barrel, down 3.94% on the day.

US Treasury yields slid in choppy trading as economic data continued to hint at an impending slowdown which could prompt the Federal Reserve to slow the pace of interest rate increases.

Benchmark 10-year notes last rose 15/32 in price to yield 2.5893%, from 2.642% late on Friday.

The 30-year bond last rose 35/32 in price to yield 2.9206%, from 2.977% late on Friday.

The dollar touched its lowest level against the Japanese yen since June and the dollar index, which measures its performance against a basket of world currencies, was volatile in the wake of the PMI data.

The dollar index fell 0.47%, with the euro up 0.38% to USD 1.0257.

The Japanese yen strengthened 1.20% against the dollar to 131.64, while sterling was last trading at USD 1.2255, up 0.73% on the day.

Gold prices edged higher as the dollar softened, as investors looked to economic data for clues regarding the pace of interest rate hikes from the US Federal Reserve.

Spot gold added 0.4% to USD 1,771.89 an ounce.

(Reporting by Stephen Culp; Additional reporting by Carolyn Cohn in London; Editing by David Holmes, Tomasz Janowski, and Cynthia Osterman)

This article originally appeared on reuters.com

By Reuters

By Reuters