Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

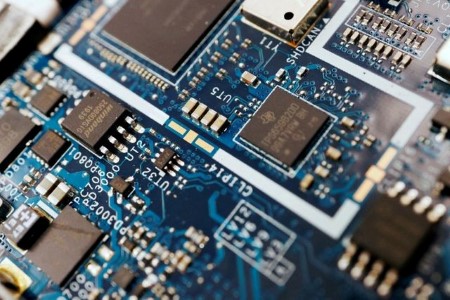

Chip stocks slide as Samsung, AMD expect steep fall in demand

Oct 7 (Reuters) – Dire forecasts from Samsung Electronics Co. Ltd. and Advanced Micro Devices Inc. (AMD) sent chip-related shares lower on Friday, sparking fears that a slump in demand for semiconductors could be much worse than expected.

AMD, Nvidia Corp. (NVDA), Intel Corp. (INTC), Qualcomm Inc. (QCOM) and Micron Technology Inc. (MU) were down between 1.2% and 6.0%, weighing on smaller peers such as Marvell Technology Inc MRVL.O and Applied Materials Inc. (AMAT).

Samsung, the world’s top maker of memory chips, smartphones and televisions, is a bellwether for global consumer demand and its disappointing preliminary results add to a flurry of earnings downgrades and gloomy forecasts.

The chip sector has been grappling with weak demand, spurred by decades-high inflation, rising interest rates, geopolitical tensions and pandemic-related lockdowns in China, hitting the PC and smartphone market as businesses and consumers rein in expenses.

Nearly a dozen analysts cut their price targets on AMD’s shares by as much as USD 50 after the US-based chipmaker slashed its third-quarter revenue outlook by about a billion dollars.

“We believe AMD’s warning will have the most negative read-across for PC peer Intel, but also somewhat for Nvidia and related memory and data center peers,” BofA Securities analyst Vivek Arya said.

Memory chip buyers such as smartphone and PC makers are holding off on new purchases and using up existing inventory, leading to lower shipments and ushering in an industry downcycle.

“We still think the industry is heading for its deepest downcycle in a decade, thanks to high supply chain inventories and falling end demand,” Jefferies analysts said.

Global chip sales grew just 0.1% in August, making it the 15th month of a down cycle since June 2021, when sales rose more than 30%, according to Jefferies.

Shares of major US chipmakers have already lost between a third and half of their value so far this year, following huge gains last year when Nvidia was inching closer to a trillion-dollar valuation.

(Reporting by Eva Mathews and Nivedita Balu in Bengaluru; Editing by Shounak Dasgupta)

This article originally appeared on reuters.com

By Reuters

By Reuters