Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

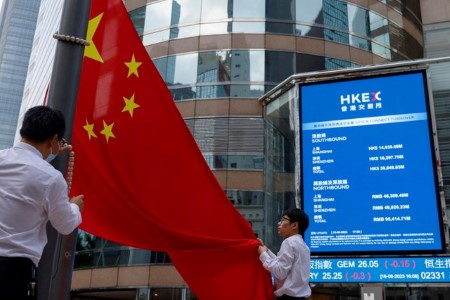

China’s value push may bridge a Hong Kong gap

HONG KONG (Reuters Breakingviews) – As one of the world’s most expensive cities Hong Kong rarely enjoys any price advantage over China. One exception is found in the stock market. For years many dual-listed firms in the finance hub have traded at hefty discounts to their mainland equivalent. That gap may ease as Beijing pushes for higher dividend payouts.

The Hang Seng Stock Connect China AH Premium Index was in February on the verge of breaking through 158, its highest level since the 2008-2009 global financial crisis. The difference between the ’A’ and ’H’ shares gauges relative enthusiasm for Chinese stocks on the mainland and in Hong Kong. When it’s above 100, onshore stocks trade at a premium to their equivalents offshore.

Hong Kong has been a lesser priority as Chinese regulators scrambled to prop up the world’s worst-performing market. The “national team”, including state-owned firms, focused on buying stocks onshore in Shenzhen and Shanghai, and the muted interest of foreign investors that dominate Hong Kong trading worsened the gap.

The AH Premium Index, however, is now easing. Wu Qing, the new-ish chair of China Securities Regulatory Commission, in April announced a flurry of measures, including the expansion of the Stock Connect cross-border investment scheme, to promote Hong Kong’s status as a global financial centre. At 140, the indicator is only seven percentage points above its 10-year average.

Some state-owned heavyweights are still trading in Hong Kong at bigger-than-usual discounts. As of June 11, the A shares of USD 10 billion China Life Insurance 601628.SS, 2628.HK, for instance, are worth three times its H shares after taking the currency exchange rate into account.

The gap translates into a huge discrepancy in yields. Chinese-listed firms announced record cash dividends totalling 2.2 trillion yuan (USD 300 billion) last year, per Reuters, and Beijing is pushing for more payouts to entice households to put more savings into stocks. It faintly echoes the Tokyo Stock Exchange’s effort that has helped push the Nikkei benchmark to record highs.

One likely side-effect may be more buying of Hong Kong stocks by Chinese investors anxious for returns. Citing unnamed sources, Bloomberg reported last month that China is planning to waive a 20% dividend tax on individual mainland investors buying Hong Kong stocks via Stock Connect. A more bullish mood in the Asian finance hub could even help to buoy sentiment onshore.

CONTEXT NEWS

The Hang Seng Stock Connect China AH Premium Index was trading at 139.9 on June 11. The index measures the valuation gap for Chinese dual-listed companies whose stocks trade as A-shares on the mainland and H-shares in Hong Kong. When it’s above 100, onshore stocks trade at a premium to their equivalents offshore.

Wu Qing has rolled out a raft of measures to promote the investment worthiness of Chinese stocks since becoming chair in February of China Securities Regulatory Commission. Companies are required to draw up plans for stock purchases in the event of share price slumps, and profitable companies that fail to draw up dividend payout plans can be put on a delisting watchlist.

(Editing by Una Galani and Aditya Sriwatsav)

This article originally appeared on reuters.com

By Reuters

By Reuters