Post-Halloween opportunities in peso government bonds

As some investors sell off because of defensiveness of the market, new opportunities have sprung up for clients who want to tactically position in peso government securities.

Access this content:

If you are an existing investor, log in first to your Metrobank Wealth Manager account.

If you wish to start your wealth journey with us, click the “How To Sign Up” button.

Halloween is over. Yet the market continues to be spooked by several factors that ultimately point to higher yields.

Despite this spooky atmosphere, several opportunities have emerged for clients who want to tactically position in government securities.

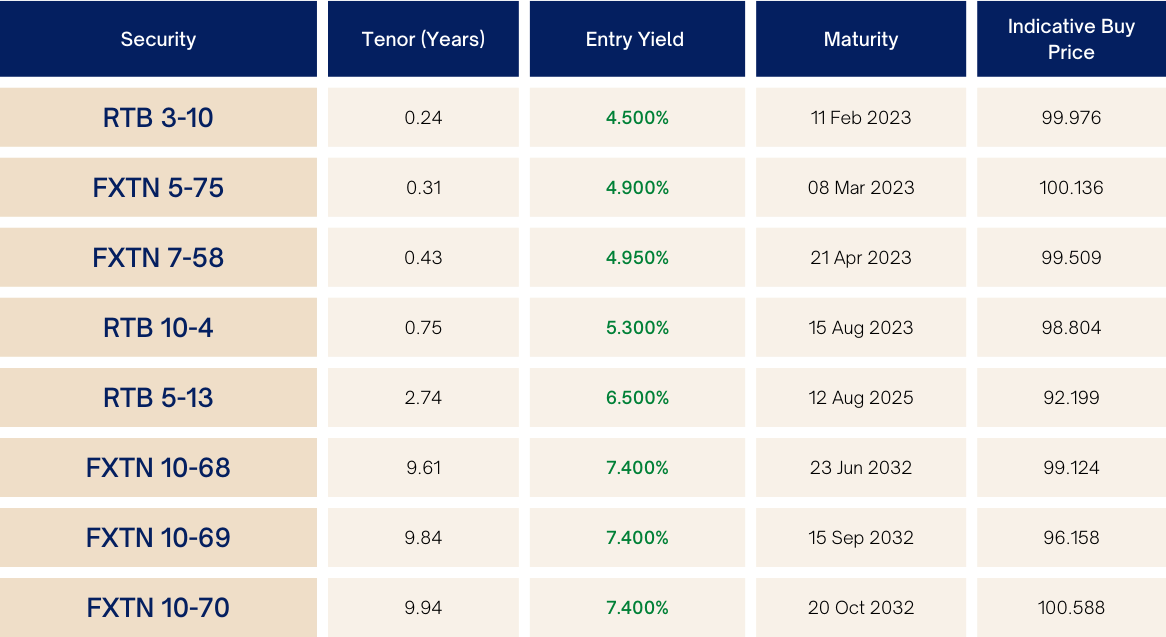

Short-dated bonds like RTB 3-10 (3-month), FXTN 5-75 (4-month) FXTN 7-58 (5-month), and RTB 10-4 (9-month) have adjusted significantly higher as they re-align with higher policy rates – making them more viable short-term investment alternatives.

Three-year bonds are currently trading near the 6.40-6.60% area, while 10-year bonds are hovering near 7.30-7.50%.

With yields in these tenor buckets fast approaching their 2018 highs, investors may start to tactically position near the entry levels indicated in the table below.

These bonds may hel

Read More Articles About:

DOWNLOAD

DOWNLOAD

By Metrobank Government Securities Trading Desk

By Metrobank Government Securities Trading Desk