Portfolio Management: Balancing short-term and long-term through laddering

Short-term and long-term investments have their advantages and limitations. How do you get the best of both worlds?

Is it really possible to get long-term rates with short-term investments?

Let’s find out. When considering the tenor (length of time to maturity) for a potential investment, we often ask ourselves two things: “How long before I might need the money?”, and “How much more do I gain from investing long-term versus short-term?”

The first question is rather straightforward, but is often followed by “what-ifs”. What if a good opportunity comes up? What if I’m faced with an emergency? These concerns (all very valid) tend to push us toward the shorter tenor placements. Why? Any time there is uncertainty, we want to remain liquid, hence the old adage, “Cash is king”.

The second question usually gets us to consider longer-tenor investments. That’s because under normal circumstances, long-term investments will outperform short-term placements. The higher interest rates are meant to compensate for the added risks of locking in longer.

So, how do we get long-term rates while keeping our portfolio relatively liquid?

The right strategy

We can do that through an investment strategy called “laddering”, where maturities are staggered across different periods in the future. For example, instead of investing in a single 5-year security, we can instead invest in three different securities maturing in 4, 5, and 6 years from now.

This gives us almost equivalent interest rates while also adding liquidity and flexibility to our portfolio. In three years’ time, we will effectively have annual investment maturities that are giving 5-year rates.

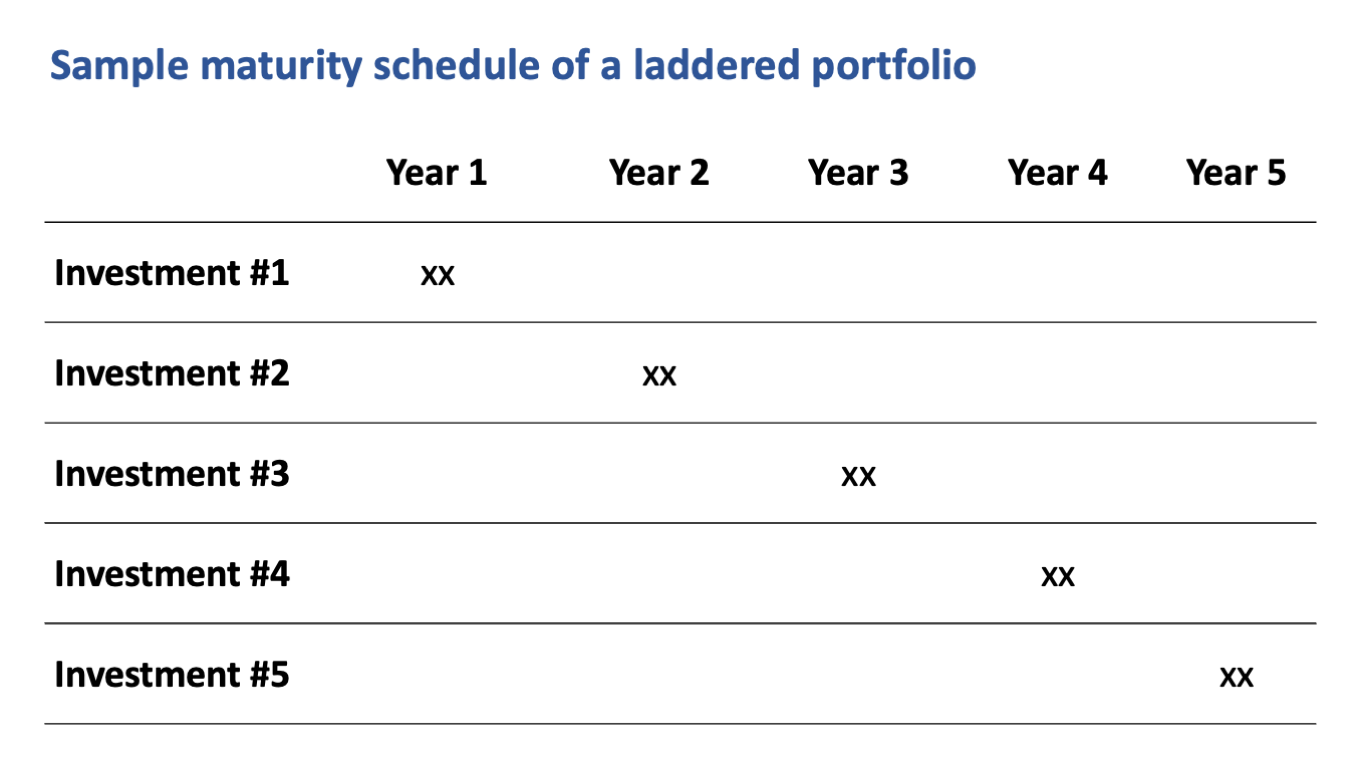

Do this frequently enough, and our portfolio should look like this:

“Laddering” can be used to schedule the maturities of your investments over time, balancing returns with flexibility and liquidity.

It looks plain enough, but assume we booked all of the investments 4 years prior. Then the year 1 maturity should be giving 5-year rates, year 2 gives 6-year rates and so on. Furthermore, the portfolio has maturities each year, giving the option of reinvesting (ideally in the long end to keep yields high) or utilizing the funds elsewhere as needed. These are the main advantages of adopting this strategy.

Trade-offs

It all looks good, but laddering also has some trade-offs. It requires a higher overall investment capital than you would otherwise need, since each placement will need to clear minimum investment requirements depending on the type of security. This makes it either difficult to implement in full, or entails a gradual build-up over time.

Secondly, laddering also requires sufficient planning before it can be properly implemented. It involves timing placements according to one’s needs as well as the interest rate environment at the time of placement. While it offers significant yield benefits, it requires a more active approach than some may prefer.

Bottomline: Laddering is definitely a viable approach to enhancing your fixed income portfolio. Should you choose to implement it, the best time to start would be when rates are already high.

Plan out your maturities according to projected funding requirements first, then just spread out your placements to maintain flexibility and enhance yields. As a general guideline, keep maturities short in a rising rate environment, and tranche in longer as rates peak and start to fall.

(If you are a Metrobank client, you may reach out to your relationship manager or investment specialist to know more.)

DANIEL ANDREW TAN is a Relationship Manager for Metrobank’s Private Wealth Division, whose function mainly involves providing investment and wealth management advice to the Ultra-High-Net-Worth Individuals (UHNWI). He brings with him over fifteen years of experience in both retail banking and financial markets, and he avidly monitors Philippine equities. He applies both active and passive investment strategies to his personal portfolio and strongly advocates for a “tailored” approach to investments.

DOWNLOAD

DOWNLOAD

By Daniel Andrew Tan

By Daniel Andrew Tan