Peso GS Weekly: Overwhelming demand for short-term securities

We expect yields to continue to trend lower. A reduced borrowing program for December may result in better buying interest.

WHAT HAPPENED LAST WEEK

Following the cancellation of the Treasury Bill (T-Bill) auction on Monday and the reduced volume for the 15-year auction, strong buying interest was seen in the peso government securities (GS) space last week.

The 15-year auction on Tuesday, the reissuance of Fixed Rate Treasury Note (FXTN) 20-23, was fully awarded at an average of 6.593% and a high of 6.65%, or at the lower-end of market expectations. The strong auction participation, at 3.5x oversubscribed, triggered further buying of peso GS.

Offshore players and end-user clients were seen flocking to the short-term bonds and T-Bills on the lack of supply. Throughout the week, buying momentum continued with the 10-year benchmark (FXTN 10-71) last dealt at 6.26% or 17 basis points (bps) lower. The recently reissued 15-year bond was last dealt at 6.375% or 22 bps lower from its auction average.

To end the week, the Bureau of the Treasury (BTr) announced that the volume for the auctions this week, the T-bills and 6-year bonds, will be reduced from PHP 15 billion and PHP 30 billion to PHP 10 billion and PHP 20 billion, respectively.

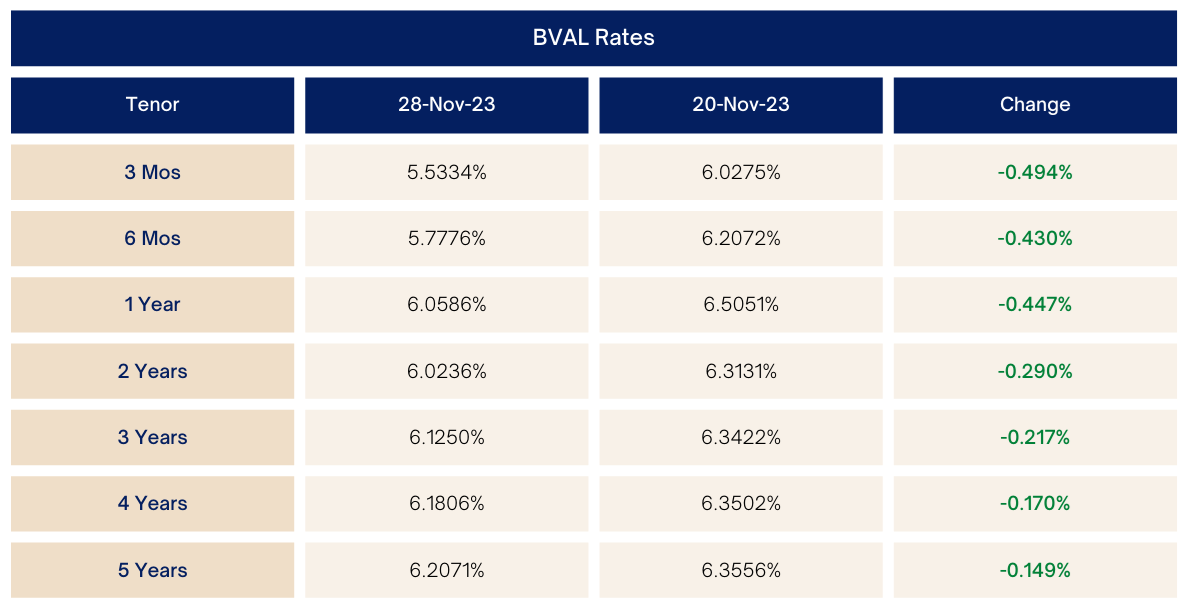

For the week, peso GS across all tenor buckets rallied by as much as 10-25 bps. The 3-month Retail Treasury Bond (RTB) 3-11 and RTB 5-12 were the outperformers last week as they fell 40 to 50 bps.

Market Levels (week-on-week)

WHAT WE CAN EXPECT

Peso GS yields may continue to trend lower given the overwhelming demand for short-term securities.

The next risk event to look out for after the auction is the release of the December borrowing program of the BTr. Another reduction in the issue size, much like what the BTr did in the past two auctions, may prompt better buying interest.

Finance Secretary and Monetary Board (MB) member Benjamin Diokno was quoted earlier that he sees the nation’s key interest rate steady for the next cycle. The next and last MB meeting for the year will be on December 14.

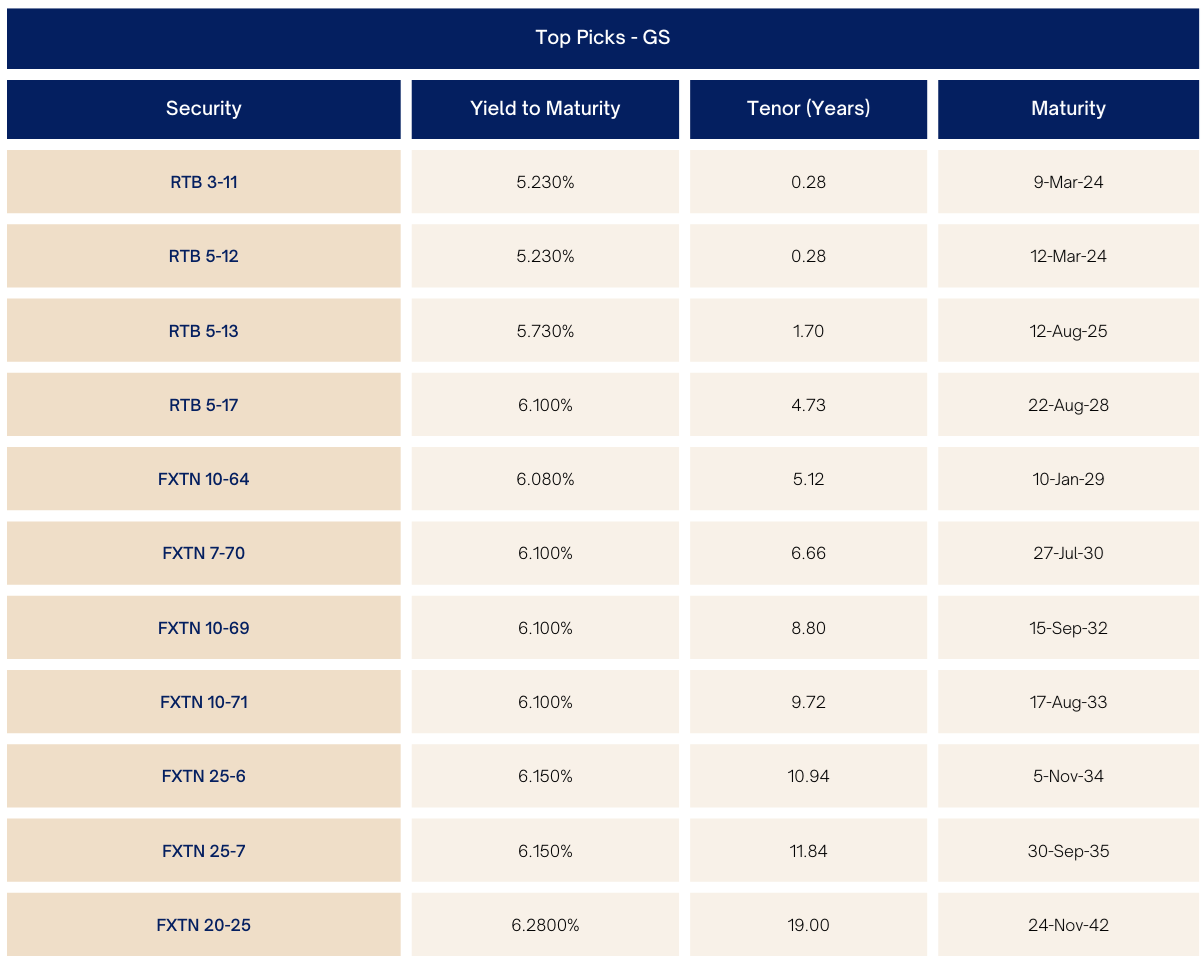

See our top picks below:

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco