Peso GS Weekly: Go for short-term peso GS

We see good value in short-term peso government securities with the flattening of the yield curve. The success of the auction last week also heralds good demand for the auction this week.

WHAT HAPPENED LAST WEEK

Good demand was seen in medium to long-term peso government securities (GS), causing the local yield curve to significantly flatten, i.e., the recent fall in long-term peso yields and the rise in short-term yields.

The rally started after the Bureau of the Treasury (BTr) fully awarded the issuance of 7-year Fixed Rate Treasury Note (FXTN) 7-69 at a high of 6.06%, setting the coupon of the bond at 6.00%. Auction results showed strong participation as highlighted by the 2.47x bid-to-cover ratio.

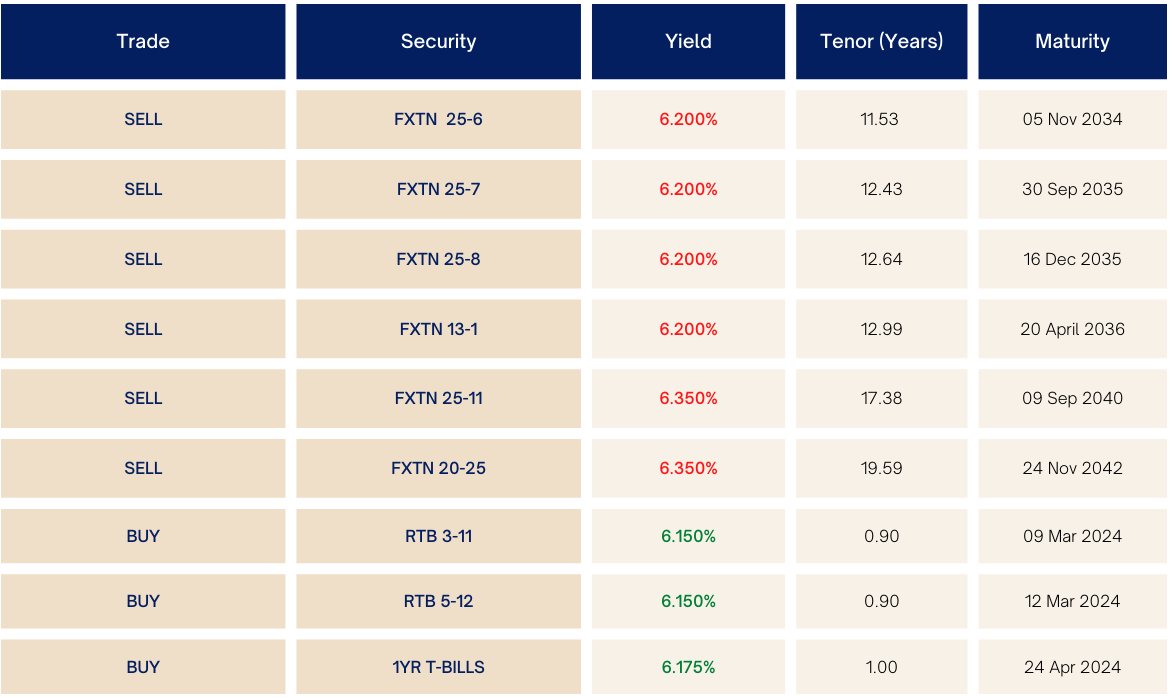

Later in the week, the BTr announced its borrowing schedule for the month of May, saying that it would issue 6-, 7-, 9-, and 13-year tenor buckets for the month. The exclusion of a 20-year bond to be issued for the second straight month improved the appetite for longer tenors. FXTN 20-25 traded lower by 16.5 basis points (bps) for the week as it closed at a yield of 6.260%, whereas FXTN 25-7 ended the week at 6.165% or 7.5 bps lower.

To close the week, as dealers and end-user clients continued to load up on long-dated bonds, the yield curve further flattened due to the ample supply of short-term bonds being sold in the market. This caused the Retail Treasury Bond (RTB) 5-12 with a tenor of less than a year to trade at the 6.175%-level vs FXTN 20-25 at 6.260%.

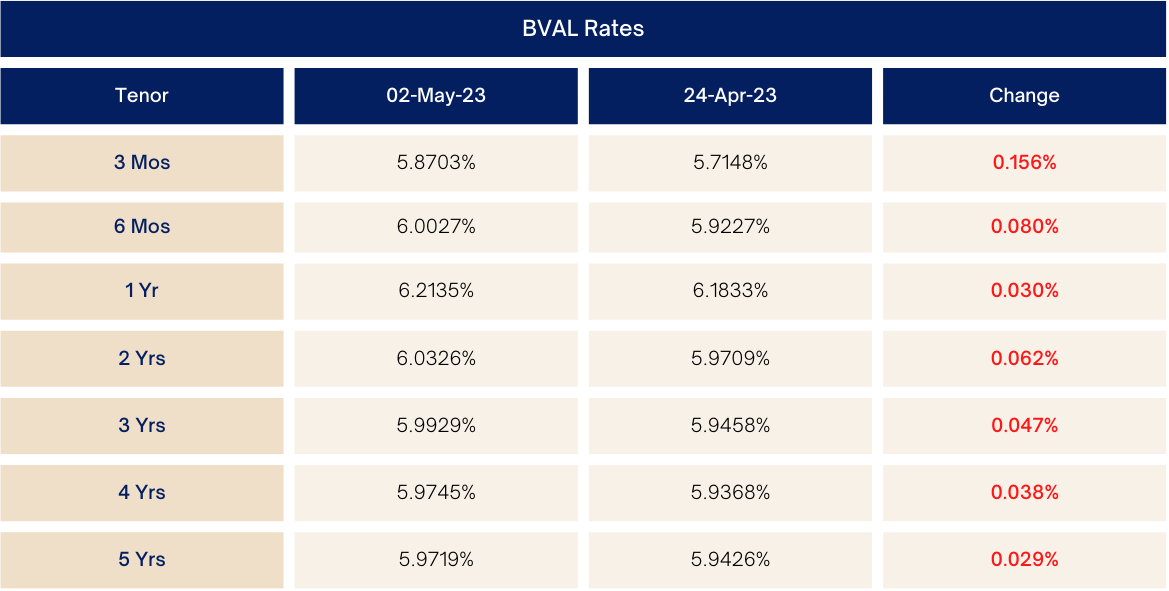

Market Levels (week-on-week)

WHAT WE CAN EXPECT

We expect good demand on the 6-year FXTN 10-64 auction, especially on the higher-end of market indications as we continue to see healthy buying demand to come out this week, just after the success of the FXTN 7-69 auction last week.

Given the significant flattening of the yield curve, we see decent value in holding short-term Treasury bills (T-bills) combined with bonds with tenors of less than one year due to their relative value as compared to long-term peso GS. RTB 5-12 is now yielding higher at 6.175% than FXTN 20-25 trading at 6.260%.

Other than the auction, investors and dealers will look at this Friday’s local inflation print for a longer-term view, where the Bangko Sentral ng Pilipinas’ (BSP) latest estimate stands at 6.3-7.1%. The Bloomberg consensus, on the other hand, is expecting inflation to be at the higher end of that range with a consensus of 7.0%.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco