On US rates: Skip doesn’t mean pause

Is a skip in the rate hikes of the US Fed generally better than a pause?

After 10 straight interest rate hikes, the US Federal Reserve decided to proceed with a “hawkish pause” in their monetary policy tightening campaign, a decision that will grant much-needed relief to consumers amid still elevated inflation. Policymakers left the target range unchanged at 5% to 5.25% to allow time to assess the impact of past hikes.

Historically, a Fed pause has been good news for investors and a boon for stocks. This time, however, the move suggests more of a “skip” than a “pause” as Fed officials think rates will need to rise further. Investing under this different scenario pose certain risks, especially when equities markets like the S&P 500 are performing well. It may be tempting to interpret the pause as a green light to increase investment in the stock market, but some caution is needed.

Hawkish bluff?

The latest Fed “dot plot” – a graphical representation of the Federal Open Market Committee’s (FOMC) members’ expectations for future rate changes – suggests two additional quarter-point rate hikes are likely within this year. Policymakers believe that rates may need to go higher than previously expected to bring down high and stubborn inflation.

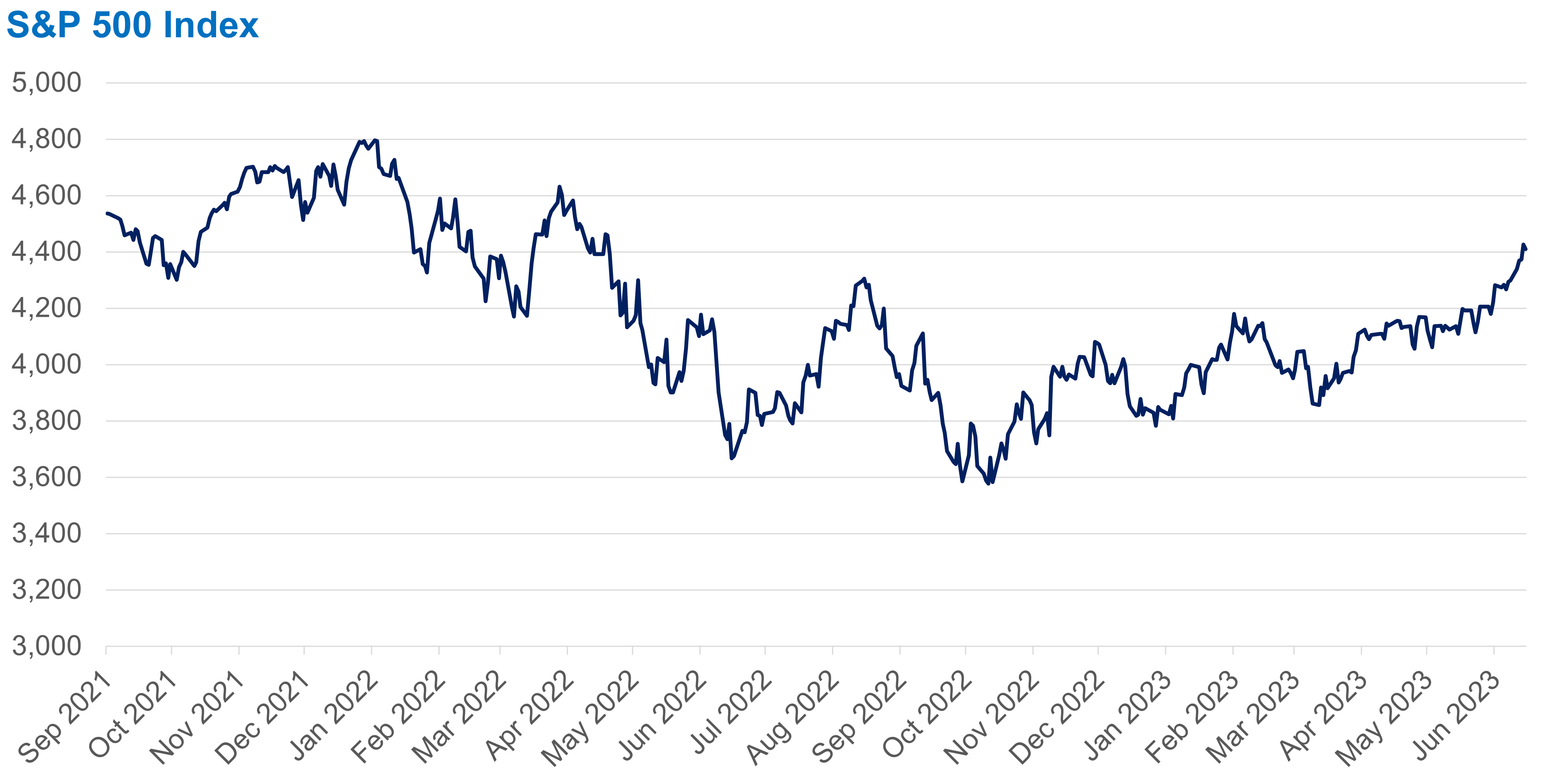

However, investors are calling the Fed’s bluff on its hawkish projections, as even Fed Chair Jerome Powell has affirmed the projections to tame sticky inflation. US inflation, which eased to 4% in May, further added to investors’ optimism that the Fed could avoid a hard landing. This pushed the S&P 500 to finish its 5th positive day in a row, the first such streak since November 2021.

Equity markets paid more attention to signals of the US Federal Reserve approaching its terminal rate, despite fresh projections of further monetary tightening before the end of the year.

A case of FOMO

History shows that the prospects for the current bull market to keep running are good, if policymakers opt for a longer pause before delivering the next rate increase they are signaling. Pauses in the Fed’s interest rate hikes have often been associated with bullish markets, providing potential opportunities for investors.

Specifically, a pattern has been observed where a series of interest rate increases followed by a pause sees stock prices rally. According to a Bloomberg Intelligence study, six instances since the 1970s revealed that extended pauses following rate hikes, particularly those lasting three months or longer, tend to correlate with an upswing in the S&P 500 Index.

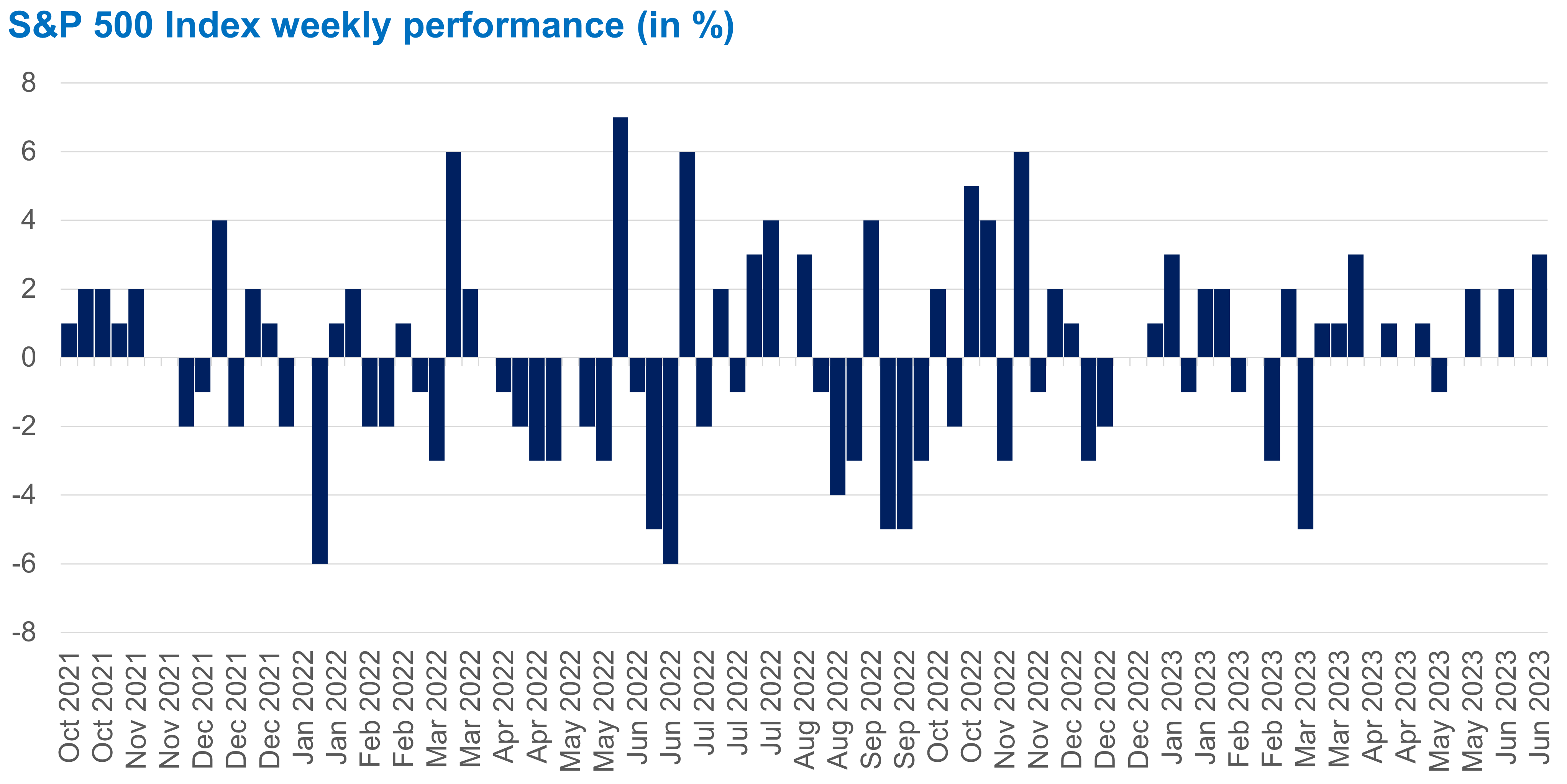

But things change if the central bank skips just one meeting before resuming its hikes. For example, when the Fed stopped its tightening cycle in April and resumed it in May, stocks fell 1.5% in the next three months. The current bull market appears to have been triggered by a similar pattern: a sequence of 10 consecutive interest rate hikes followed by a pause.

As we previously said, do not chase the rally. In our previous article about the recent rally, technical analysis suggested that the S&P 500 has reached the hard resistance level of 4,420 driven by the AI euphoria.

The last time prices accelerated this quickly was during the Dotcom bubble of March 2000 and November 2004. The rally may continue to push higher and even re-test the all-time highs seen in January 2022, but lingering uncertainties do not support it.

The S&P 500 has rallied the past two weeks, driven by AI and the technology sector.

If we find ourselves in a “skip,” between two hikes rather than an extended pause, forecasting market behavior becomes more complex. Typically, these “skips” tend to be less predictable than their longer “pause” counterparts, mainly because the brief duration without interest rate alterations doesn’t afford markets ample time to adapt and recalibrate.

Timing is important

As we always tell our clients, wait for the real pivot. We think that the results of the June Fed dot plot were done to prevent the markets from aggressively pricing in Fed rate cuts this year. Powell has reiterated that the Fed expects to raise interest rates one or two more times this year, but at a slower pace to avoid tipping the economy into a recession. The market is pricing in a little less one hike for July, with no full rate cut priced in anymore for the year.

We still think the Fed will continue with the pause throughout the year. If two Fed hikes materialize this year, we think the BSP will keep rates unchanged at 6.25% until the end of 2023.

BSP Governor Felipe Medalla said after the June 22 Monetary Board (MB) meeting that the central bank may consider cutting rates if headline inflation falls below 3% in January to February 2024. We do not think the BSP will match any possible Fed rate hikes, as the BSP’s policy actions will be largely driven by its inflation target.

We maintain our year-end official forecast of the BSP policy rate at 6%, with a 25-basis-point (bp) cut in December. We think that the impact on the USD/PHP exchange rate will be minimal, even if the interest rate differential (IRD) tightens to 75 bps.

Future interest rate expectations matter more, in which case both the Fed and BSP will be cutting in 2024, and the BSP was able to replenish its foreign currency reserves up to USD 100.6 billion as of end-May.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history and Korean pop music.

RENZO TAN AND MARCO SIY are interns under the Institutional Investors Coverage Division (IICD) of Metrobank. Renzo is currently studying at the University of Massachusetts Amherst, while Marco is studying at Georgetown University’s McDonough School of Business. Both are avid foodies and somewhat entomophobes.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco, Marco Siy, and Renzo Tan

By Geraldine Wambangco, Marco Siy, and Renzo Tan