No worries about external liabilities

The Philippines’ external debt rose to a record high of USD 111.27 trillion as of yearend 2022, up by 4.5% from 2021. But with economic output and foreign currency reserves going up, the Philippines is doing well compared to ASEAN peers.

The Philippines’ external debt has reached its highest ever, from USD 106.43 trillion in 2021 (27% of gross domestic product) to USD 111.27 trillion (27.5%) in 2022. On its own, it appears worrisome but one thing about debt is that it must be understood in context. First, what was the debt used for, and second, how do the debt ratios compare versus the past and versus peers? Let’s take a look at these.

The Use

According to Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla, the increase in external debt was primarily driven by public and private sector spending on COVID-19 recovery measures, as well as to support economic growth. It’s a no-brainer that this kind of spending had to happen even if foreign debt had to be incurred.

The Past

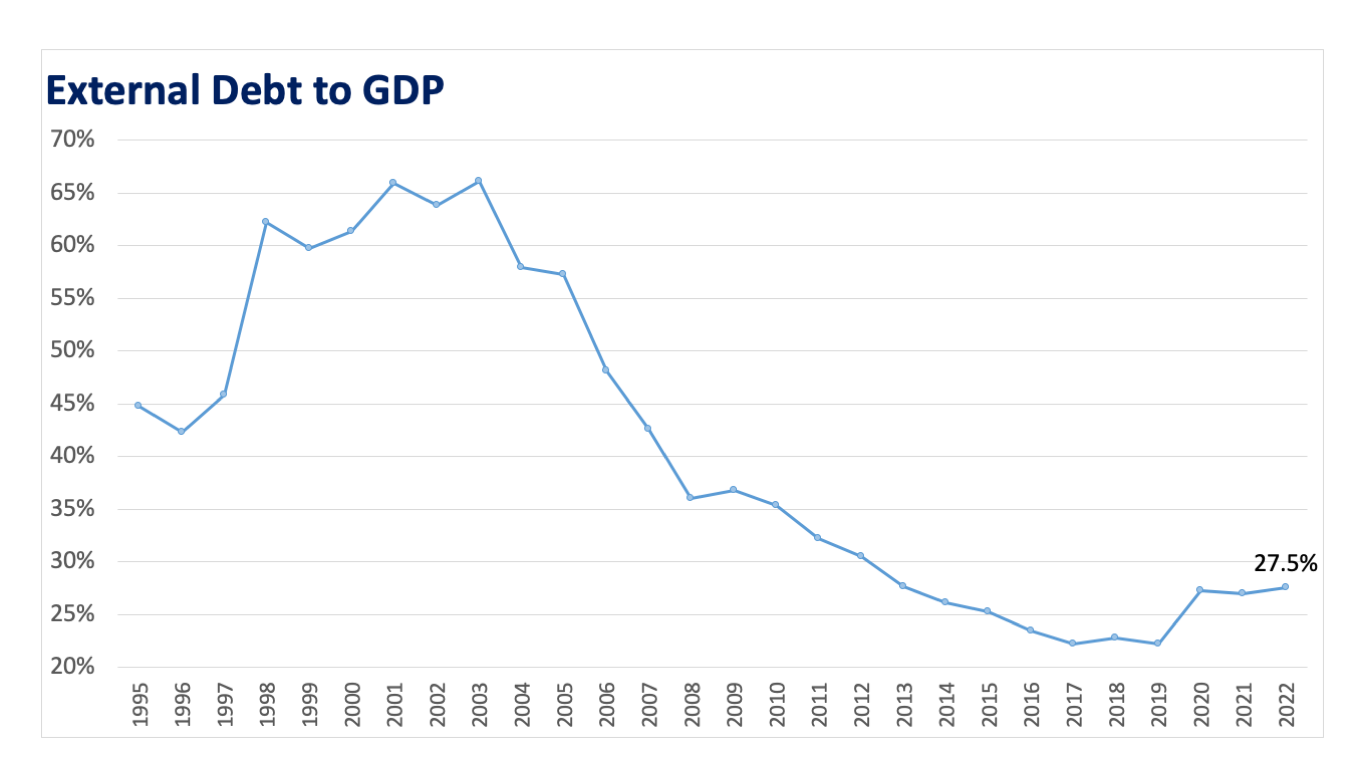

Over the years, the external debt-to-GDP ratio dramatically shrunk (see figure 1) – it only went up during the pandemic when we needed more external financing to support the economy and fight COVID. Eventually, GDP recovered and just like external debt, nominal GDP has gone to its highest levels ever. These two, GDP and external debt, have to be taken together in context.

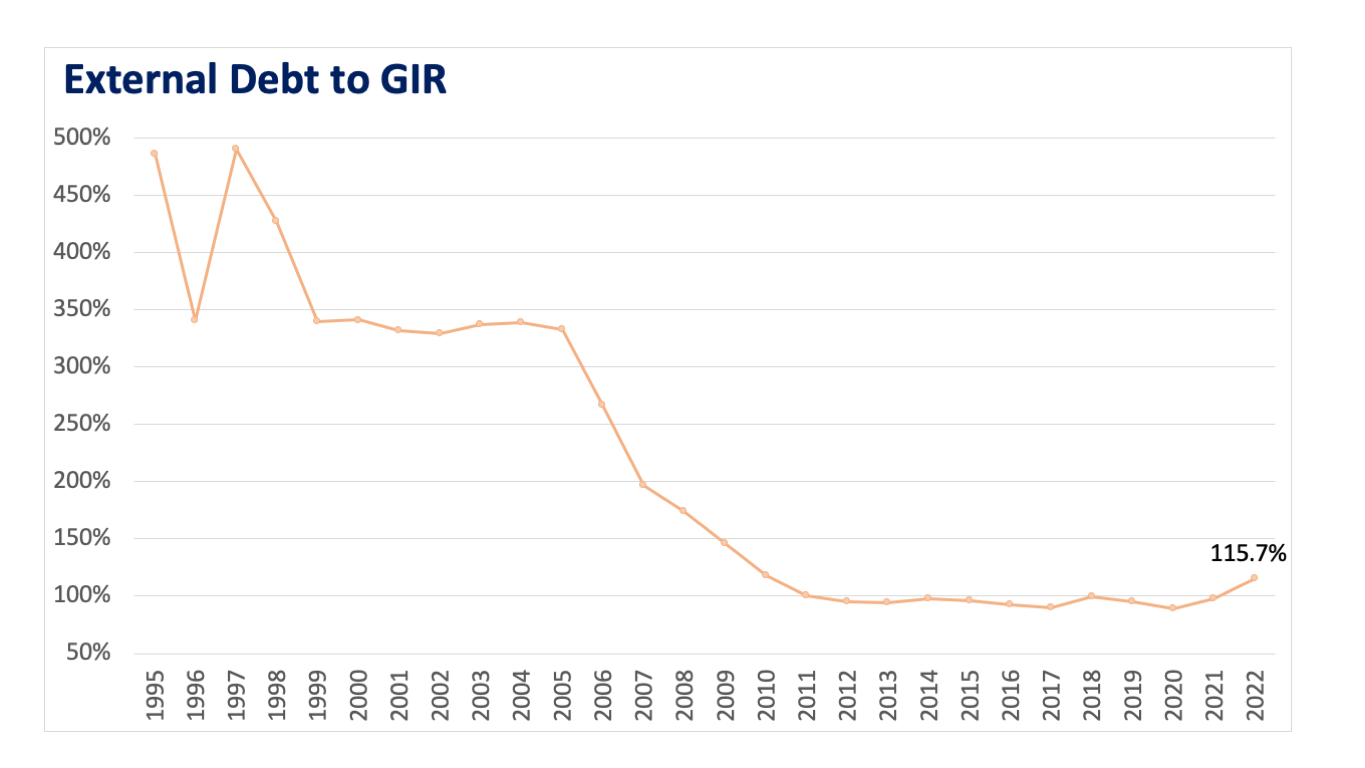

Moreover, our capacity to pay for it has improved as depicted in the external debt-to-GIR ratio (see figure 2). Gross international reserves (GIR) are assets held by central banks to back liabilities and help manage external shocks that impact their currencies (e.g., preventing their respective currencies from rapidly devaluing or depreciating). The Philippines’ GIR has been relatively increasing since the mid-2000s, thus improving this ratio.

So, a look at the external debt-to- GIR ratio of the past shows a dramatic shrinking of the debt burden relative to reserves, with the current upward ratio just a blip in the overall scheme of things. It must be remembered that not all external debt is due and demandable right now, with only a small portion due within a year (only around 15% of total external debt is short-term).

Definitely, the GIR is more than adequate at the moment.

The Peers

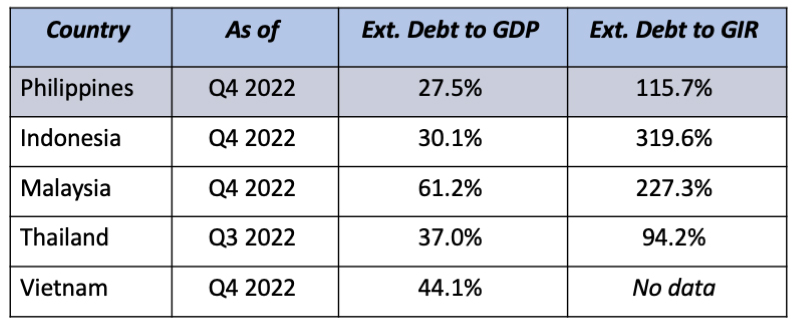

In comparison with its ASEAN peers, the Philippines’ external debt-to-GDP ratio is clearly the lowest as listed below. Its external debt-to-GIR ratio is also satisfactory and is second-best to Thailand, which means the country is in a better position compared to other ASEAN peers and is less prone to risks that go with foreign-denominated borrowings.

Source: Bloomberg

So, in summary, yes, the external debt grew, but so did the economy, recovering and growing as a direct result of the activities that the external debt helped finance in the first place. That’s the thing about debt – if it’s incurred for productive capacity and the resulting productivity itself pays for that debt, there’s no issue.

So, worried about external debt? Don’t be, things are working as planned.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano