Deficit spending remains unabated

No reduction in deficit spending yet as the Philippines’ debt-to-GDP ratio rises amid the pandemic; fiscal efforts persist to sustain economic stability.

Much ado about debt

Analysts have voiced concern about the Philippines’ worsening debt-to-GDP ratio as it breached the 60%-mark. 60% – 70% is normally the debt sustainability range level accepted as benchmark for emerging market economies, as guided by the IMF-World Bank Debt Sustainability Framework. With ratings agencies closely monitoring the level, prolonged high ratio may be a recipe for a downgrade.

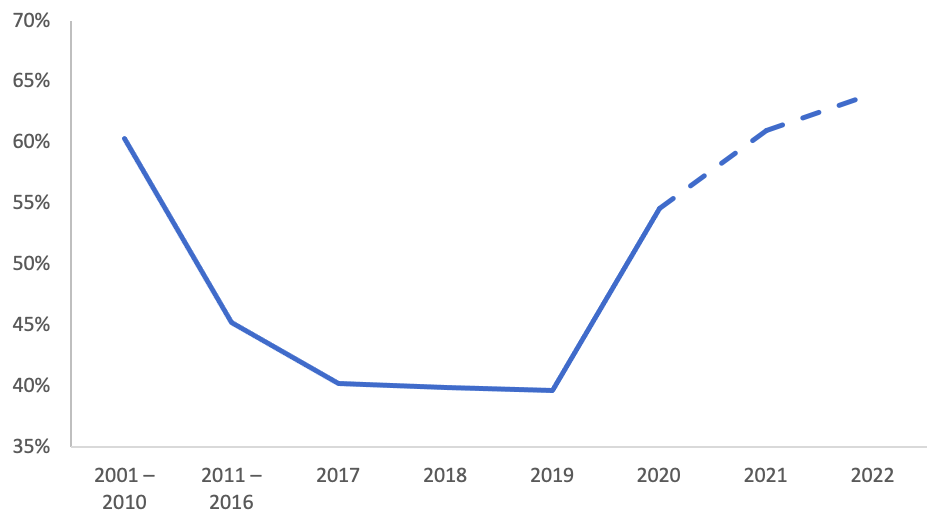

Prior to the pandemic, the debt-to-GDP ratio has been on a downtrend (Table 1). Actual debt dropped from a high of 71.6% of GDP in 2004 to a historic low of 39.6% in 2019. Through different administrations, economic managers’ support for fiscal consolidation resulted to the Philippines eventually achieving investment grade rating. Unfortunately, Covid-19 threw a monkey wrench even to well-laid out plans.

Debt-to-GDP has consistently been on a downtrend during the pre-pandemic years

Table 1: Historical actual debt to GDP

(excludes guaranteed debt)

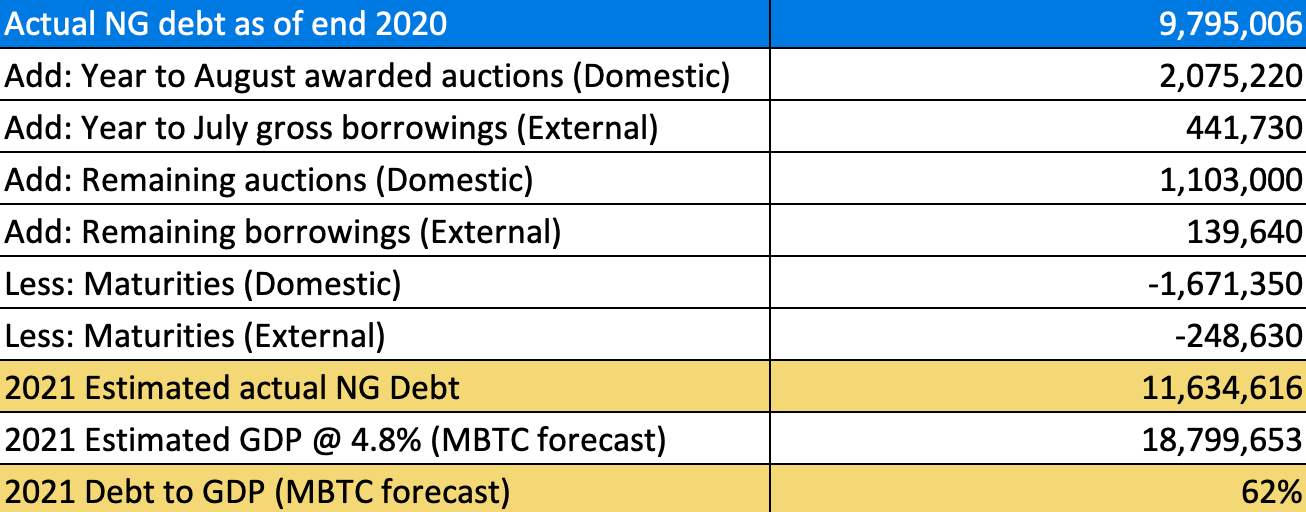

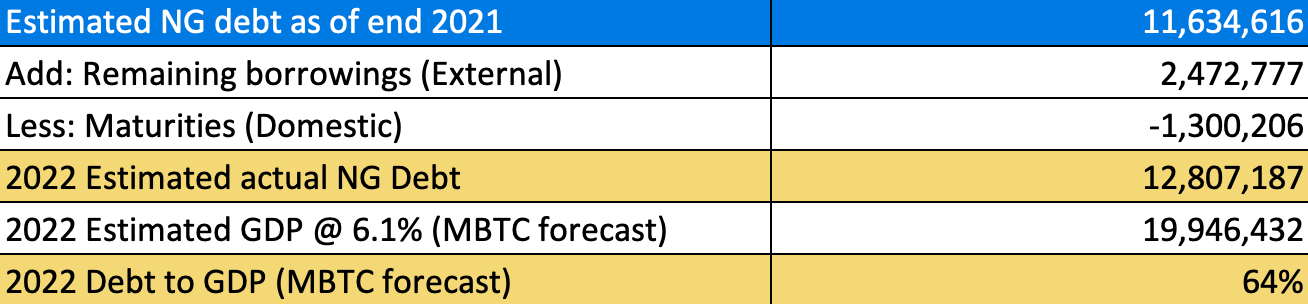

The debt stock jumped due to the elevated level of fiscal deficit incurred since last year. This situation runs counter to fiscal discipline and prudent debt management strategies that the country’s economic managers have carefully crafted over the years. A report from the Bureau of Treasury (BTr) as of July 2021 showed total government debt amounted to P11.610 trillion or 41.25% higher than by the end of 2019. Based on our own estimation using Metrobank’s GDP forecast, by the end of 2021 the country’s actual debt to GDP ratio will rise to (Table 2). By 2022, it will go up to 62% (Table 3).

The government is expected to keep debt ratio below 70% as it implements fiscal consolidation strategy

Table 2: 2021 estimated actual debt to GDP

Table 3: 2022 estimated actual debt to GDP

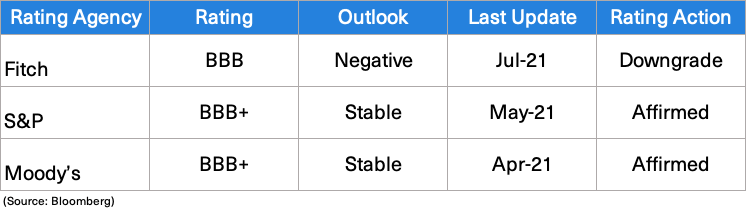

Consequently, ratings agencies have highlighted the weakening fiscal finances due to the pandemic and therefore increasing risks to the country’s credit profile. Fitch Ratings, in a July 2021 release, revised its outlook for the Philippines from “stable” to “negative”, citing risks to growth prospects in the medium-term and possible scarring effects due to the pandemic. The negative outlook implies the possibility of a credit rating downgrade, which can mean higher interest rates on external borrowings for the country (Table 4).

Philippines keeps investment grade rating for now.

Table 4: Philippine Credit Ratings

However, the events since the past year could not be considered as “normal.” This extraordinary global occurrence needed extraordinary measures. The higher debt-to-GDP ratio could also be attributed to the shrinking of the economy due to the recession. We have posited in our April publication of the RADAR: Investment Grade, Stable Outlook Intact, prudent fiscal management, tax reform, and “good spending” by way of infrastructure spending will continue to anchor the Philippines’ investment grade rating this year. Moreover, financing risk and debt position while elevated, remain stable. Still, we expect the government to keep the debt ratio below 70% as it begins fiscal consolidation.

While the debt-to-GDP ratio is commonly used as threshold indicator to determine debt sustainability, it is not an absolute indicator of a country’s debt distress. Other factors should also be considered such as the source of debt (domestic-external borrowing mix), the currency of the debt (local vs. foreign), and the debts’ maturity profile.

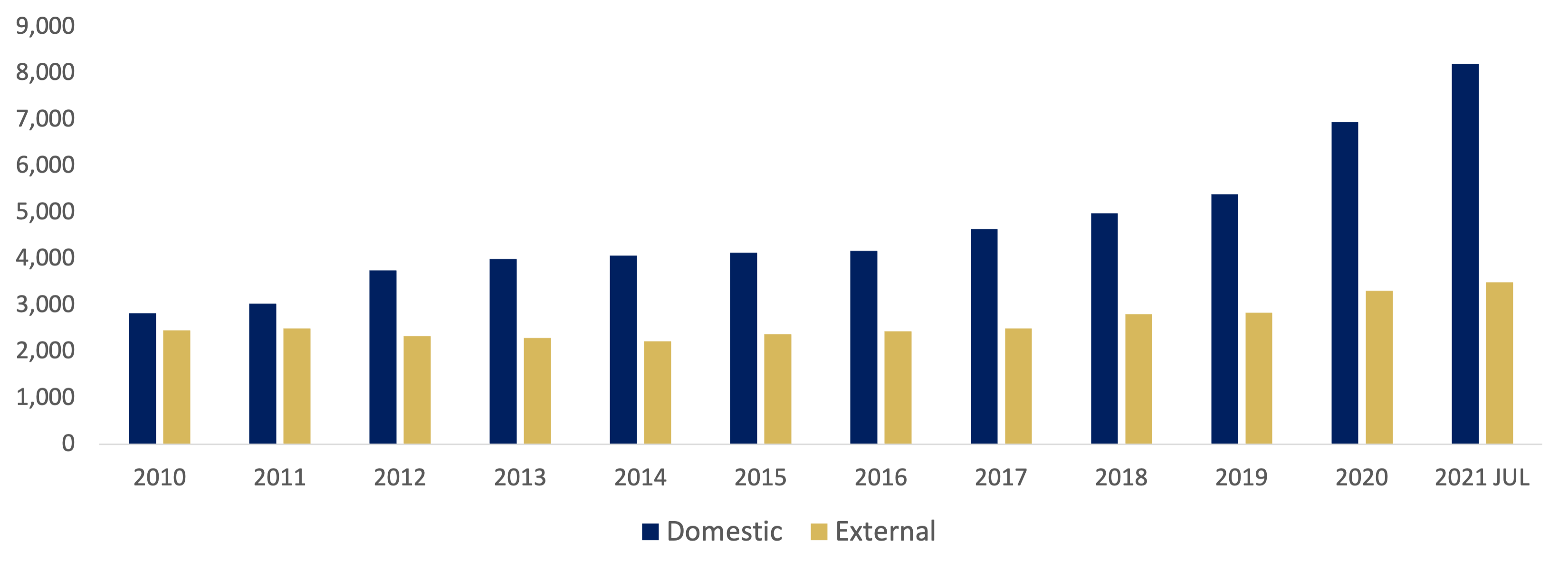

We look at recent data from the Bureau of Treasury (BTr). The share of domestic debt to total debt increased from 53.51% in 2010 to 67.68% in 2019, then 76.7% as of July this year. Peso denominated debt rose from 67.67% in 2019 to 70.45% as of July 2021. Increasing the share of domestic debt and local currency denominated debt reduces vulnerabilities from foreign exchange and external interest rates shocks, and liquidity risks stemming from foreign investor risk appetite.

In a 2002 study done by the IMF on debt sustainability (IMF, Assessing Sustainability May 28, 2002, p. 25), it was determined that an external debt-to-GDP ratio of 40% provides a useful benchmark. For a country with a debt ratio below this level (40%), the conditional probability of a debt crisis or correction is around 2-5%. Currently, based on an assumption of 4.5% GDP growth this year, the country’s external debt-to-GDP ratio is 13.5%, way below the 40% benchmark (Table 5).

Table 5: Domestic debt vs External debt

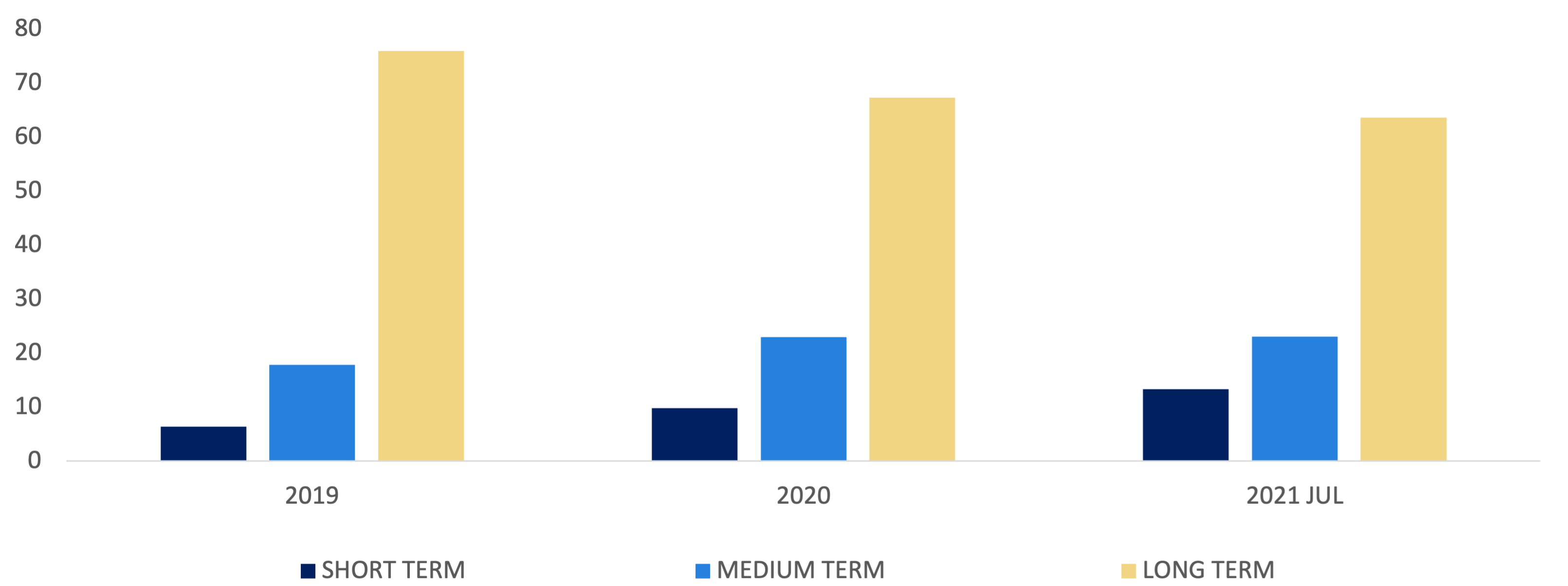

With regard to the debt maturity profile, as of July 2021 medium to long term debt accounted for 86.7% of total debt. Given this, rollover risk is low as short term debt is only 13.3% of total debt (Table 6). We do note that short term debt increased from 6.1% in 2019 to the current level as the government has to raise much needed funds amidst market risk aversion.

Low rollover risk

Table 6: Philippine Debt Indicator (%)

On a medium-term horizon, as the economy recovers, GDP is expected to return to its pre-pandemic level and hopefully back to its growth trajectory. A bigger GDP and with fiscal consolidation in place, debt ratio will fall. However, this is not to paint a rosy picture of the economy going forward. Risks abound that may upend even the smartest of plans.

Next year, the country faces national elections that aside from upping political risk, this also means election period ban on public construction, throwing another roadblock to the government’s infrastructure initiative. The government has been banking on its Build, Build, Build program to boost the economy. Other sources of fiscal risks are natural disaster and health emergencies, the Supreme Court ruling on the Mandanas petition, and the Unified Military and Uniformed Personnel Separation, Retirement and Pension scheme if not amended. These last three risks we discussed in our latest published RADAR entitled No Relief from Deficit Spending Part 1.

Despite the aforementioned risks, we remain optimistic. The recent lockdown may have less impact on economic activity, as people and businesses adapt to the situation, with businesses introducing new practices and consumers less cautious compared with 2020. As the vaccination rollout expands and gains momentum, giving more confidence to the government and the population to continue returning to pre pandemic activity, economic numbers should improve moving forward. GDP is expected to return to pre-pandemic level by the end of 2022.

In the meantime, the national government continues to raise funds for its pandemic response. Recently, the BTr issued 5 and 10 Year Retail Onshore Dollar Bonds targeted at individual investors. The 5 Year has a coupon rate of 1.375% while the 10 Year has a coupon rate of 2.25%. Rates are higher than market rates of prevailing dollar denominated debt of the Republic. This will be offered until October 1 and will settle on October 8. This is an opportunity to diversify and expand one’s investment portfolio.

DOWNLOAD

DOWNLOAD

By Eric Calumpang

By Eric Calumpang