March 2024 Updates: Still chasing moderate growth

A gradual recovery in government spending and lower imports suggest continuing tailwinds to the local economy, which may also be affected by El Niño and emerging geopolitical conflicts.

Philippines headline inflation rose more than expected to 3.4% year-on-year in February from 2.8% in January, mainly driven by an increase in the prices of food and non-alcoholic beverages. January and February recorded the same month-on-month growth at 0.6%, suggesting that inflation is not yet slowing sequentially.

Meanwhile, the National Government (NG) posted a larger budget surplus of PHP 88 billion for January 2024 compared to the PHP 45.7 billion recorded a year ago, reflecting an increase of 92.25% YoY or PHP 42.2 billion, driven by a faster 21.15% YoY increase in revenue collection outpacing the 10.39% expansion in government spending. The budget deficit is seen ending lower at PHP 1.36 trillion (-5.1% of GDP) this year versus the PHP 1.51 trillion (-6.2% of GDP vs. -6.1% est.) recorded for full year 2023.

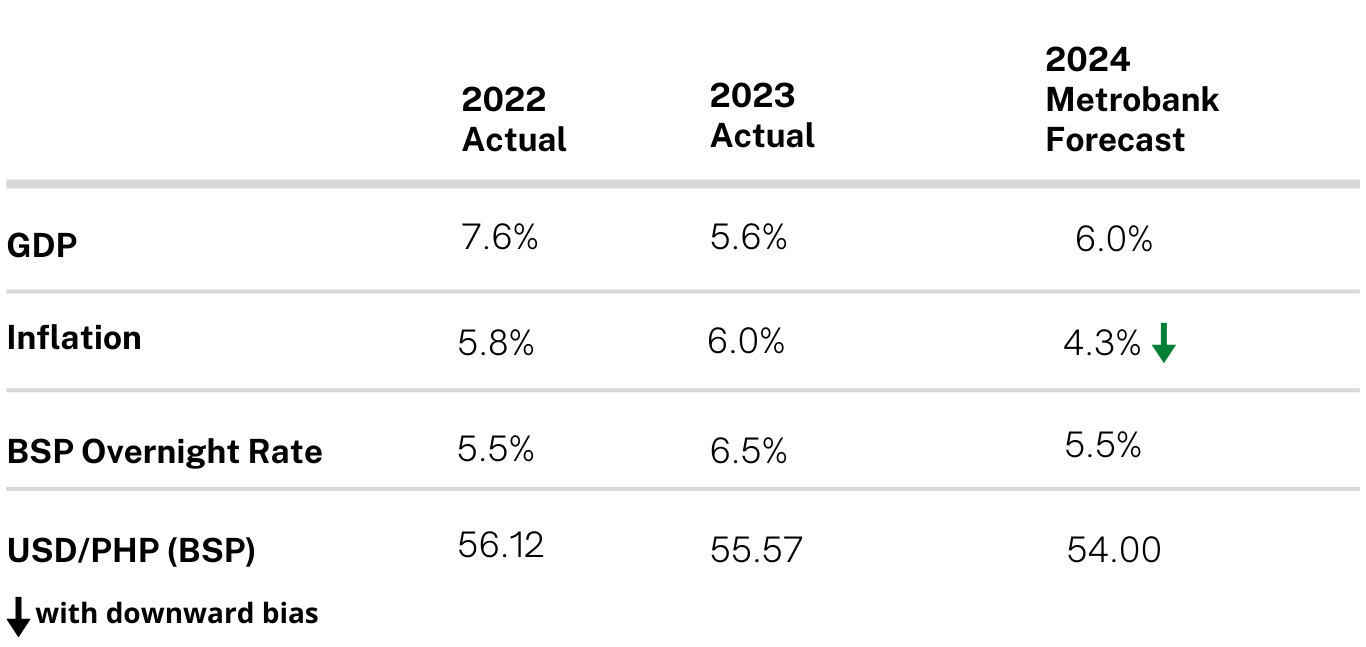

We are maintaining our outlook on the following key macroeconomic indicators:

For more information on the performance and outlook for several macroeconomic indicators, as well as local macroeconomic news, please download the full report below:

March 2024 Updates: Still chasing moderate growth

Metrobank Research retains its yearend average inflation forecast at 4.3% (with a downward bias) as there continues to be strong upward inflation pressure for the year due to the rising rice prices and the impending effects of El Niño on food items and of emerging geopolitical risks on global market prices.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research