Long-term bonds: Why savvy investors should buy them now

With the current interest rate environment, long-term bonds are opening opportunities to create wealth.

Last March 23, 2023, the Bangko Sentral ng Pilipinas (BSP) raised rates by only 25 basis points (bps) from 6.00% to 6.25%. While it is smaller relative to recent hikes, the move still brought the policy rate to its highest level in the last 16 years.

Naturally, one would assume that higher prevailing interest rates would result in higher interest-bearing investments. But that is not always the case.

Inflation expectations matter

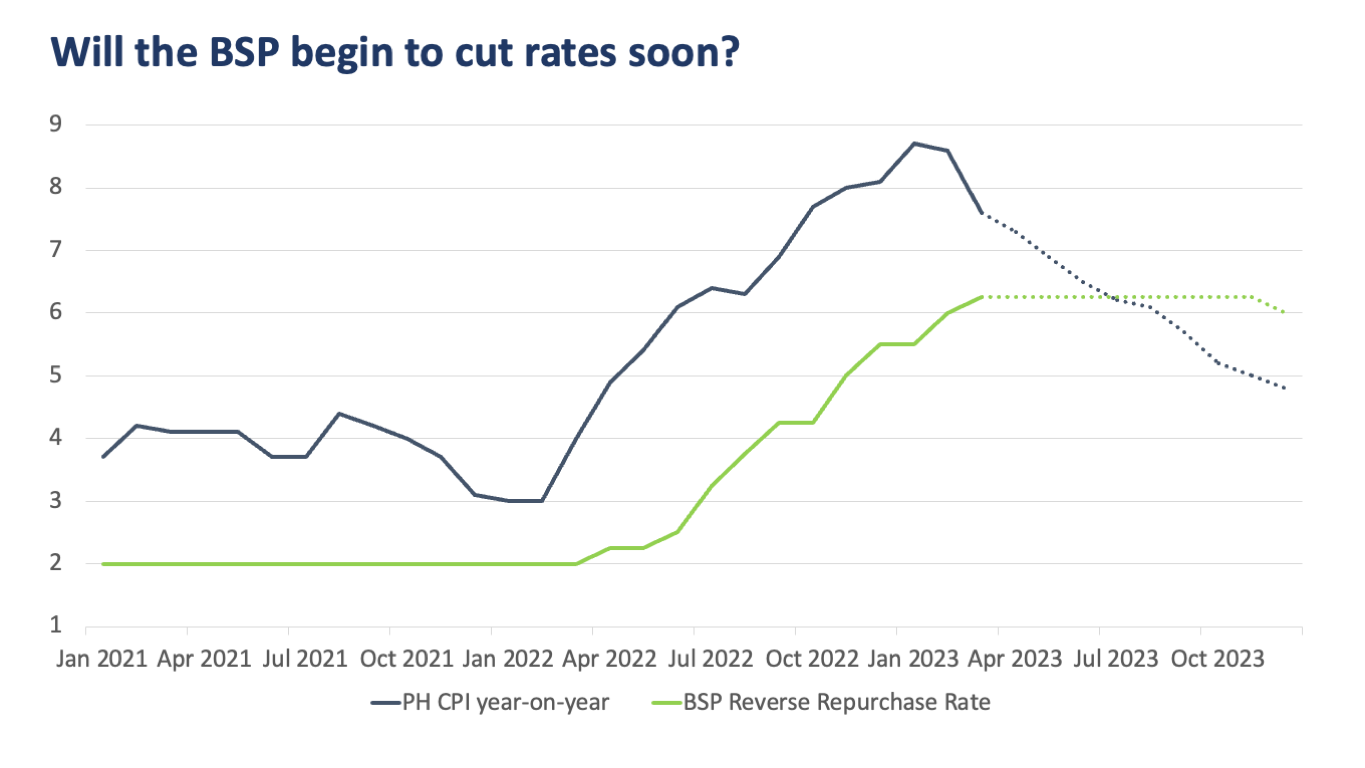

March 2023 inflation has come out much softer than expected at 7.6% year-on-year versus 8% forecast and 8.6% the previous month.

Now investors are starting to think that inflation is on a sustained downtrend and the BSP may not need to hike interest rates any further. We expect the full year Consumer Price Index (CPI) to average between 6% to 7%, driven by lower fuel prices, base effects from already elevated 2022 prices, and a potential global economic slowdown.

The BSP could hold its policy rate at 6.25% or hike to 6.50% in May. But as the CPI continues to decelerate, our research team forecasts that the BSP will cut rates back down to 6.00% in December, in order to signal the beginning of a new easing cycle in 2024.

Chasing after peak interest rates

For this reason, investors are abandoning short-term treasury bills (3 months to 1 year) and instead buying long-term treasury bonds (greater than 1 year) in order to lock-in yields before an imminent drop in inflation and hence, interest rates.

With the Bureau of Treasury (BTr) also about 40% done with its domestic borrowing plan, it is unclear just how many new long-term bonds will continue to be issued at the current rates. This uncertainty regarding bond supply pushes investors to chase after the peak and the surging demand inadvertently causes bond yields to fall.

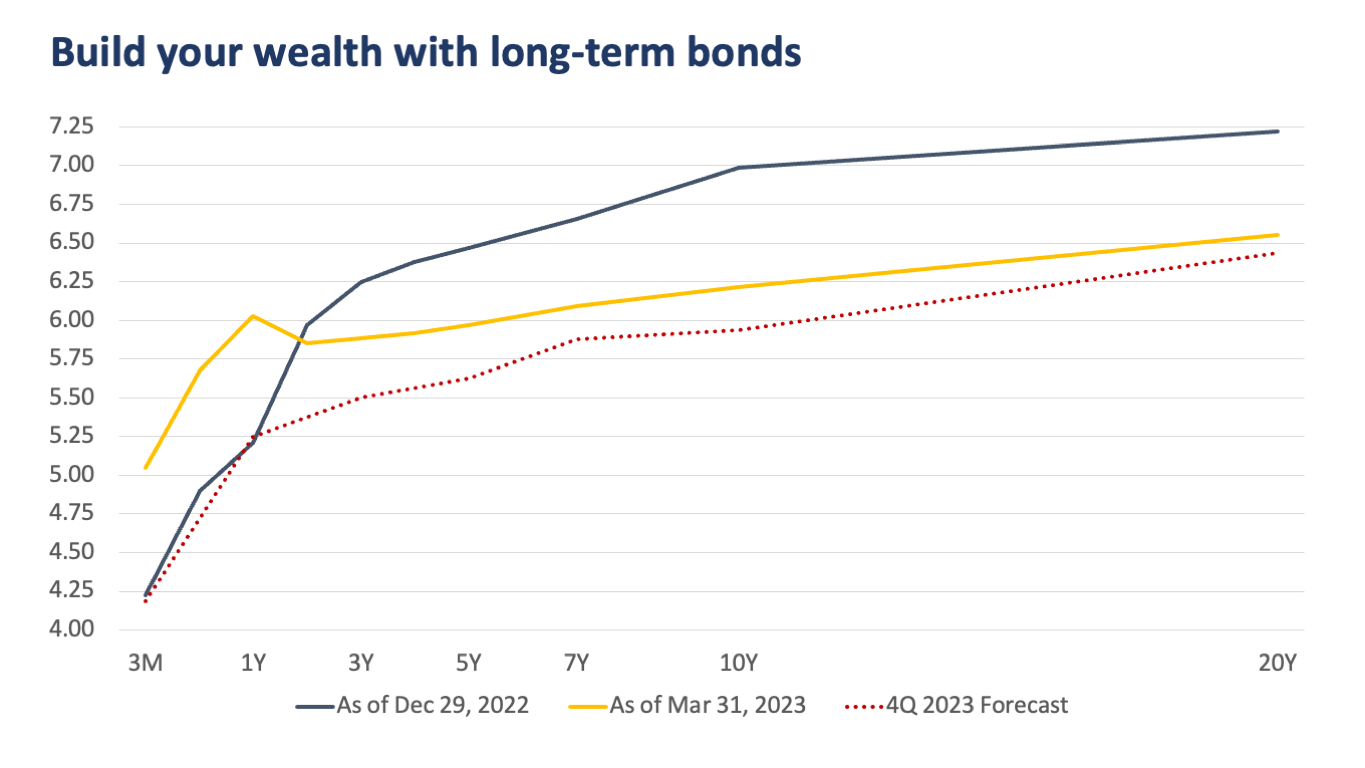

The chart below shows the movement in the peso government securities yield curve from the ends of 4Q 2022 to 1Q 2023. The sell-off in short-term treasury bills caused yields to rise by 75-80 bps. Conversely, greater demand for long-term treasury bonds caused yields to fall by as little as 35 bps on 3-year bonds to as large as 77 bps on 10-year bonds.

The chart also shows where our government securities traders forecast yields to fall by the end of the year. They expect the short-term yields to return lower by 75-85 bps and for the long-term yields to fall by another 20-40 bps.

Add duration and lock in bond yields for longer

Even though yields have fallen from their 2022 highs, this is still a once-in-a-lifetime opportunity to invest in bonds at the peak of a high interest rate environment.

We encourage clients to invest in 10- to 20-year bonds now. Higher-duration or longer-tenor bonds are also more sensitive to changes in interest rates. If the BSP starts cutting interest rates, new bonds will get issued at lower coupon rates and investors may see their long-term bonds appreciate.

While we encourage investors to hold onto their bonds until maturity date, wealth can also be created when selling higher yielding bonds in a low interest rate environment.

For more information on how you can invest in or trade government securities with Metrobank, please reach out to your relationship manager or investment specialist, or visit the nearest branch.

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre