Lock in high yields and gradually add stocks to your portfolio

Gradually add stocks to your investment portfolio by locking in high yields. Read this article today for more information.

Say you are a moderately aggressive investor. Where should you put your money?

With the current market outlook, it is recommended to invest about 70% of your wealth in fixed income instruments or bonds and 30% in equities or stocks.

As inflation is taking more time to go down, opportunity lies in fixed income investments in a higher-for-longer investment climate. It is best to invest in bonds with a longer duration and lock in higher interest rates before they finally go down around the latter part of the year.

Meanwhile, broad-based recovery for equities would likely happen as rate cuts begin. Nevertheless, it is recommended to gradually increase holdings in stocks given the latest market developments.

Modest improvement in growth expected

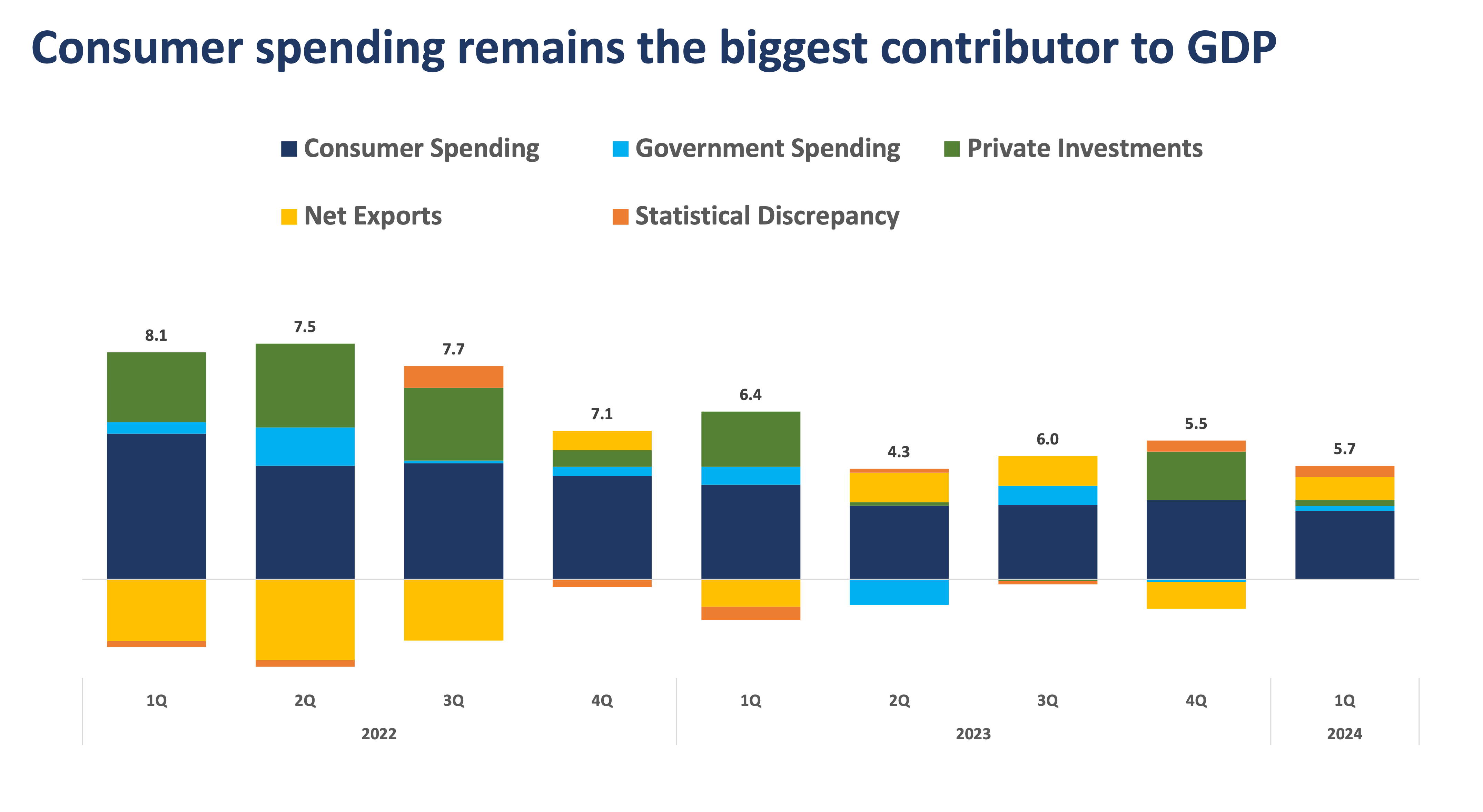

In the first quarter, the country’s gross domestic product (GDP) grew by 5.7% YoY, slightly below expectations albeit higher than the previous quarter’s 5.5% growth. Domestic demand has weakened, with consumer spending at its slowest growth since the post-pandemic period due to elevated inflation and interest rates.

Nevertheless, resilient external demand has bolstered exports, particularly for automotive electronics and semiconductors.

Sources: Bloomberg, Metrobank Trust Banking Group estimates

Looking ahead, the National Economic Development Authority (NEDA) anticipates a potential uptick in household consumption as long as inflation remains tame. Alongside short-term government measures, labor market improvements could also support consumer spending.

Government expenditure is also poised for improvement in the next quarter, fueled by increased spending observed in April.

Will inflation breach BSP’s 2-4% target range?

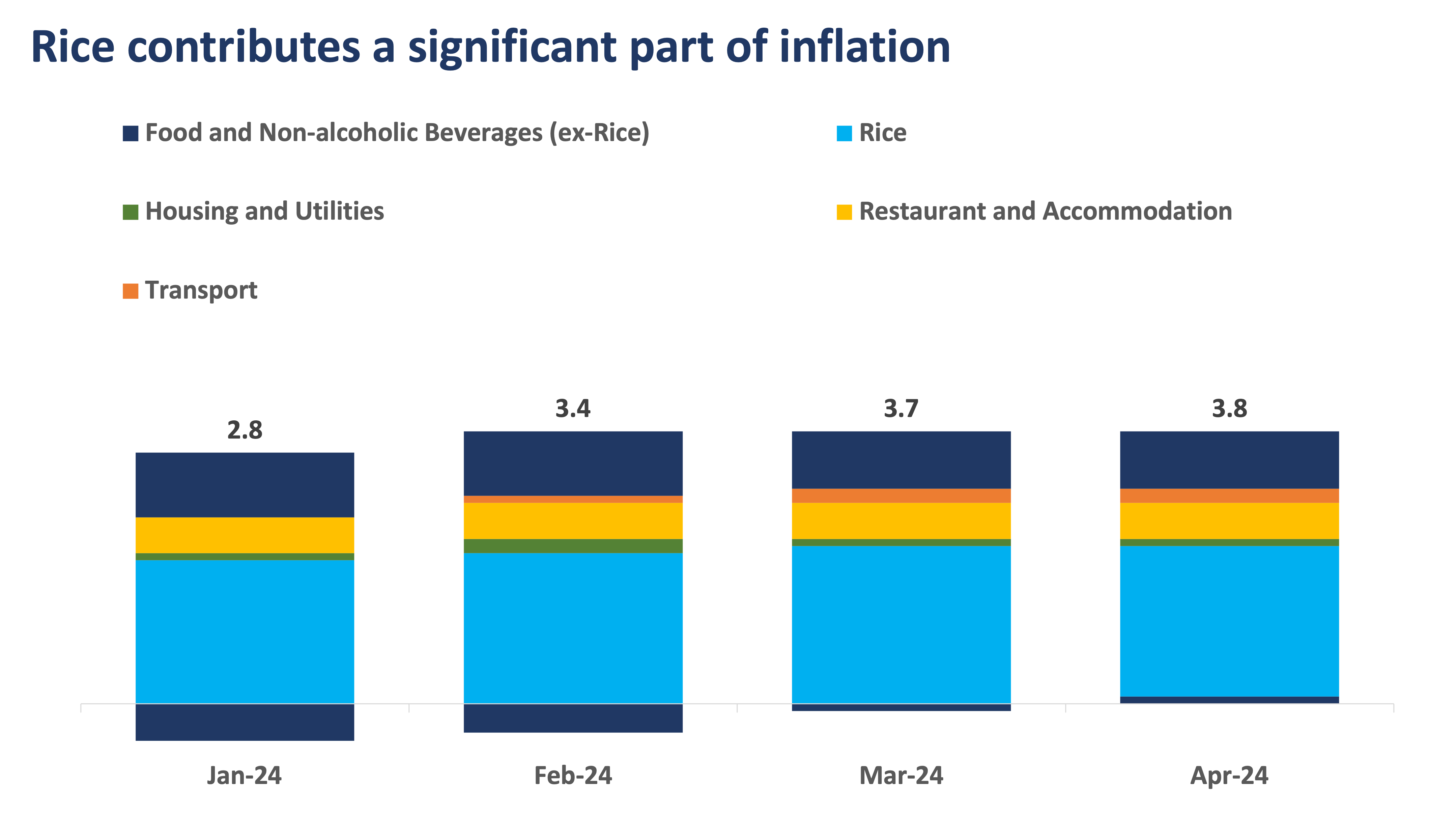

Inflation is on an upward trajectory despite remaining within the target range of the Bangko Sentral ng Pilipinas (BSP), currently standing at 3.8% year-on-year (YoY) as of April. Persistent increases are primarily driven by food prices, with rice inflation surpassing 20% and fuel prices gradually rising.

Sources: Bloomberg, Metrobank Trust Banking Group estimates

Inflation is expected to accelerate further, potentially exceeding the target range in the coming months particularly due to the impact of El Niño on food and other commodities. Additional upside risks include higher transport charges, electricity rates, and geopolitical tensions. Given this, inflation may likely only decelerate by the third quarter of this year.

Pushback of rate cut expectations

Rate cut expectations have moved to later this year as prices continue to fluctuate. While the BSP is relatively less hawkish than before, it still expects inflation to go beyond the target range from May to July. Previously, the BSP also emphasized that it is looking into the actions taken by other central banks, including the US Federal Reserve.

Consequently, monetary easing may only happen towards the latter half of 2024 once inflation settles back within the central bank’s target. The BSP is likely to proceed with rate cuts after the Fed does to avoid further local currency weakness.

Before making any investment decision, we advise you to consult your relationship manager or investment advisor.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here or visit any Metrobank branch so you can begin your wealth journey with us.)

SOPHIA THERESE “PIA” BONIFACIO is a Research Officer at Metrobank’s Trust Banking Group, covering local and offshore macroeconomic research. She obtained her Bachelor’s degree in Economics with a Specialization in Financial Economics, cum laude, from the Ateneo de Manila University and is a Certified UITF Sales Person (CUSP). Pia enjoys long road trips and is a self-proclaimed milk tea connoisseur.

ANNA DOMINIQUE CUDIA, MBA, CSS, is the Head of Markets Research at Metrobank’s Trust Banking Group, spearheading the generation and presentation of financial markets insights to internal and external clients. She used to be with Metrobank’s Investor Relations, where she brought in international awards and took part in various multi-billion peso and dollar capital raising activities. She holds a Master of Business Administration (Finance) degree, with distinction, from the University of London, and industry certifications in finance. She is a naturally curious person and likes to travel here and abroad.

GINNY PECAÑA is the Head of Investment Services Division at Metrobank’s Trust Banking Group, overseeing markets and equities research, investment analysis, fund selection, portfolio analytics, and trade execution. Ginny has garnered multiple awards for fund management with her decades of banking experience. She holds a Bachelor’s degree in Business Management from the Ateneo de Manila University as well as various finance certifications. On weekends, Ginny plays Mom to two teenage boys and a 10-month-old corgi named Hobie.

DOWNLOAD

DOWNLOAD

By Sophia Bonifacio, Anna Cudia, and Ginny Pecaña

By Sophia Bonifacio, Anna Cudia, and Ginny Pecaña