LNG in the Philippines: Bridging the gap toward renewables

Discover how liquefied natural gas plays a crucial role in the Philippines’ energy transition.

The Philippines welcomed its first-ever liquefied natural gas (LNG) import in April. What lies ahead as the country transitions to the “lesser evil” fuel?

In our previous article, we talked about the ongoing challenges for the Philippine energy sector given Malampaya’s looming depletion. As Malampaya may run out of gas in less than four years, the country needs to scout for alternative energy sources, among which is Liquefied Natural Gas (LNG).

Just recently, the Philippines commenced the operation of its first LNG terminal in Batangas and welcomed its first LNG import of 137,000 billion cubic meters in April. This shipment will fuel one of the 1,200-megawatt power plants in the country for a trial run.

However, some are worried renewable energy in the Philippines may increase electricity prices. This concern is warranted given the spike in energy prices last year that pushed up electricity generation costs and, therefore, the bills we pay.

But before diving into inflation real quick, it might be helpful to get acquainted with the industry first.

Who runs the world’s gas?

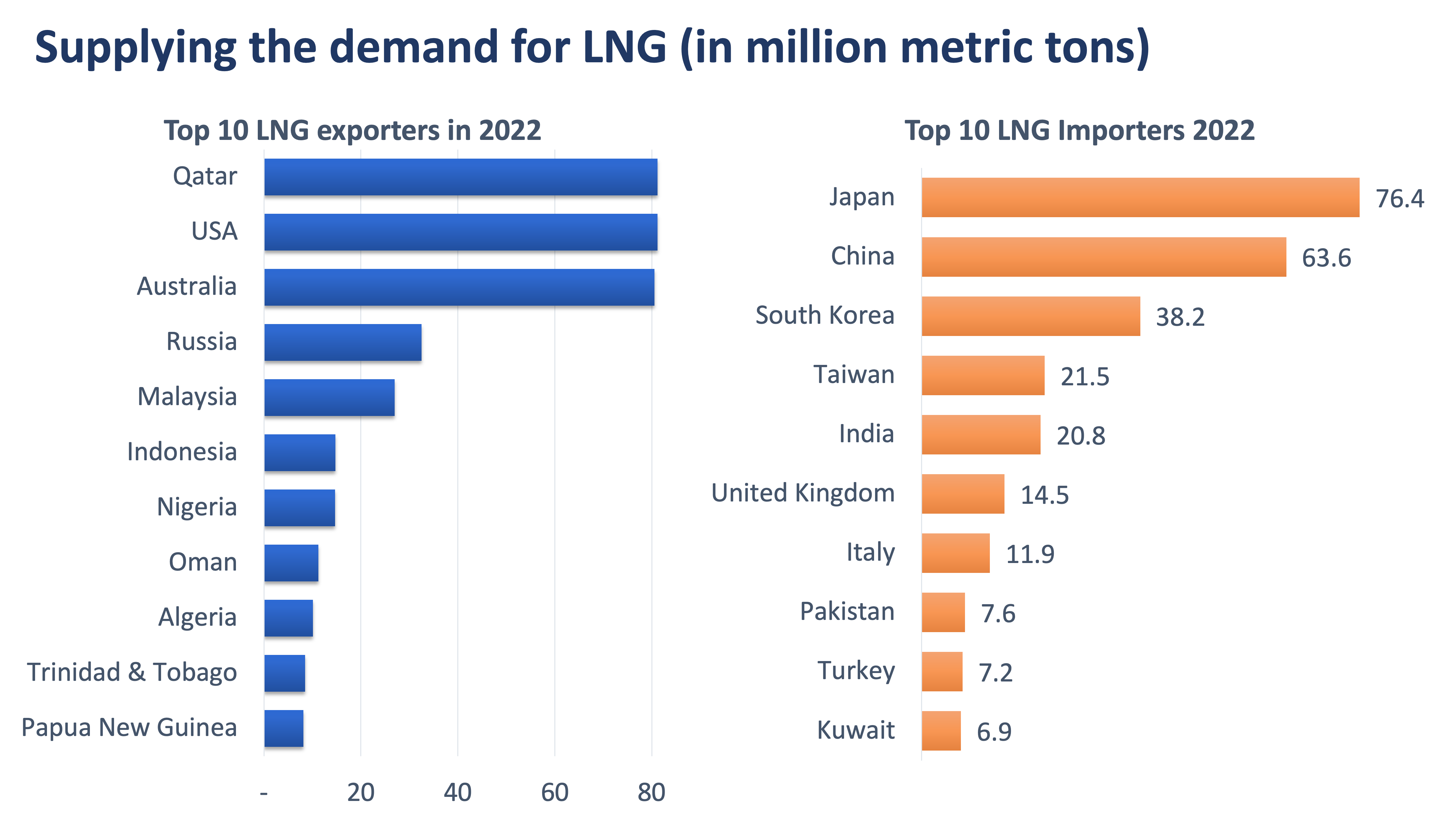

In 2022, Qatar remained the top LNG exporter, but this time with the US as a close tie. Bloomberg reported that the US had a huge jump in production from 2021. The global energy crisis and Europe’s shift away from Russian gas led to this increased demand for US LNG. Meanwhile, Japan led the global imports followed by China and South Korea.

Qatar and USA are neck-on-neck as the world’s top exporters, while Japan led LNG imports. (Source: Ship-tracking data compiled by Bloomberg.)

In terms of outlook, the Institute for Energy Economics and Financial Analysis (IEEFA) noted that the global LNG supply growth is currently on a two-year slump until mid-2025.

This will be followed by a leap in supply additions driven by the US and Qatar’s expansion projects. Qatar’s expansion is said to solidify its position as the LNG leader globally, while the expected supply additions from both US and Qatar are seen to exceed the supply growth of the prior five years combined.

Meanwhile, demand is seen weakening from top LNG importers Japan, China, and South Korea, whose imports already took a dip in 2022 amid high prices, lockdowns, and a shift to renewable energy. Japan and South Korea are seen to boost their nuclear, wind, and solar energy reliance, while China has been benefiting from Russia’s cheaper natural gas pipeline imports. The boost in LNG supply from 2025 onwards is seen to meet weaker demand, which increases the likelihood of lower LNG prices in the future.

What it means for the Philippines

The Philippines, as laid down in the Philippine Energy Plan (PEP) for 2020-2040, has initiatives in place to substantially boost the shares of cleaner energy sources in the energy mix wherein LNG will be the “bridge fuel” to renewables.

In the PEP’s Reference (REF) scenario, liquefied natural gas should overtake coal as the major fuel for power generation in the Philippines, significantly increasing its share from 20% to 40% by 2040. Given this transition, will this put upward pressure on electricity prices? Not yet at least.

As the global energy crunch eased post-winter, which led to structural changes in the global energy trade (e.g., the EU shifting away from Russian gas, China and India importing Russian oil and gas), LNG prices have since fallen, nearing its pre-pandemic levels. While new industry players in the country have not secured long-term contracts yet, spot prices are currently stable. And, it is hoped, given the structural changes in trade, the situation will stay this way in the long run.

US LNG (latest data as of March) and Japan-Korea-Market Platts Prices (JKM Platts) are on a downward trajectory after hitting peaks during last year’s energy crunch. JKM Platts is the benchmark price assessment for spot physical cargoes referenced in spot deals, tenders and short-, medium- and long-term contracts, both in Northeast Asia and globally.

Moreover, the timing is still in our favor. While the rest of the LNG projects in the pipeline are set to commence operations by the end of 2023 to 2024, these will still undergo trial runs that might not need high import volumes just yet.

Malampaya gas will be available until 2027 or earlier as others predict. Nevertheless, full importation of LNG might happen in 2025 at a time when US and Qatar would have already expanded supply.

LNG is also said to be cheaper than coal in terms of generation cost. It is also exempt from excise tax, but this story is for another time.

Thus, should spot prices continue to trend downwards and growth in LNG supply gets the expected boost after two years, we may see lower prices, and there will be no need to fret just yet.

INA JUDITH CALABIO is a Research & Business Analytics Officer at Metrobank in charge of the bank’s research on industries. She loves OPM and you’ll occasionally find her at the front row at the gigs of her favorite bands.

DOWNLOAD

DOWNLOAD

By Ina Calabio

By Ina Calabio