NCR’s wage hike may be a tailwind for consumer stocks

Metro Manila’s daily minimum wage increase may have a positive impact on consumer stocks

The National Capital Region’s (NCR) largest pay increase granted by the wage board may have a positive impact on household spending and, consequently, consumer companies.

Minimum wage earners in Metro Manila’s non-farm sectors got a PHP 50 daily wage increase to PHP 695 starting July 18, 2025.

The increase contrasts with the region’s rice deflation year-to-date. Rice is a staple especially for low-to-mid-income households, and the grain’s prices remaining subdued frees up disposable income for other goods.

Demand simulation

Translating this to consumer spending and listed consumer companies, the analysis maintains a modestly positive view on demand stimulation. The pay hike benefits approximately 1.2 million Filipinos, with staple goods and retailers positioned as primary beneficiaries.

Quick facts:

- The central bank’s second-quarter consumer expectations survey shows households earning PHP 500-PHP 1,500 daily kept a positive outlook for the year ahead despite subdued overall sentiment.

- IBON Foundation data indicates over 50% of the estimated daily living wage of a family of five in NCR is allocated to food, favoring consumer staples and value retailers.

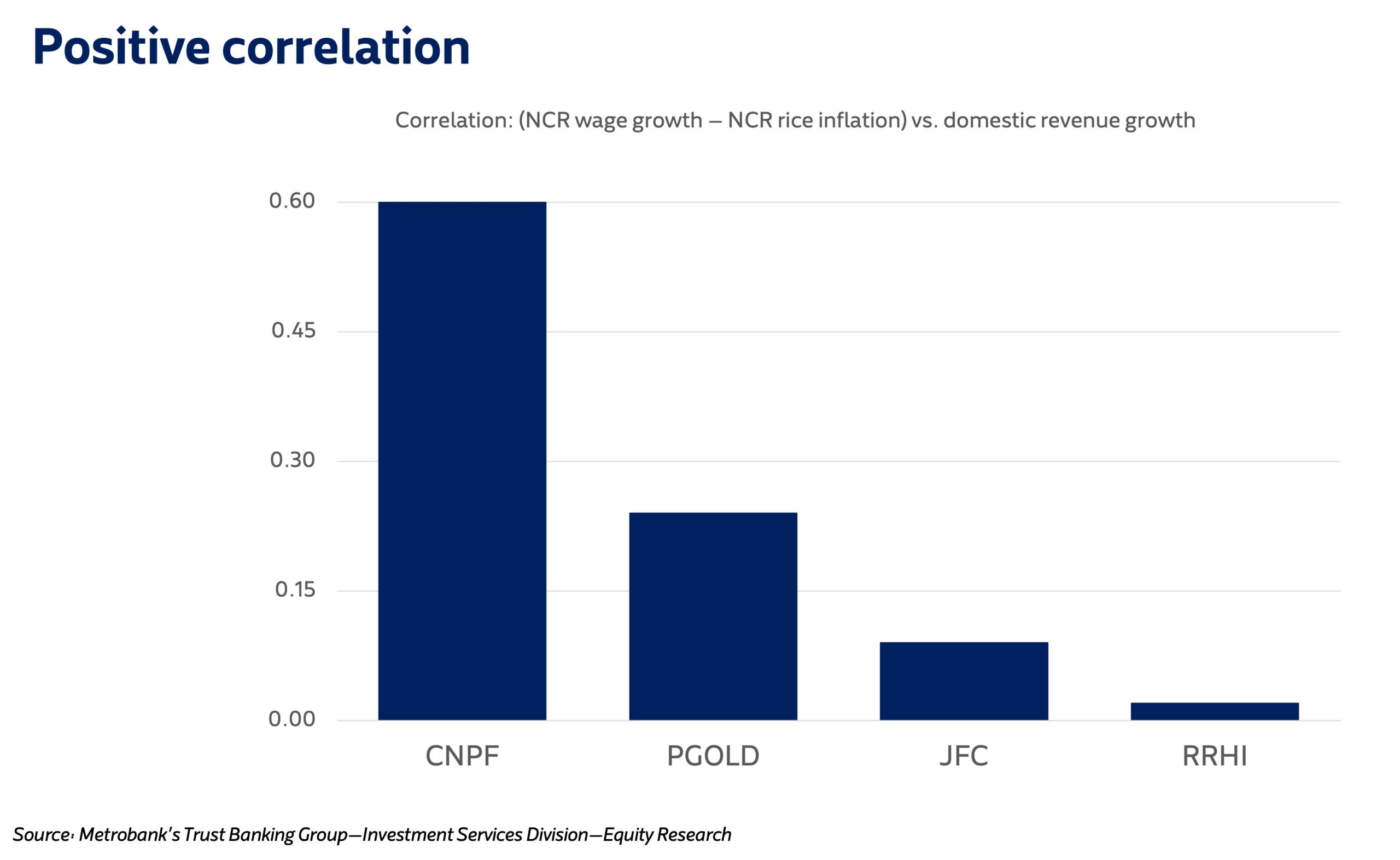

Century Pacific Food Inc. (CNPF) and Puregold Price Club Inc. (PGOLD) exhibit stronger correlations between domestic revenue growth and NCR’s wage growth net of NCR’s rice inflation, compared with Jollibee Foods Corp. (JFC) and Robinsons Retail Holdings Inc (RRHI).

While correlation does not Imply causation, CNPF’s focus on affordable staples and PGOLD’s essential goods focus align logically with this trend, particularly for CNPF as lower rice prices boost purchasing power for its products.

Read more: Eye on Earnings: Signals of consumer recovery provide a lift

Moreover, the magnitude of the wage increase remains insufficient to significantly boost savings or big-ticket spending intentions, supporting sustained demand for essential goods.

Labor and sales

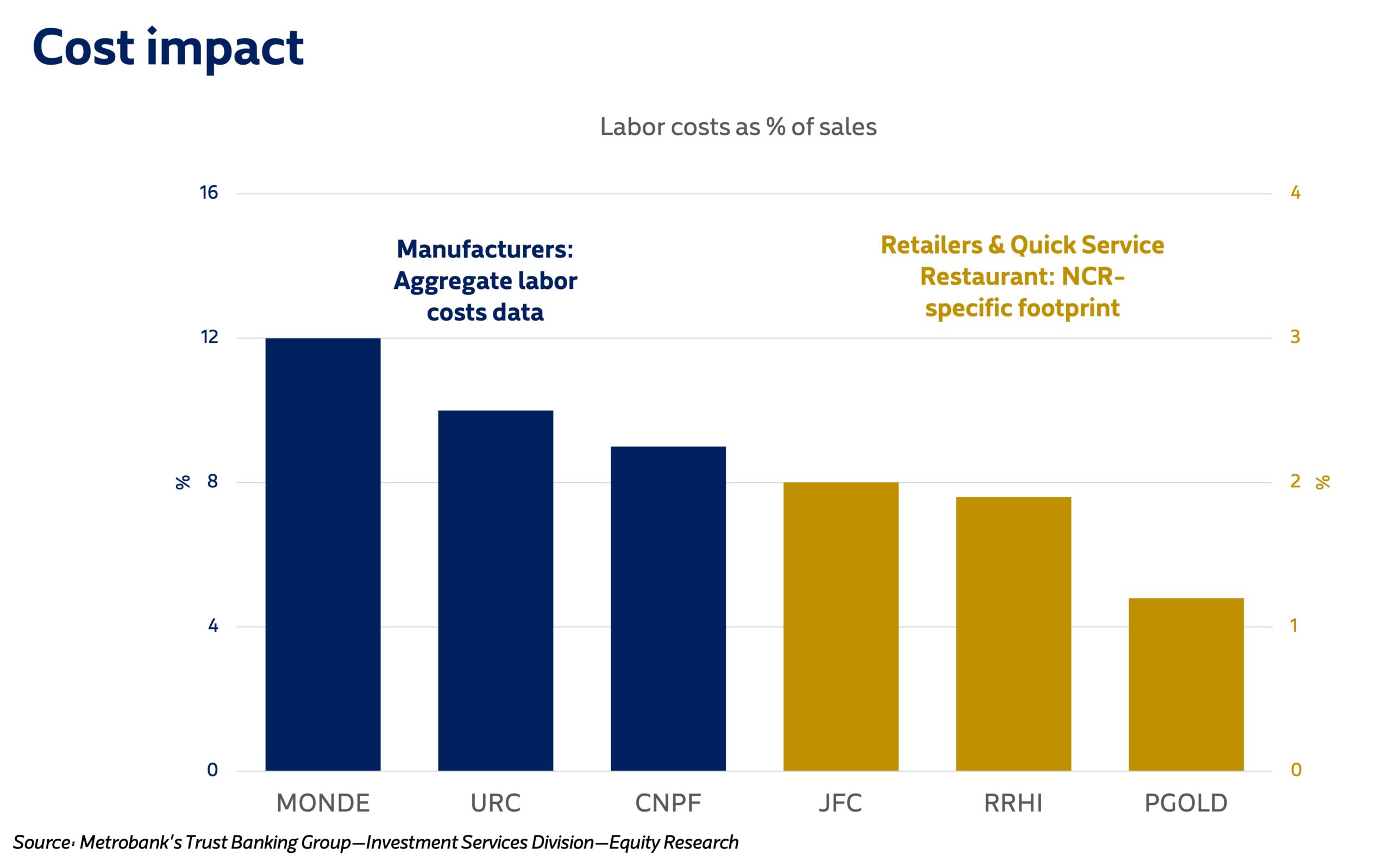

On costs, labor/sales analysis shows differentiation.

CNPF and PGOLD demonstrate the lowest exposures among manufacturers and retailers, respectively. JFC and Monde Nissin (MONDE) face the highest relative pressure, while Universal Robina (URC) and RRHI are in the middle of the pack. Overall, sector-wide cost impacts from the hike appear manageable.

This view is reinforced by CNPF’s earnings guidance, which already factors in wage hikes, confirming major firms have anticipated this.

The wage hike is a net positive for the sector, supporting modest revenue growth. Coupled with rice deflation, it should drive gradual consumption gains.

Benefiting from freed-up food budgets, staple-focused companies like CNPF and PGOLD remain well-positioned to capture demand with controlled cost exposure.

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses.)

CHARLES RANDY LUMHOD is an Equity Research Analyst at Metrobank’s Trust Banking Group. His coverage includes shipping, properties, REITS, and consumers, as well as select offshore markets. He holds a Bachelor’s degree, cum laude, in Business Administration major in Financial Management from the University of Santo Tomas. He is also a Certified Treasury Professional and Certified UITF Salesperson, and is currently pursuing other industry certifications. Outside work, he stays active by running and going to the gym.

GERMAN DE LA PAZ III, CFA serves as an Equity Research Lead at Metrobank’s Trust Banking Group. His coverage includes gaming, telcos, conglomerates, and utilities, as well as select offshore markets. German holds a Bachelor’s degree in Humanities and a master’s degree in Industrial Economics from the University of Asia and the Pacific. Recently, he obtained his CFA charter and is currently pursuing additional industry certifications. In his free time, German enjoys playing sports, particularly basketball, and has a penchant for reading fiction books.

DOWNLOAD

DOWNLOAD

By Charles Randy Lumhod and German de la Paz III

By Charles Randy Lumhod and German de la Paz III