Economic impact of US tariffs in the Philippines

The impact of US tariffs on Philippine exports could reshape trade and growth. Explore key challenges and resilience factors driving the economy. Read here.

Navigating pockets of resilience amid global trade shifts

There is a flurry of trade deals reshaping economic fortunes.

Where can we find the bright spots? Here we explore where pockets of resilience can make an impact.

As of this writing, the Philippines has reached a trade deal with US President Donald Trump following Philippine President Ferdinand Marcos Jr.’s visit to the White House last July.

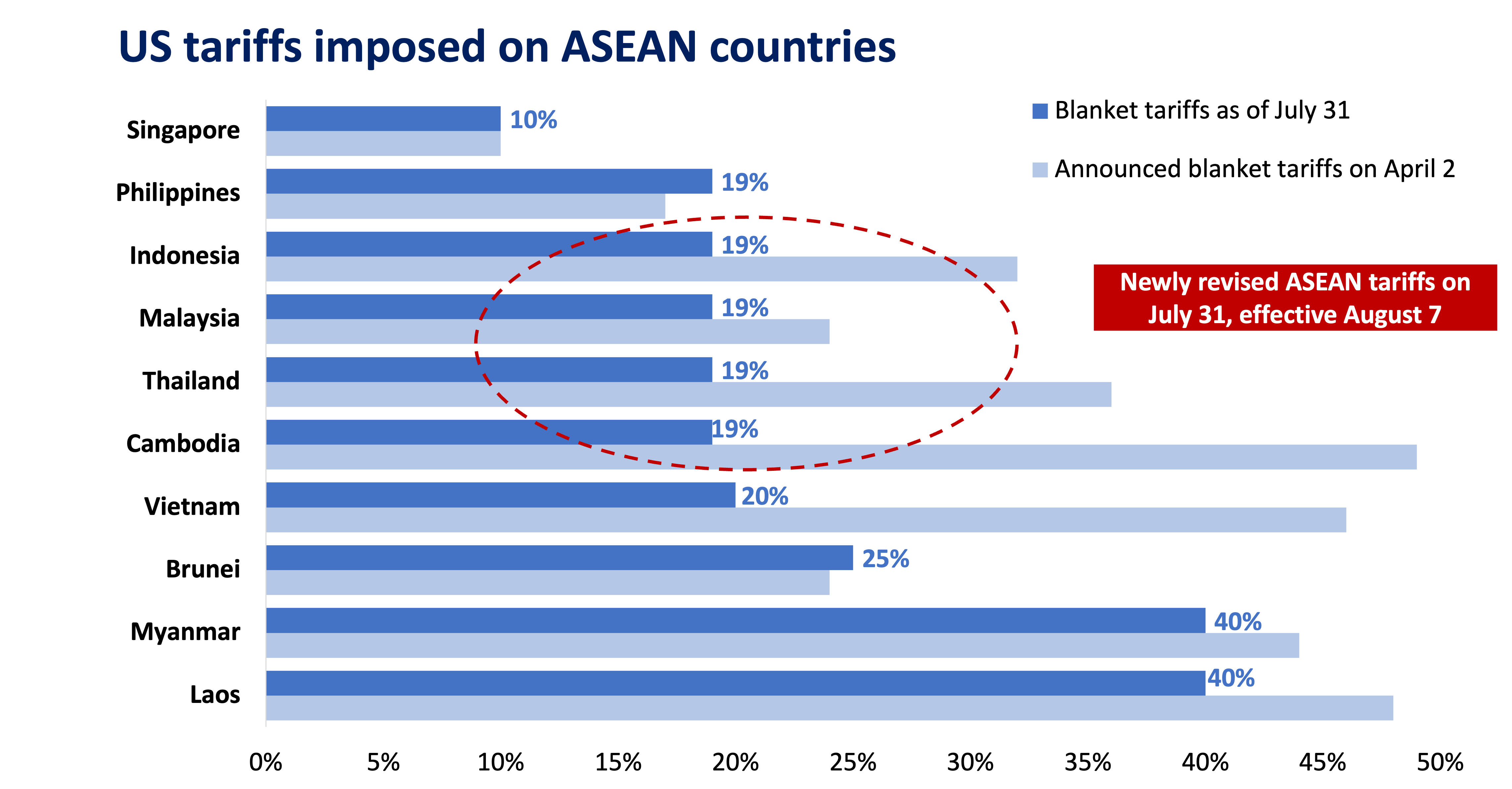

Products imported from the Philippines are now subject to a 19% tariff rate, a modest adjustment to the proposed 20% but higher than the original reciprocal tariff of 17% announced in April.

The graph below reflects the tariffs imposed on the ASEAN region.

Challenge: The Philippines now sits on the same level as some of its ASEAN neighbors after Trump revised the tariffs to 19% as well.

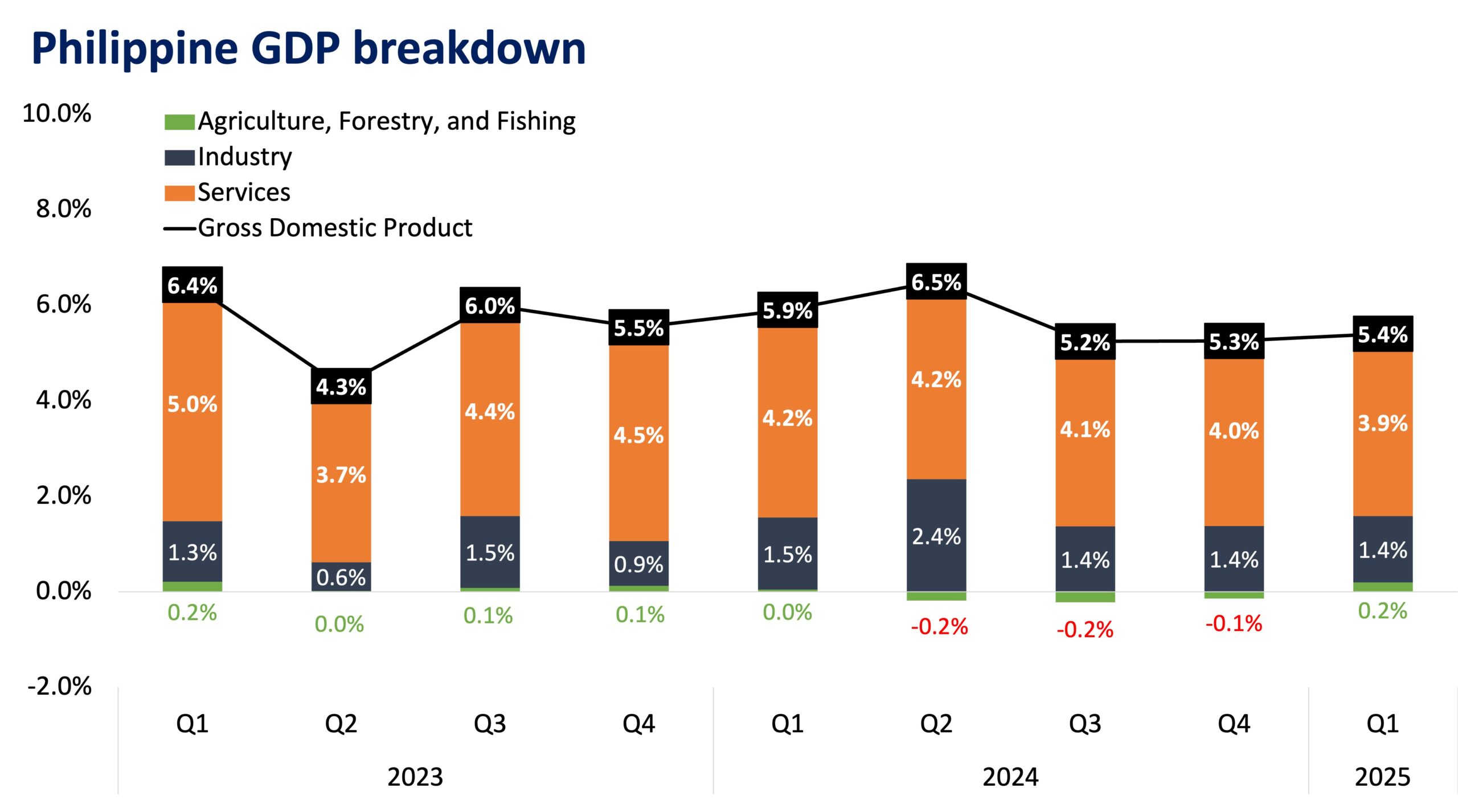

Mitigating Factor: Unlike the other ASEAN countries with similar tariffs, the Philippines is not export-oriented. The graph below shows the breakdown of the Philippine GDP. The duties are expected to have a modest effect.

Source: Philippine Statistics Authority

Challenge: How do US tariffs affect the Philippines? The tariffs are anticipated to slow global growth and disrupt international supply chains. With tariffs on multiple trading partners, US firms are forced to reassess supplier contracts, which can impact local production. The softening in demand is expected for Philippine-made goods, which could affect local producers, especially smaller businesses.

Mitigating Factor: Robust domestic demand can be an advantage for the Philippines amid slowing global growth. To cushion threats to employment and production in tariff-sensitive industries, Philippine firms can diversify their export markets with the help of free trade agreements with neighboring countries. Besides the US, the majority of Philippine exports are sent to Asia-Pacific Economic Cooperation (APEC) nations.

Challenge: The US tariffs in the Philippines may strain overall exports and impose a drag on the economy.

Mitigating Factor: The Philippines has a strong export services industry and manufacturing industry. Export services, which currently face no tariffs, continue to expand year by year. Resilience in export services can continue to drive exports despite the duties placed on goods. On the commodities side, semiconductors make up the majority of exported goods and are also currently exempt from tariffs. Scaling the sector and the competitiveness of its products can draw in foreign importers and investors over time.

On the lookout

As the US finalizes its tariffs on different countries, the stage is set for how the effects will play out. On local shores, attractive export services and the manufacturing industry’s potential can be advantages for the Philippines amid slowing global growth. At the same time, businesses and individuals alike must stay focused on managing investments to navigate potential risks and opportunities.

The next several months will be an opportunity for the Philippines to spot opportunities and demonstrate its resilience.

(Photo above is taken from www.whitehouse.gov.)

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses.)

CARMEN CASTAÑEDA is an intern in the Research and Market Strategy Department, Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She is currently pursuing her Bachelor’s degree in Strategic Management and Economics from the University of Notre Dame in the US in hopes of incorporating economic insights into corporate strategy. As much as possible, she enjoys trying new cuisines and exploring new cities with her loved ones.

DOWNLOAD

DOWNLOAD

By Carmen Castañeda

By Carmen Castañeda