How does Europe’s winter affect our inflation story?

Europe has stored enough gas to survive the winter, which has, for now, tapered the volatility in global energy commodities markets. Nonetheless, a rebound to high prices is highly likely and the global energy crunch is here to stay for a while.

In our previous article, we talked about Europe’s dependence on Russian energy and its energy crunch as it approached winter amid the Russia-Ukraine conflict.

Since then, Europe has shifted away from Russian gas, turned to other sources of liquified natural gas or LNG, coal, and oil as well as tapped into other markets to secure its energy needs for the winter.

This triggered volatility in the energy commodities market, leaving other economies dependent on these energy sources such as the Philippines paying for higher-than-ever prices.

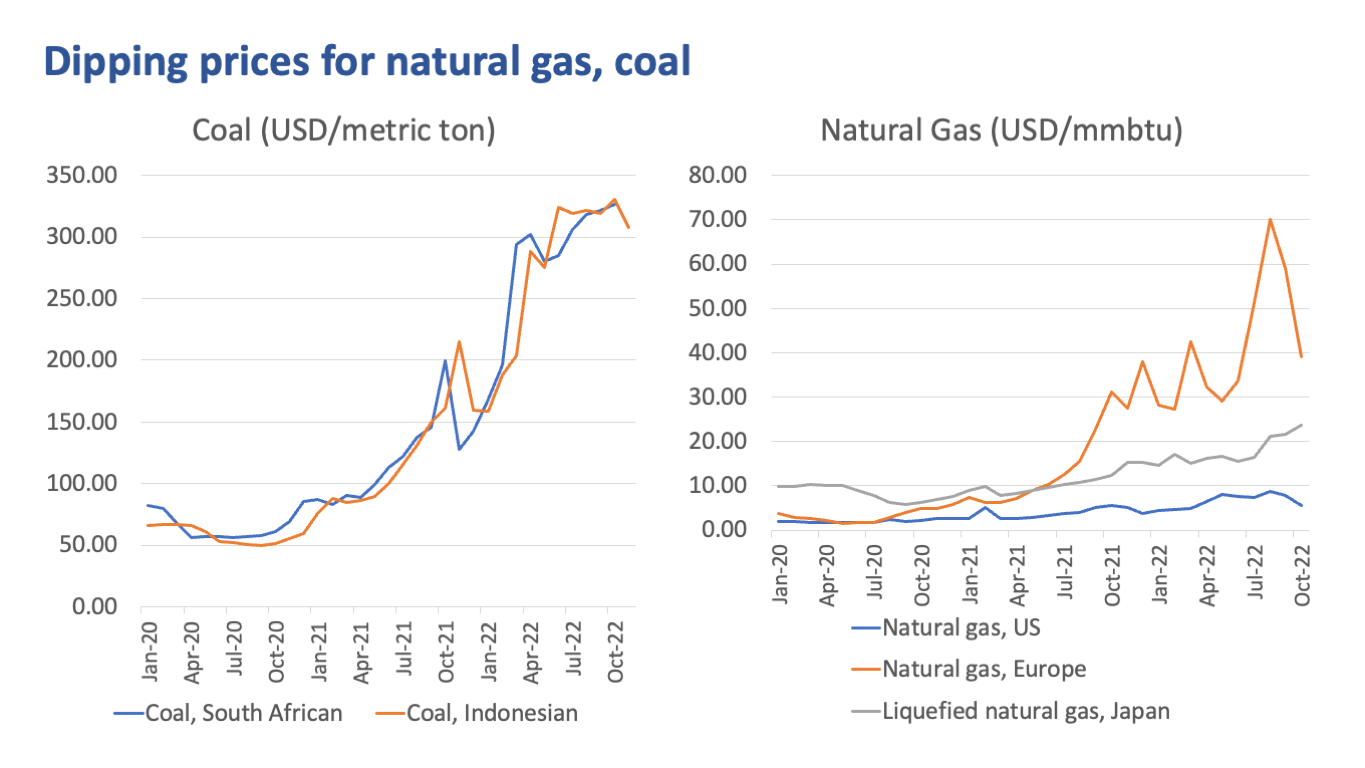

European and US natural gas prices are declining as Europe achieves its target gas storage. The Indonesian coal price is on a slight decline for November on account of Europe’s met demand for gas.

European countries have already met or even exceeded their gas storage targets (80%) ahead of the winter. As of November 17, the EU has already filled 95.3% of its storage sites with gas (according to Reuters) and continuously does so to reach higher levels.

Given this and favorable weather forecasts of a mild winter, the EU will survive winter and natural gas prices will soften for now. Coal prices are also on a slight downtrend given Europe’s met demand for gas.

Problem solved for this winter. Now what?

While the EU has reached its target supply of oil and gas, the long-term problem remains – there is a limited supply of fossil fuels for energy, especially with the Russia-Ukraine war still ongoing.

Aiming to cut dependency on Russian energy, the EU is set to ramp up its LNG imports in 2023 and its demand is projected to boom. This, however, would be at the expense of LNG shipments to emerging markets. According to Bloomberg, major exporters of LNG (Qatar and the US) are already entertaining bids from European importers with which emerging economies such as Pakistan, Bangladesh, and Thailand have to compete with.

Repercussions in the Philippines

This puts the Philippines in a critical position since it is set to enter the LNG market in 2023. Plus, it would get more complicated once China’s demand picks up as it has been a top importer of LNG.

The same story goes for diesel as inventories go on record lows, and exporting countries shift shipments to countries that can pay big premiums that poorer countries can’t afford.

Economists and market analysts foresee a more difficult energy crunch globally in the next two years. This means elevated energy prices will remain, supply will remain tight while demand will continue growing.

For the Philippines, two LNG terminals are set to operate by the 2nd quarter of 2023. While the global LNG market is seen to tighten, this development provides the country options other than coal in its energy imports. Moreover, the share of renewables in the country’s power mix is seen to grow, especially solar and wind, in line with the country’s goal to transition to a cleaner energy mix.

With elevated energy prices expected to linger, diversification in the country’s power sources is needed as we brace for the impacts of a tougher global energy crunch.

INA CALABIO is a Research & Business Analytics Officer at Metrobank in charge of the bank’s research on industries. She loves OPM and you’ll occasionally find her at the front row at the gigs of her favorite bands.

DOWNLOAD

DOWNLOAD

By Ina Calabio

By Ina Calabio