How deep is your cut?

In finding the perfect harmony between growth and stability, the BSP has changed its tune. Here’s why its latest move could reshape the Philippine economic landscape.

The Bee Gees immortalized a tune with lyrics similar to the question above, and by mentioning it, I may have inadvertently given you your LSS (Last Song Syndrome) for the day.

With BSP jumping out of the starter blocks by cutting policy rates to aid an economy showing signs of slowing, the focus now shifts from “if they cut” to “how deep” will the cuts be. The market seems to be grappling with a similar question for the US Federal Reserve (Fed): just how does that dot plot look like nowadays?

With investors vacillating between three cuts and four cuts over the past few trading sessions, we’ve seen risk sentiment move in tow with more Fed cuts suggesting a less potent dollar but an increased likelihood of a harder than soft landing.

For the next couple of months we’ll still likely be watching the Fed for cues on the latest edition of where will the Fed funds be at the end of the year.

Tight not right

As we had suspected, Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. was keen to cut rates at the soonest, likely as he viewed the economy to be in need of some relief from what he deemed as “tight” monetary policy.

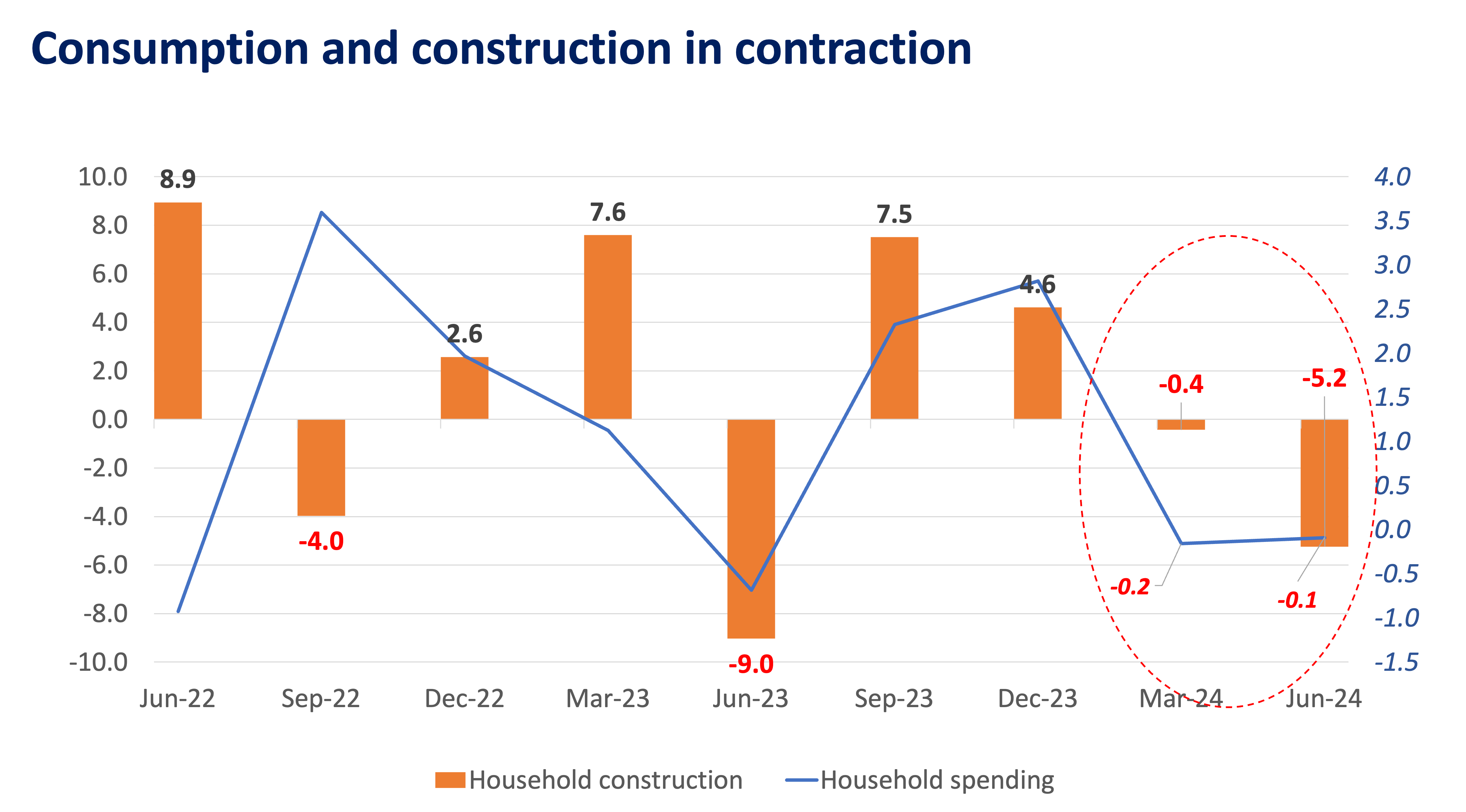

The move suggests that rates are not at “normal” levels and that the restrictive stance would impose a toll on economic growth if kept at elevated levels for much longer. In May, the BSP indicated that growth was expected to slip below the official government target for both 2024 and 2025, which may have been the impetus for the early move from BSP.

Tight policy rates may have been imperative when inflation was well-above the target, but with inflation on the downtrend, it appeared that tight policy was no longer the right prescription for a growing economy.

BSP to cut 2 or 3 this year?

With one rate cut out of the way, we ask the question, “Will we have one more rate cut or two more rate cuts this year?” Governor Remolona came out firing quickly, suggesting that there was one more rate cut in the works for 2024, with a 25-basis-point rate reduction penciled in at either the October or December meeting.

For now, we are holding on to our “2+1” rate cut call (two cuts with a possibility of a third cut) for 2024 with up to 75 bps worth of easing slated for early 2025. The main argument for rates to slip to 5% by mid-2025 lies in the outlook for growth and inflation.

Inflation and GDP on downtrend = policy easing

We do expect the BSP to embark on a modest easing cycle to lower the policy rate to a balanced 5% by 2025. Given the BSPs forecasts pointing to inflation remaining within target all the way through to 2026, we believe that BSP has the price stability objective in hand for the moment.

Barring any supply side shocks, the BSP appears to have more than enough room to engineer a “soft takeoff” for the Philippine investment sector, which for the most part has been operating at a very measured pace. The latest GDP growth numbers plus the BSP’s own forecasts pointing to growth staying below 6% this year and the next suggest that the BSP does have scope to ease off the brake pedal and shift to the accelerator at a “measured pace”.

If inflation remains well-behaved, the Fed proceeds with three rate cuts and growth remains constrained, we could see BSP cutting rates another 50 bps before the end of the year.

RR Redux Resumption (RRR)

Easing inflation also gives the BSP the opening to resume its reserve requirement reduction, which would be its operational adjustment to align with market best practices for liquidity management. The BSP learned from its previous foray into RR reduction and rightly opted to wait for an episode of slowing inflation before considering a resumption of this objective.

Given that RR reduction is not a policy move, we could actually see these adjustments carried out at non-monetary setting MB meetings. Reductions to the RR should result in even more excess liquidity, but unless we see policy rates lowered further, we may have to get used to industry growth rates for productive lending and single-digit growth levels for a little longer.

NICHOLAS MAPA is Metrobank’s Chief Economist, Market Strategist, and Head of the Research and Market Strategy Department in the Financial Markets Sector. He graduated from the University of Asia and the Pacific (UA&P) with an undergraduate degree in Humanities and a Master of Science (MSc) in Industrial Economics. He also completed an MA in Economics from Vanderbilt University and an MBA from the Kelley School of Business at Indiana University. He travels regularly with his family, enamored by culture and history. An avid learner, he also reads extensively.

DOWNLOAD

DOWNLOAD

By Nicholas Mapa

By Nicholas Mapa