Global currencies recap: Debt ceiling fallout

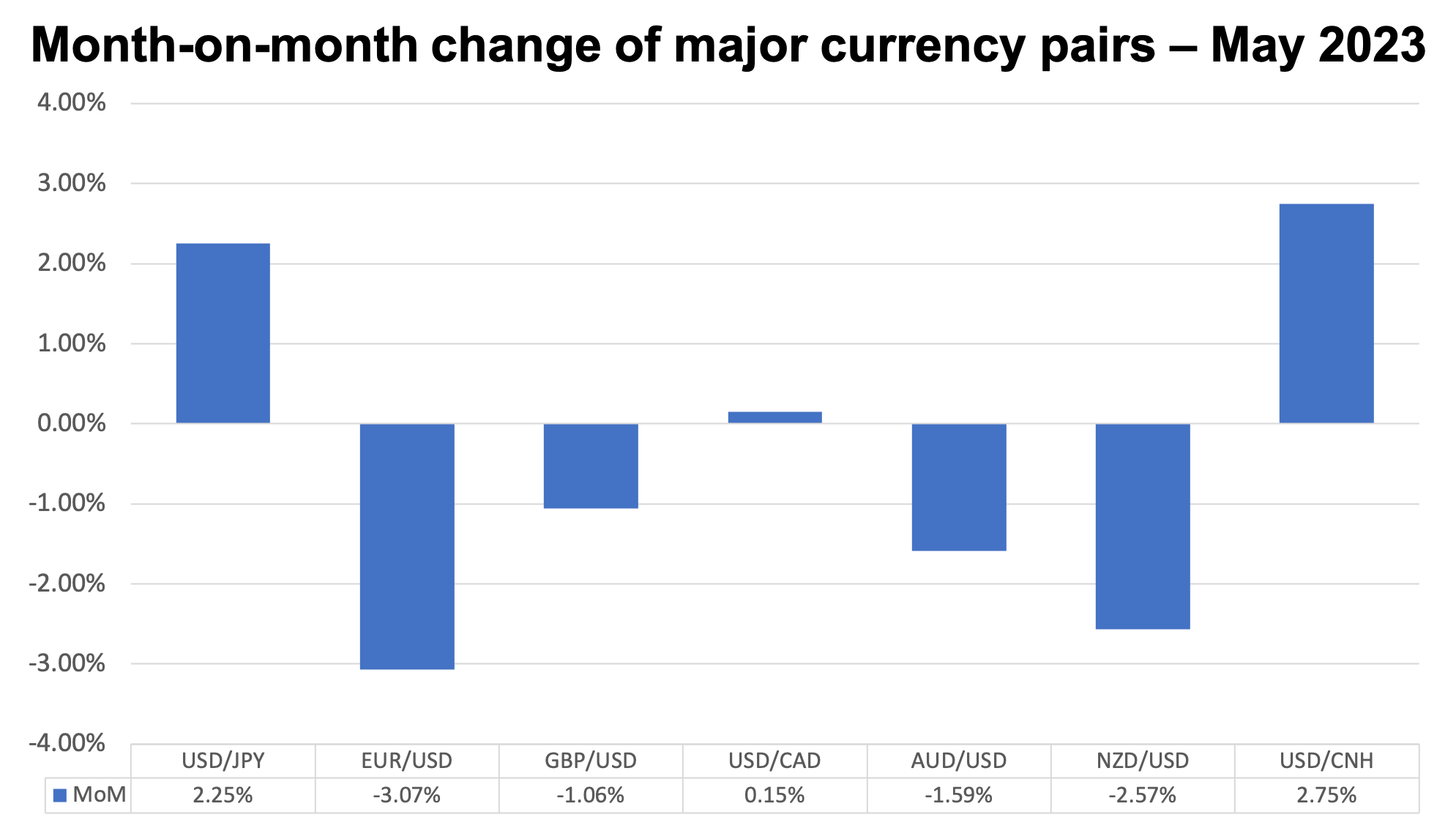

There are more losers than winners in today’s forex market. But with the US overcoming the debt ceiling crisis, global markets are expecting more aligned decisions based on economic growth.

The US dollar saw some relief in May 2023 after back-to-back losing months in March and April. Initially, the dollar was sold off as some Fed members provided dovish rhetoric following the Fed’s policy meeting on May 3.

Price action remained range-bound in the week that followed, supported by a stronger Non-Farm Payroll jobs report (253,000 vs. 185,000 forecast) but also tempered by a cooler Consumer Price Index (CPI) (4.9% vs. 5.0% forecast). Ironically, the dollar continued to strengthen as the US approached its June debt ceiling deadline.

Short-term treasury bills maturing in June were sold off but investors continued to buy longer-term treasury bonds as a defensive play. General weakness among the rest of G10 currencies continued to echo risk-off sentiment in the financial markets.

Rate hikes actions of central banks—or the lack thereof–are affecting currencies across the world.

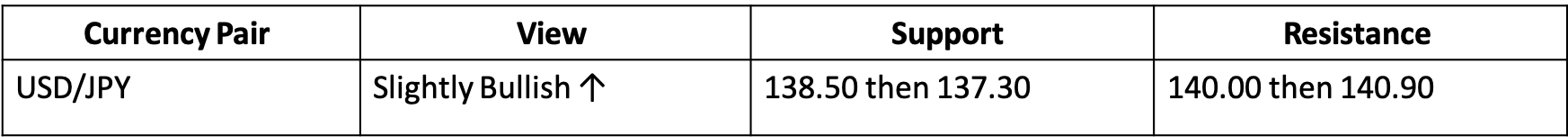

Warning signs for the yen

Japan’s central bank continues to buy long-term bonds. Link to chart: USD-JPY May 2023.png

The Japanese yen (JPY) continued its depreciation from April, hitting a high of 140.60 on May 26 before closing the month lower at 139.34. Bank of Japan (BOJ) Governor Kazuo Ueda kept the status quo as the central bank continued to buy long-term Japanese Government Bonds (JGB) to direct its ultra-loose monetary policy.

Inflation has also come down from its high of 4.3% in January, despite jumping to 3.5% in April from 3.2% in March. This gives the BOJ little incentive to consider tightening monetary policy and the widening differential between US and Japanese policy rates will contribute to further JPY weakness.

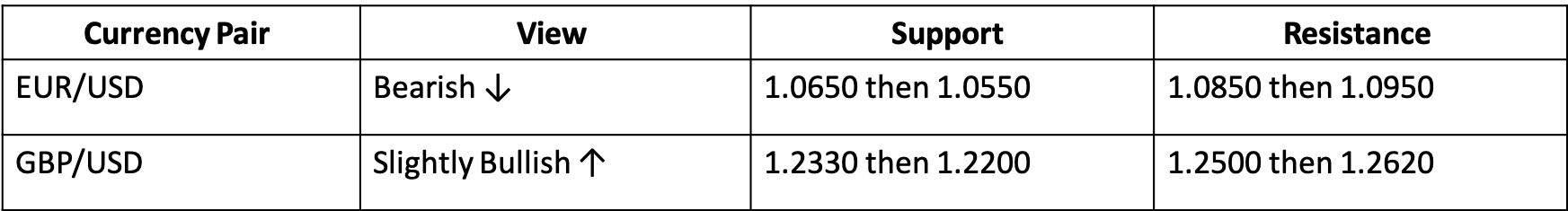

A weakened euro and a stronger pound

Euro is still the biggest loser while the British pound is getting higher.

The euro (EUR) was the biggest loser among the G10, falling by 3.07% to close the month at 1.0689. Hawkish statements from the European Central Bank (ECB) after the April CPI of 7% seem to have fallen on deaf ears as the markets focused on underperforming economic data.

Germany, which contributes 30% of the European Union’s (EU) total Gross Domestic Product (GDP), also slipped into a technical recession after posting quarter-on-quarter GDP growth rates of -0.5% and -0.3% in Q4 2022 and Q1 2023 respectively. Our FX traders are bearish on the EUR/USD on the view that the economic headwinds experienced by Germany is likely a sign of things to come for the whole EU.

Across the English Channel, the pound sterling (GBP) also weakened by -1.06% on stagflation fears, despite United Kingdom (UK) inflation easing to 8.7% in April from 10.1% in March. GBP/USD actually bounced back up from a low of 1.2321 on May 25. Taking a broader look at UK unemployment, the increase from 3.5% to 3.9% seems to represent a return to pre-pandemic levels rather than an indicator of economic slowdown. A stable job market provides more cover the Bank of England (BOE) to continue its hiking cycle, which gives our FX traders confidence that the GBP could still push higher.

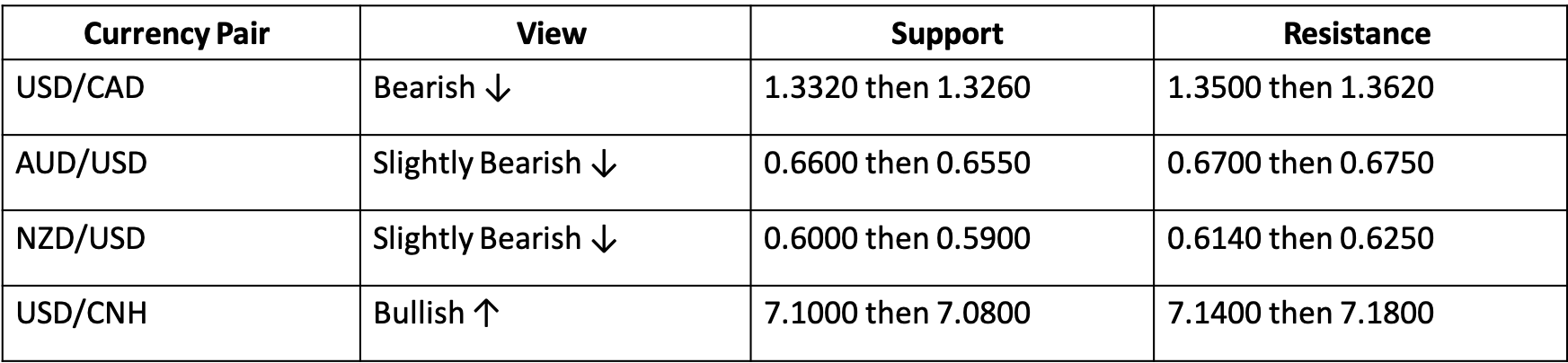

Rates still up in Canada, Australia

Only China is expected to ease to support the economy.

The Canadian dollar (CAD) depreciated the least by 0.15% to end at 1.3574. Bank of Canada (BOC) Governor Tiff Macklem, in what was considered a hawkish tilt, stated that it was “far too early” to consider rate cuts. Strong Canada employment (41,400 vs. 20,000 forecast) and sticky April inflation (4.4% vs. 4.1% forecast) provided further basis for the BOC’s view of higher rates for longer.

The Reserve Bank of Australia (RBA) delivered a surprise hike of 25 basis points (bps) to 3.85% after keeping its policy rate at 3.6% since March. Governor Philip Lowe emphasized the need for further monetary policy tightening to get inflation down to its 2% target. Despite this, the Australian dollar (AUD) still depreciated by 1.59% to 0.6503 on underwhelming Chinese economic data and the implied effect on Australia’s metal exports.

On the other hand, the Reserve Bank of New Zealand also hiked rates by 25 bps to 5.5% but announced this to be the terminal rate and that rate cuts will begin in the Q3 2024. New Zealand showed mixed economic data with a stable jobs market and declining retail sales highlighting easing demand pressures. The New Zealand dollar (NZD) fell by 2.57% to a low of 0.6022. The recent announcement of the official terminal rate leaves the currency vulnerable against any further action from other central banks.

Chinese Manufacturing and Services Purchasing Managers’ Index (PMI) and Industrial Production all underperformed against expectations, further proving that China’s post-lockdown recovery will take longer than initially expected.

Markets were quick to place their bets against the offshore yuan (CNH), pushing the USD/CNH rate beyond the 7.00-level for the first time since December 2022. Although the People’s Bank of China (PBOC) tried to intervene at the 7.10-level, markets continued to push the exchange rate to a new year-to-date high of 7.13 before closing the month at 7.1192, 2.75% weaker from where it started.

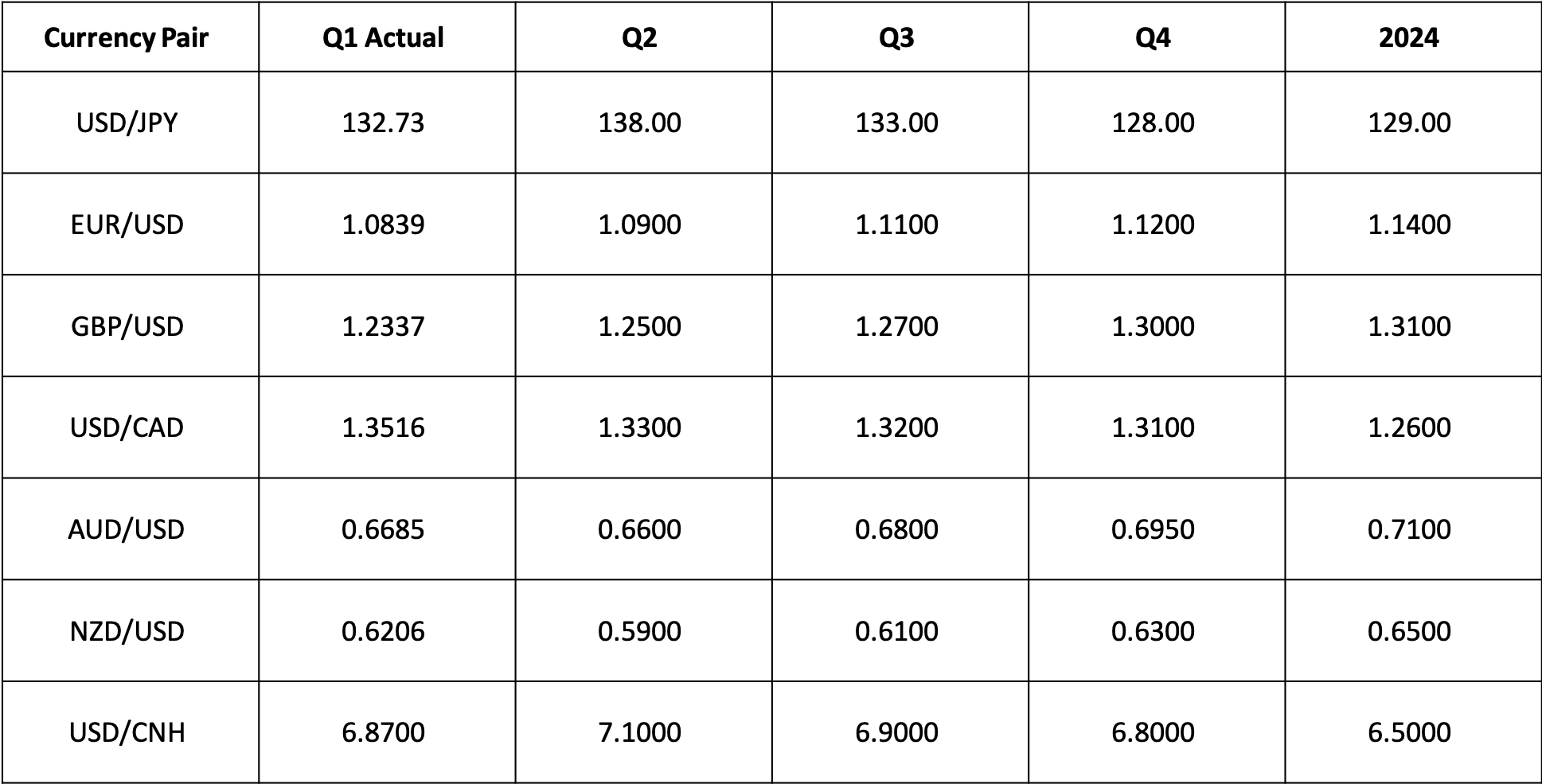

FX Traders’ Forecasts

The above forecasts are the foreign exchange traders’ personal opinions and may not reflect the official views of the bank.

The recent Federal Open Market Committee (FOMC) meeting resulted in the Fed still pausing rates in June in order to continue monitoring the impact of its monetary policy on the US economy. But this was followed by yearend interest rate projections increasing by 50 bps with similar adjustments to forecasts over the next two years. This puts the US dollar in an awkward position as the Fed anticipates key economic data that could still sway future rate decisions.

Markets will likely turn toward other global central banks to see if they can continue tightening monetary policy relative to the US while also keeping their economies stable.

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre