February 2024 Updates: 2023 closed higher than expected, but still lower than gov’t target

Despite the higher-than-expected economic growth in 2023 and downward trend in inflation at the start of the year, continuing risks affecting inflation and growth remain.

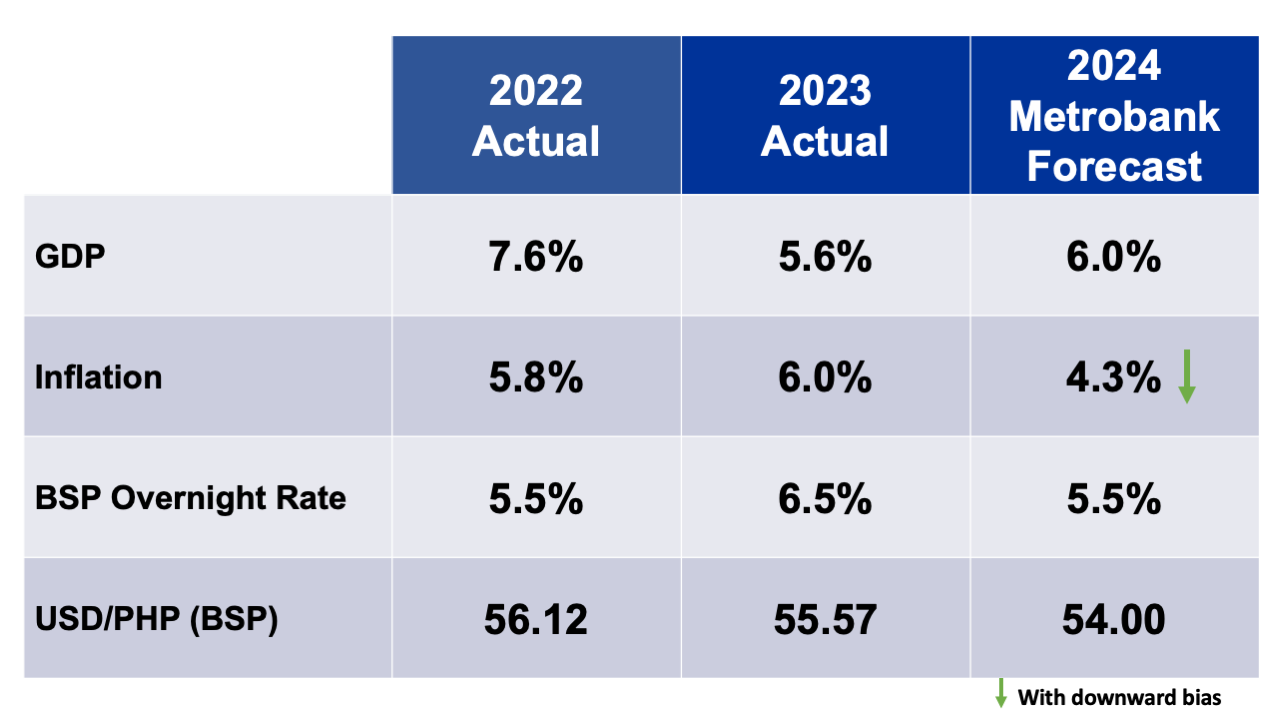

The Philippines’ Gross Domestic Product (GDP) in the fourth quarter of 2023 expanded at a moderate pace by 5.6% year-on-year versus last quarter’s 6.0% growth, driven by the recovery in investment spending and strong consumer spending. This brings the full year GDP average to 5.6% (vs. 5.5% Metrobank Research forecast). Although higher than consensus estimates, the latest GDP print fell below the government’s target of 6% to 7%.

Philippines headline inflation eased to 2.8% year-on-year in January from 3.9% in December 2023, mainly driven by slower annual increases in the prices of food and non-alcoholic beverages in particular vegetables, followed by lower prices of housing, water, electricity, gas, and other fuels, and transport.

The Bangko Sentral ng Pilipinas (BSP) maintained its target overnight reverse repurchase (RRP) rate at 6.50% for the third time at its first Monetary Board meeting this year. While the Monetary Board recognizes improvements in inflation, prevailing upside risks to prices remain, specifically higher transport charges, increased electricity rates, higher oil and domestic food prices, and the additional impact on food prices due to a strong El Niño episode.

Metrobank Research retains its baseline forecast on the timing of the BSP’s easing cycle, which will likely begin in the second half of the year. Also, the year-end view for USD/PHP is maintained at 54.00.

Considering these developments, we are maintaining our outlook on the following key macroeconomic indicators:

For more information on the performance and outlook for several macroeconomic indicators, as well as local macroeconomic news, please download the full report below:

February 2024 Updates: 2023 closed higher than expected, but still lower than gov’t target

Philippines headline inflation eased in January 2024, driven by slower annual increases in the prices of food and non-alcoholic beverages in particular vegetables. This is followed by lower prices of housing, water, electricity, gas, and other fuels, and transport.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research