Peso government securities are the safest investment instruments around. But that doesn’t mean they don’t come with risks.

FEATURED INSIGHTS

FEATURED INSIGHTSWhat are peso government securities?

If you are a rookie investor looking to explore the world of fixed income, one of the safest investments you can begin with is peso government securities (GS). These are debt instruments issued by the Republic of the Philippines with the obligation to pay investors back. They are backed by the full taxing power of the government and therefore default risk-free. Why? The Philippine government can simply print more money and increase taxes to pay back its obligations.

In exchange for investing in these bonds, the investors will receive periodic coupon payments. When the bond matures, the investor will get back the principal initially invested plus the last coupon payment.

Why does the national government issue government securities?

The short answer is to finance the government’s various expenditures. The national government, through the Bureau of the Treasury (BTr), sells these securities to provide funding for priority projects such as infrastructure. The government ensures that revenues exceed expenditures by issuing government bonds. It will issue fewer bonds when revenues far exceed expenditures and vice-versa.

For instance, the national government may need to borrow a lot from the public during times of crisis. We have seen a record-high supply of government bonds since 2020 to fund record-high fiscal spending and support the economy through the COVID-19 pandemic.

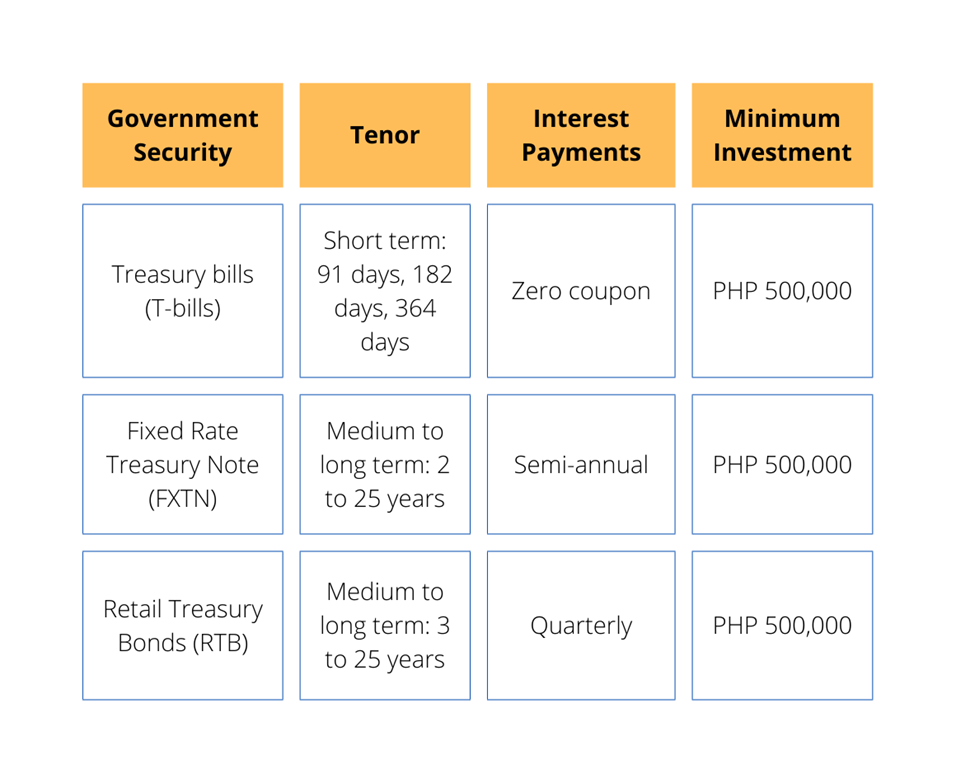

What are the types and features of peso government securities?

What are the benefits of investing in peso government securities?

If you need to get your investment sooner, T-bills mature in 365 days or less. You can lock in quick gains and earn money from securities like T-bills, which are sold at a discount and redeemed at the face value of the security. Fixed Rate Treasury Notes (FXTNs), on the other hand, have more flexible options since the tenor of this security ranges from 3 to 25 years. You can make a profit if you decide to sell the notes before maturity and the rates have gone up since your purchase.

Lastly, Retail Treasury Bonds (RTBs) are readily available to retail investors. You can get a steady stream of income thanks to quarterly interest payments. These are low-risk, short-term investments that are liquid and tradeable since you can freely buy and sell the bonds in the market.

What are the risks?

Perhaps the main selling point of peso GS is that it is virtually risk-free. They are the safest fixed-income investment instruments since they are denominated in the local currency, which means there’s a very low probability of the lender defaulting. However, they are not entirely risk-free. Like any other asset or security, investing in peso GS comes with other risks investors must be aware of.

The most common risk bond investors have to face is movements in interest rates. Bond prices move in the opposite direction of interest rates. When rates rise, bond prices fall because new bonds are issued that pay higher coupons, making the older, lower-yielding bonds less attractive. Conversely, bond prices rise when interest rates fall because the higher payments on the old bonds look more attractive relative to the lower rates offered on newer ones.

We also have an inflation risk. Since interest payments are fixed, the real return can be eroded by inflation. There is also a reinvestment risk. It is the risk that an investment’s cash flows will earn less in a new security, creating an opportunity cost.

It is the potential that the investor will be unable to reinvest cash flows at a rate comparable to their current rate of return. Last but not the least is currency risk. For foreign investors looking to invest in peso GS, one might need to face the risk of losing money due to unfavorable moves in exchange rates.

Indeed, peso government securities are a good starting point for fixed income investments as they provide reliable income. Your designated investment specialist is just one phone call away if you want to know more about investing in peso GS.

You can also check Wealth Insights regularly for tips and insights from our experts and analysts so you can maximize the returns on your portfolio.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the Bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco