Why should you keep an eye on the interest rate differential? Learn the answer to this question and more in this article.

FEATURED INSIGHTS

FEATURED INSIGHTSIn our previous explainer, we discussed why central banks around the world raise or decrease their key policy rates according to their inflation targets to ensure sustainable economic growth. Recall also that a rate increase may stem a currency’s decline as higher rates increase the demand for and value of a currency. This begs an important question: By how much should a central bank hike rates to prevent further depreciation?

The Bangko Sentral ng Pilipinas (BSP) said it would maintain a differential of 100 basis point (bps) between our policy rate and that of the US to support the peso and to curb inflation that reached a near 14-year high in October. BSPP Governor Felipe Medalla particularly stressed the need to match the aggressive rate increases delivered by the US Federal Reserve to maintain a comfortable differential.

What is an interest rate differential, or IRD?

As the name suggests, an Interest Rate Differential or IRD, is the difference between the interest rates of two countries. In the foreign exchange spot market, this pertains to the difference in interest rates between a currency pair. For example, if the Philippine peso has an interest rate of 3% and the US dollar has a rate of 2%, then it has a 2% or 200-bp IRD.

What does the IRD tell us?

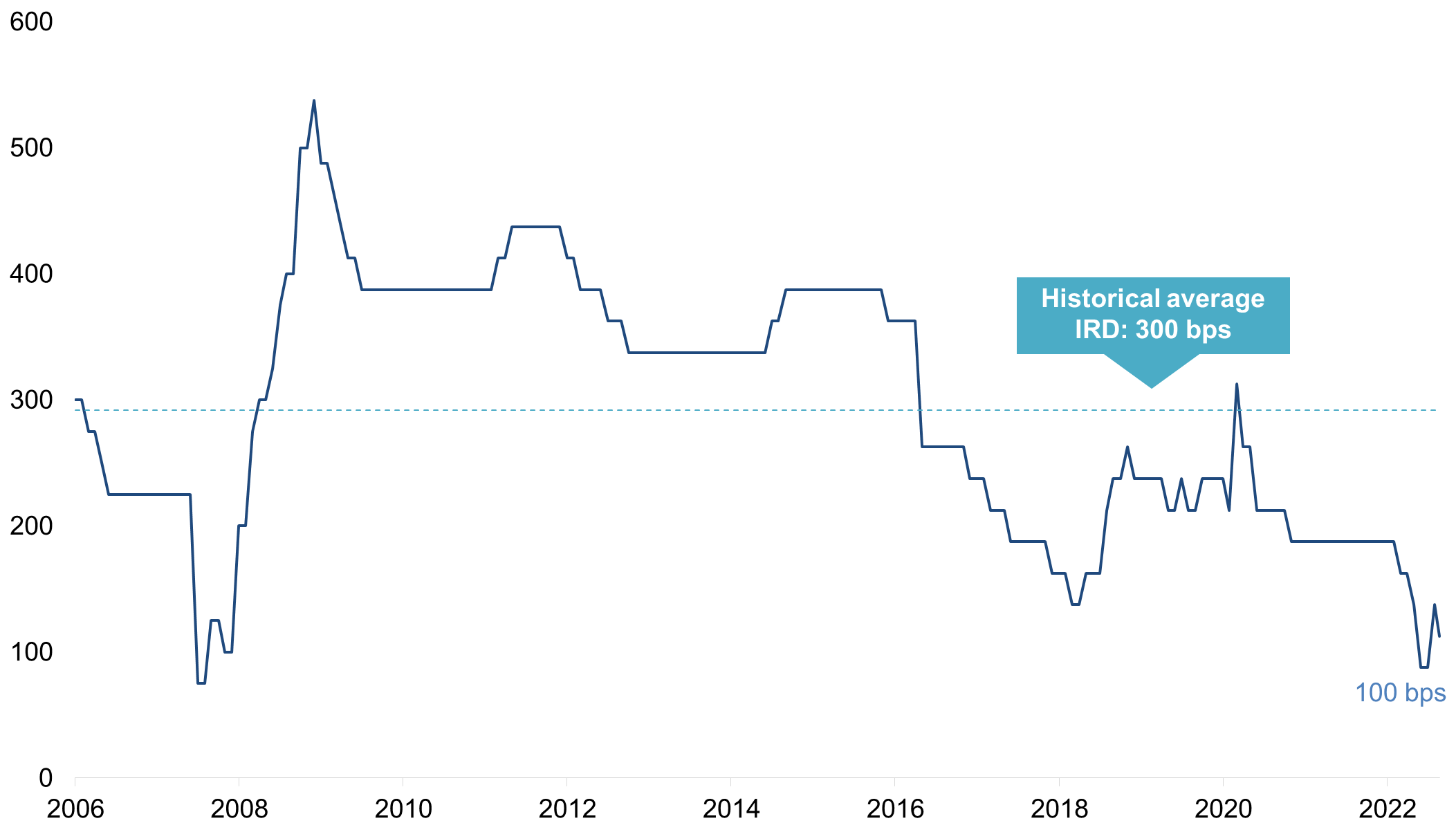

Historically, the spread between the BSP’s Reverse Repurchase (RRP) and the US Fed’s Federal Funds Rate (FFR) is around 3% or 300 bps. A narrow or tight IRD would mean that the home currency is under pressure as the foreign currency may have higher rates. This can happen when their own central bank is implementing strong monetary tightening measures, for instance. Conversely, a wide IRD would mean that the home currency is stable as it maintains an adequate differential with the foreign currency.

The USD/PHP exchange rate tells us the same story. With the US Fed busy with its own fight against inflation, the strong dollar has sent the foreign exchange market in heightened volatility this year. The peso has depreciated by 11% year-to-date (YTD). This compelled the BSP, similar to other central banks, to embark on its aggressive monetary tightening measures to keep up with the US’ key policy rate. The impact of a narrow IRD is not only on the exchange rate, but also on the inflationary effects that feed into the cost of goods. Hence, this is why Governor Medalla vowed to maintain the 100-bp IRD with the US key policy rate.

Until the Interest Rate Differential (IRD) between the peso and the US dollar retraces back towards its historical average of 200 bps vs 100 bps currently, which in turn will likely be triggered more by the US Fed pivot, the peso may continue to depreciate.

Why does the IRD matter?

Now more than ever, the BSP stands ready to follow the US Fed’s lead in aggressively tightening policy. The rate increases will prevent a “significant narrowing” between the BSP and the Fed. While the BSP observes a flexible exchange rate policy, it may continue to face challenges until the depreciation of the peso is contained. Nonetheless, the BSP is always determined to use its numerous policy tools as needed to bring both core and headline inflation back on target.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the Bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco