Learn about the real effective exchange rate, its significance, and how to interpret it. Read this article today for more information.

FEATURED INSIGHTS

FEATURED INSIGHTSIn case you missed it, all hands are on deck to combat the negative effects of a soaring dollar on the economy. The US Federal Reserve’s interest rate hikes continue to have a tremendous economic impact, particularly on emerging market currencies. While the peso alone is not alone in this turmoil, one can argue that the Philippine economy remains fundamentally sound. There is one measure that tells us that the current state of the financial markets is not doom and gloom for our own local currency. It’s called the Real Effective Exchange Rate (REER).

What is the Real Effective Exchange Rate (REER)?

The Bangko Sentral ng Pilipinas (BSP) defines the Real Effective Exchange Rate (REER) as the weighted average value of the country’ exchange rate across a basket of other currencies adjusted for price differences between the country and those of other countries included in the basket. The REER is usually trade-weighted. When looking at the REER of the peso, we must compare its value against that of the Philippines’ main trading partners. These major trading partners of the Philippines account for at least one percent of the total merchandise exports and imports of the Philippines for the past five years, such as China, Japan, and Korea. A weighting will be given to different trading countries depending on how significant they are.

How do we interpret the REER?

A rising REER means local goods are becoming more expensive compared to those of trading partners. A country can get more foreign goods for an equivalent amount of domestic goods. Thus, an increase in REER will tend to increase net imports. Foreigners will buy less of our expensive exports, while importing becomes more attractive. On the upside, this can lower domestic demand and help reduce inflation. On the downside, an increase in REER will decrease the country’s international competitiveness.

The opposite is true for a falling REER. A fall in the REER should increase net exports as domestic goods are more competitive.

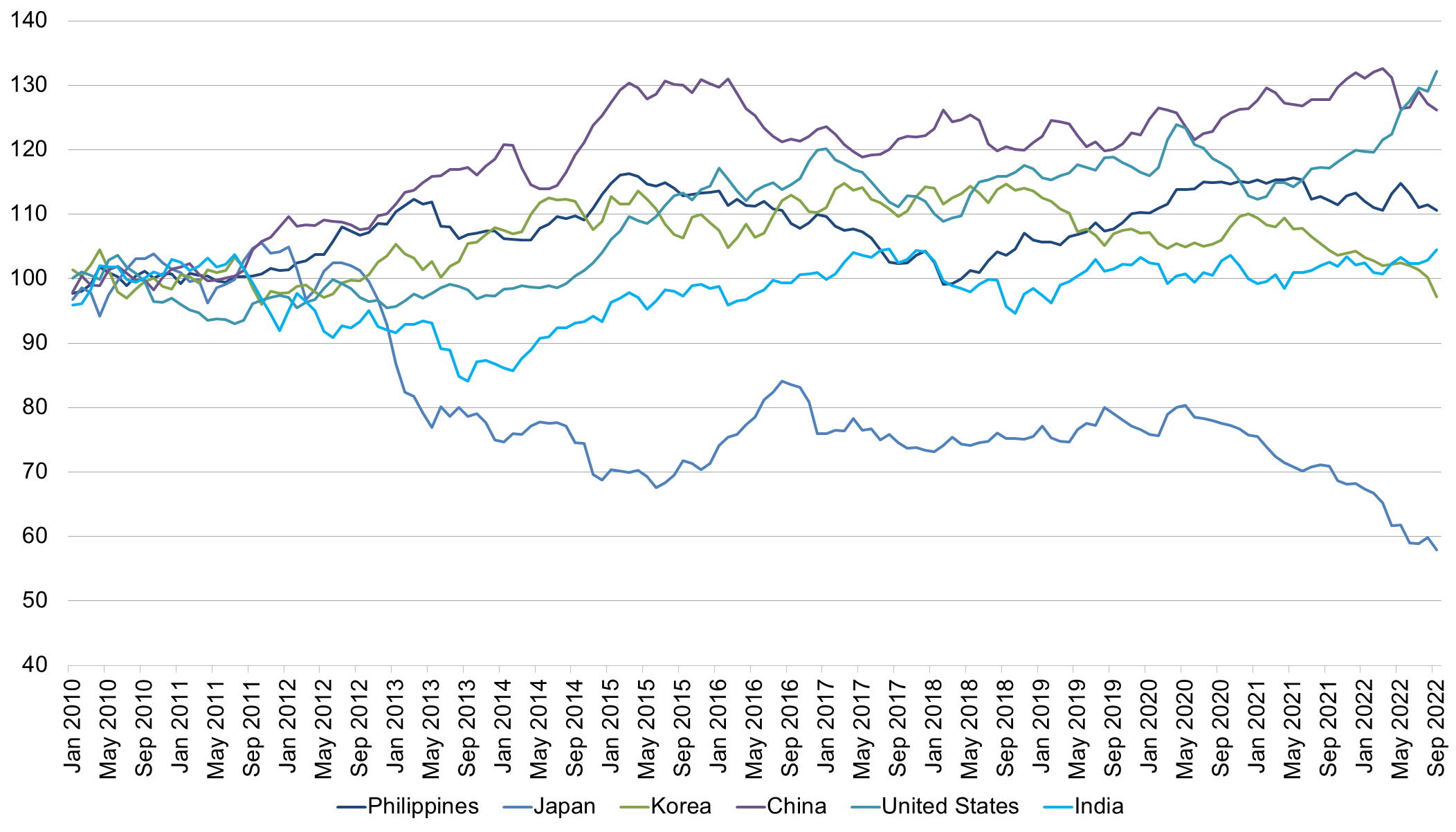

If we look at the REER of the peso based on the chart below, our currency is holding up to the dollar unlike other currencies. This means that imported goods are cheaper to buy.

On a trade-weighted basis, the peso is stronger relative to other currencies in Asia, thereby making our exports less competitive.

What is the significance of the REER?

The REER exists for us to have another measure to analyze the strength or weakness of the peso. One can also say the REER is an objective way of looking at the state of the local economy. While it is true that the strong dollar has brought about pain worldwide, the Philippines included, the peso is still strong against our neighbors’ currencies. At least, that is what the Real Effective Exchange Rate, or REER, tells us.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the Bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco