Tight labor markets, where there are more jobs than available workers, can cause prices of goods to soar. Raising interest rates to contain inflation can help, but it may still tip the scales towards a recession.

FEATURED INSIGHTS

FEATURED INSIGHTSOver the past year, the US Federal Reserve has rapidly increased interest rates to bring inflation under control. While inflationary pressure has begun to ease and the economy has shown signs of softening in recent months, the US labor market remains seemingly strong. How does the labor market remain robust despite the US Federal Reserve’s efforts to slow the economy?

What do we mean by tight or strong labor markets?

A labor market is said to be “tight” or strong if there are plenty of vacant jobs, while available workers are scarce. The labor market is said to be “loose” if the opposite holds true.

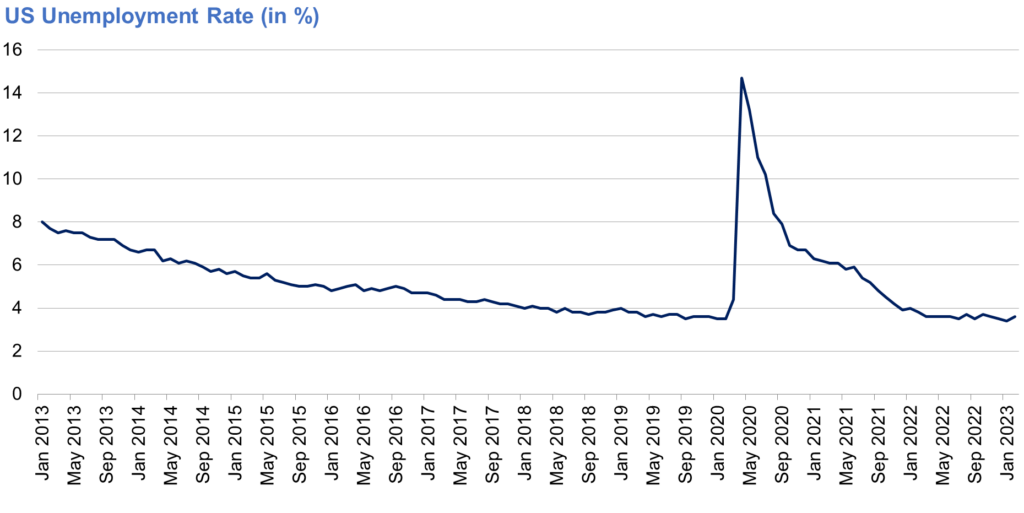

Let us look at recent data to better appreciate this definition. Take the US unemployment rate and jobless claims. While the unemployment rate and jobless claims slightly increased in February, they are still relatively low compared to previous decades.

Average hourly earnings also decelerated, but nonfarm payrolls (NFP) and job openings per unemployed worker remain relatively high. The data indicate that the labor market is still strong, albeit with mixed signals.

What made the US labor market strong?

Our research shows us that the tightness of the US labor market can be attributed to the low unemployment rate in the country. As inflation continued to accelerate in the US because of supply chain shortages and the Russia-Ukraine War, many people took on second jobs to cope with rising costs.

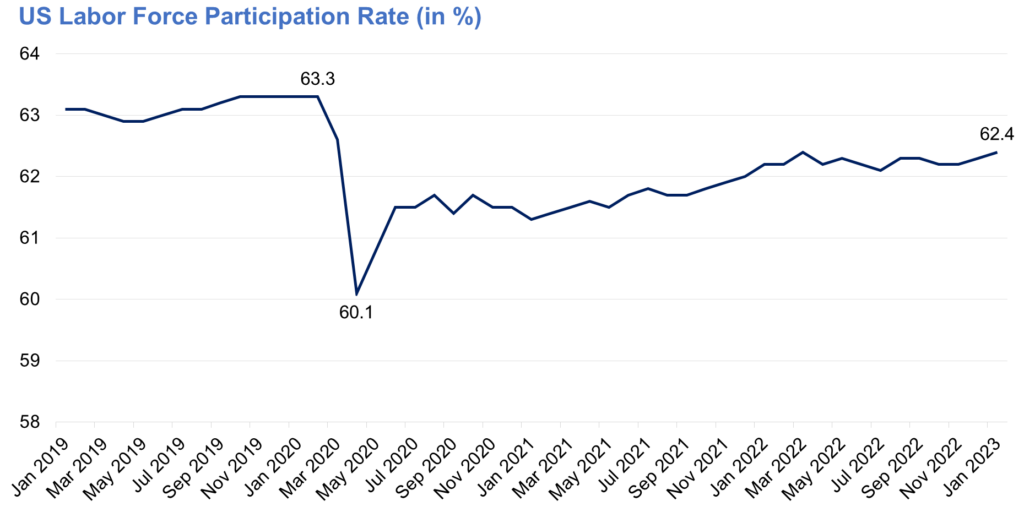

The low unemployment rate, on the other hand, may be due in part to the reduced size of the labor force. From a high labor force participation rate of 63.5% before the pandemic, this dropped to 60.1% amid the COVID-19 pandemic.

The low labor force participation rate may have stemmed from high unemployment benefits, stimulus checks, and other COVID-19 policy responses by the government, which led to higher household savings and encouraged individuals to postpone looking for work.

Other factors considered were the desire for higher wages which reduced interest in low-paying jobs, higher pace of retirements due to an aging population, slower population growth, increased dependent care needs, and even fears of contracting COVID-19 virus.

Why is a strong labor market inflationary?

When an economy is close to full employment, hiring workers becomes difficult. Businesses have to increase wages to retain and even hire more workers. To accommodate this increase in wage cost, businesses are forced to raise prices, thereby contributing to inflation.

What are the implications for monetary policy?

Since tight labor market conditions are inflationary, this will keep a central bank such as the Fed raising interest rates for longer to tame elevated inflation. This is why markets are concerned about whether the Fed can achieve a “soft landing,” where inflation is reduced without causing a recession.

A recession has become a risk because a decrease in consumer demand can also result in a decrease in companies’ sales, which will further hurt profits and trigger layoffs. Recent events have raised more questions about the ramifications of a tight monetary policy amid a persistently high cost of living and uncertainties in the global banking sector.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco