Discover the difference between nominal and real interest rates and make better decisions for your investments during inflation. Read this article to learn more.

FEATURED INSIGHTS

FEATURED INSIGHTSCurrent market conditions have reminded us of one of the key facts in economics: inflation erodes the purchasing power of money. Whether you are an investor or borrower, we need to adjust interest rates for inflation to understand their value over time. The real interest rate gives a more complete picture as it is adjusted to take into consideration the changes in the buying power of the money borrowed or invested. Let us dive deeper.

What is the difference between real vs. nominal interest rate?

Interest rates can be expressed in nominal or real terms.

A nominal interest rate is one that does not adjust for inflation. It shows the price of money and reflects current market conditions. It may be influenced by a central bank’s key policy rate or another benchmark rate. This nominal interest rate tells you how much money you will either pay (such as in interest on a loan) or receive (such as interest on a savings account).

On the other hand, the real interest rate reflects the actual return on investments, as well as the true cost of borrowing. High inflation can erode purchasing power, and at the same time, increase the value of payments on debt in real terms, which is why the real interest rate provides a better picture whether you borrow or invest.

How do we calculate the real interest rate?

In economics, the so-called Fisher equation provides the link between nominal and real interest rates. To convert from nominal interest rates to real interest rates, we use the following standard formula:

real interest rate = nominal interest rate − inflation rate

To find the real interest rate, we take the nominal interest rate and subtract the inflation rate. For example, if a loan has a 6% interest rate and the inflation rate is 2% percent, then the real return on that loan is 4%.

In calculating the real interest rate above, we used the actual inflation rate. This is appropriate when we want to understand the real interest rate paid under a loan contract.

But when a loan agreement is made, the future inflation rate is not yet known. Instead, we can use inflation expectations to determine the interest rate on a loan. More formally, we can say that real rates are calculated by adjusting nominal rates by an estimate of the inflation rate in the economy. The formula now becomes:

real interest rate = nominal interest rate − expected inflation rate

How do we interpret positive or negative real rates?

When the nominal interest rate is higher than the inflation rate, the real interest rate is positive. When the nominal interest rate is lower than the inflation rate, the real interest rate is negative.

Higher real rates are good news for investors. It means you have more purchasing power. It also implies you will have more purchasing power in the future if you start investing today. Meanwhile, higher real rates reflect the fact that borrowing is getting more expensive. The same is true on the opposite side.

How does monetary policy affect real interest rates?

The Bangko Sentral ng Pilipinas (BSP) can influence the direction of the Philippine economy with its monetary policy. We already know that high inflation may push the central bank to tighten monetary policy and vice versa. The BSP cannot set the real interest rates because it cannot set inflation.

However, the central bank’s policy action can influence inflation expectations. Thus, by signaling its policy intent through monetary policy rate adjustment, the central bank can affect the real return on funds faced by households and firms.

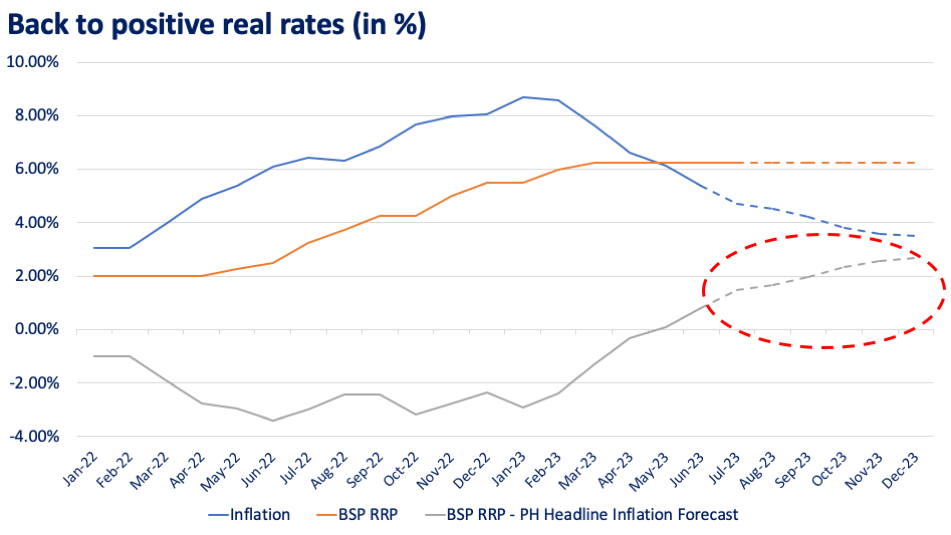

As seen in the chart below, we think the return to positive real rate territory this year should attract offshore investors driven by the decline in domestic inflation. While price pressures have significantly tempered in recent months, upside risks to inflation will be a major consideration for the BSP, which may also push inflation expectations higher and will prompt the BSP to keep interest rates at its current level of 6.25% until yearend.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco