The “Dot Plot” is a convenient guide for predicting where US interest rates are going. Its predictive value may not always be spot on, but investors can’t ignore it either.

FEATURED INSIGHTS

FEATURED INSIGHTSSince 2012, the US Federal Reserve has published a chart known as the “Dot Plot”, which maps out policymakers’ expectations for where short-term interest rates could be headed in the future. It is closely watched by investors, economists, and other market watchers for indications on the future trajectory of the US interest rate.

What is the Fed Dot Plot?

Every quarter, the policy-setting Federal Open Market Committee (FOMC) publishes a Summary of Economic Projections (SEP) which includes the Dot Plot, a chart showing where each of the 19 members of the FOMC expect the federal funds rate to be for the next three years and the long term. The 19 Fed officials who contribute to the Dot Plot include seven members of the Board of Governors of the Federal Reserve System and presidents of the 12 regional banks. Each dot on the chart represents the forecast of every Fed official sans their identity.

The long term view of the Fed officials represents the peak or “neutral rate” for the federal funds rate after the central bank has finished tightening or loosening monetary policy. It is the rate at which the monetary policy is neither accommodative nor restrictive, or the rate if economic growth and inflation rate are both at its natural rate.

Why was the Dot Plot created?

Fed officials started using the Dot Plot in 2012 at a time when the US economy was recovering from the aftermath of the 2008 financial crisis and when interest rates were near zero. The US central bank wanted to give the financial markets an advance look at what officials were thinking before they make any official policy decisions during their meetings. It was also introduced in an attempt to become more transparent about its policies moving forward.

The Dot Plot was a form of an “aggressive forward guidance”, a concept that former US Fed Chairman Ben Bernanke coined to prepare markets and guide investors’ expectations.

How do you read the Fed Dot Plot?

When one is looking at the Dot Plot, every dot actually tells us a member’s view of the range where rates should be for a particular period. Each dot represents the middle or median of a range. In short, the dot is not a fixed or specific figure that a member is targeting.

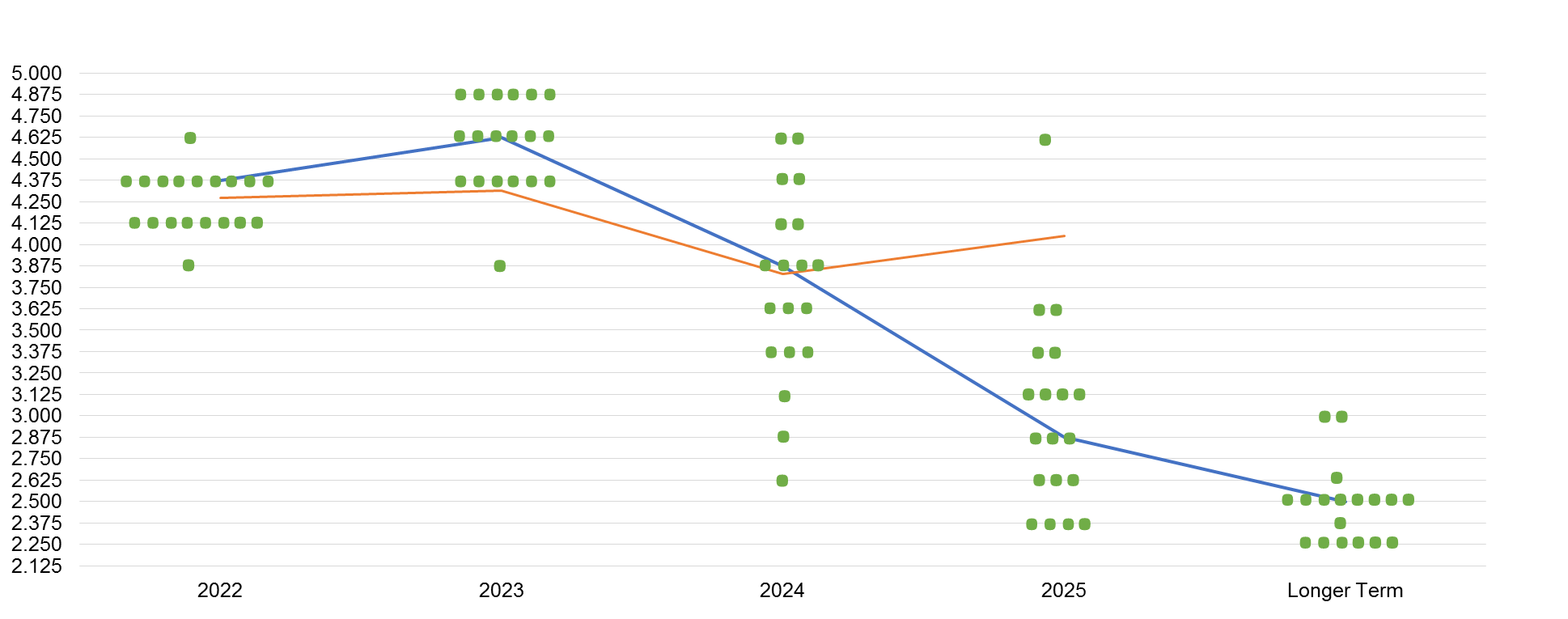

Let us look at the September 2022 FOMC Dot Plot:

The X-axis of the chart below represents the years, while the Y-axis represents the target fed futures target rate.

By yearend 2022, majority of Fed officials believe that the fed funds target rate should be in the range of 4.25% to 4.5%.

By yearend 2023, six Fed officials believe that the fed funds target rate should be in the range of 4.75%-5%. Six members also think that the interest rate will be in the range of 4.5%-4.75%, while another six think it will end within 4.25%-4.5%.

Now try it yourself and read the dots for 2024 and 2025.

With the latest inflation and employment, forward expectations based on the Fed Dot Plot are higher US policy rates for longer, with no cuts until 2024, consistent with Fed statements that inflation needs to slow for several months before they ease off on tightening.

How reliable is the Fed Dot Plot?

While the Fed Dot Plot has been very helpful and useful for investors and economists for gauging potential changes in monetary policy, Fed officials mentioned to not place great emphasis on the Dot Plot. The central bank’s monetary policy claims to be largely data-driven, depending on economic trends, inflation, and global events. As a result, long-term projections carry less weight than those of the near term.

For example, the Fed did not stick to its December 2019 predictions as the coronavirus pandemic surprised the whole world in 2020. The Federal Reserve altered the country’s key policy rate by setting it near zero.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the Bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco