Examining the economy in 2022 and predicting what’s ahead

Here is a quick review of what happened in 2022 and how it may affect the Philippine economy this year and the next.

Despite more relaxed mobility restrictions and the reopening of most countries, the previously anticipated faster global growth for 2022 was unexpectedly hampered by geopolitical tensions and external events.

In February 2022, the conflict between Russia and Ukraine broke out, which disrupted supply chains and induced an energy crisis, especially in Europe. The shockwaves in the global commodities market pushed inflation up globally.

This led to a more aggressive monetary policy tightening by the US to abate inflation, which then strengthened the dollar and weakened other global currencies. Moreover, this was also the year when China implemented its zero-COVID policy more aggressively, triggering market volatility because so much depended on that country’s demand.

These three major events affected the global economy, with global GDP growth in 2022 expected to fall to 2.9%, according to estimates from the World Bank and Euromonitor, versus the 3.2% forecast of the International Monetary Fund (IMF), from 6% growth in 2021.

Growth beyond expectations

Despite these global headwinds, the Philippines outperformed growth expectations in 2022, as improved domestic conditions offset external challenges. On average, the economy grew by 7.7% from Q1 to Q3 of 2022, versus 4.9% during the same period in 2021.

First quarter growth posted the sharpest increase for 2022, mostly on base effects. The positive expansions in the 2nd and 3rd quarters put the Philippines as the second-best performing nation among emerging Southeast Asian economies.

Growth was primarily fueled by private consumption, with pent-up demand driving revenge spending due to the reduction in COVID-19 cases and the accelerated pace of the economic reopening that followed. Election-related and campaign activities during the first half of the year likewise boosted domestic demand and bolstered certain industries, such as travel, accommodation, information and publishing, and communication, among others.

Inflation woes

Full-year average inflation, on the other hand, came in at 5.8%, versus 3.9% in 2021. This was in the face of inflationary pressures from the supply-chain bottlenecks caused by the conflict in Eastern Europe, which elevated global commodity prices, especially for food and fuel items.

Further exacerbating headline inflation were the weather disturbances that constricted the supply of various agricultural commodities, as well as shortages in select commodities throughout the year, such as salt, sugar, fertilizer, and onions, among others. Second-round effects, which have seeped into transportation costs and wages, have also pushed prices higher.

Because of the high-inflation environment experienced globally, the US Federal Reserve adopted a hawkish monetary policy stance in 2022, increasing benchmark rates by a cumulative total of 425 basis points (bps) to a range of 4.25% to 4.50% by yearend 2022.

Rate hikes to combat inflation

As a result, central banks around the world, including the Bangko Sentral ng Pilipinas (BSP), had to assume a tighter monetary stance as well. The BSP hiked policy rates by a total of 350 bps to 5.5% by yearend 2022 to mitigate heightened inflation expectations, the weakening of the local currency, the rise of second-round effects manifested in wage increases and transport fare hikes, and the higher suggested retail prices of several commodities.

Because of aggressive Fed rate action, the peso depreciated substantially in 2022, where it closed at record lows of PHP 59:USD 1 twice, during September and October, depreciating by 15.7% since yearend 2021.

Nonetheless, the peso was able to rebound in the last few months of 2022 due to interventions by the BSP, the seasonal increase in OFW remittances, and the export season toward yearend. Additionally, markets seemed to have already priced in rate cuts despite the Fed’s continued rate hike signals, which likely strengthened the peso.

Outlook for 2023 and 2024

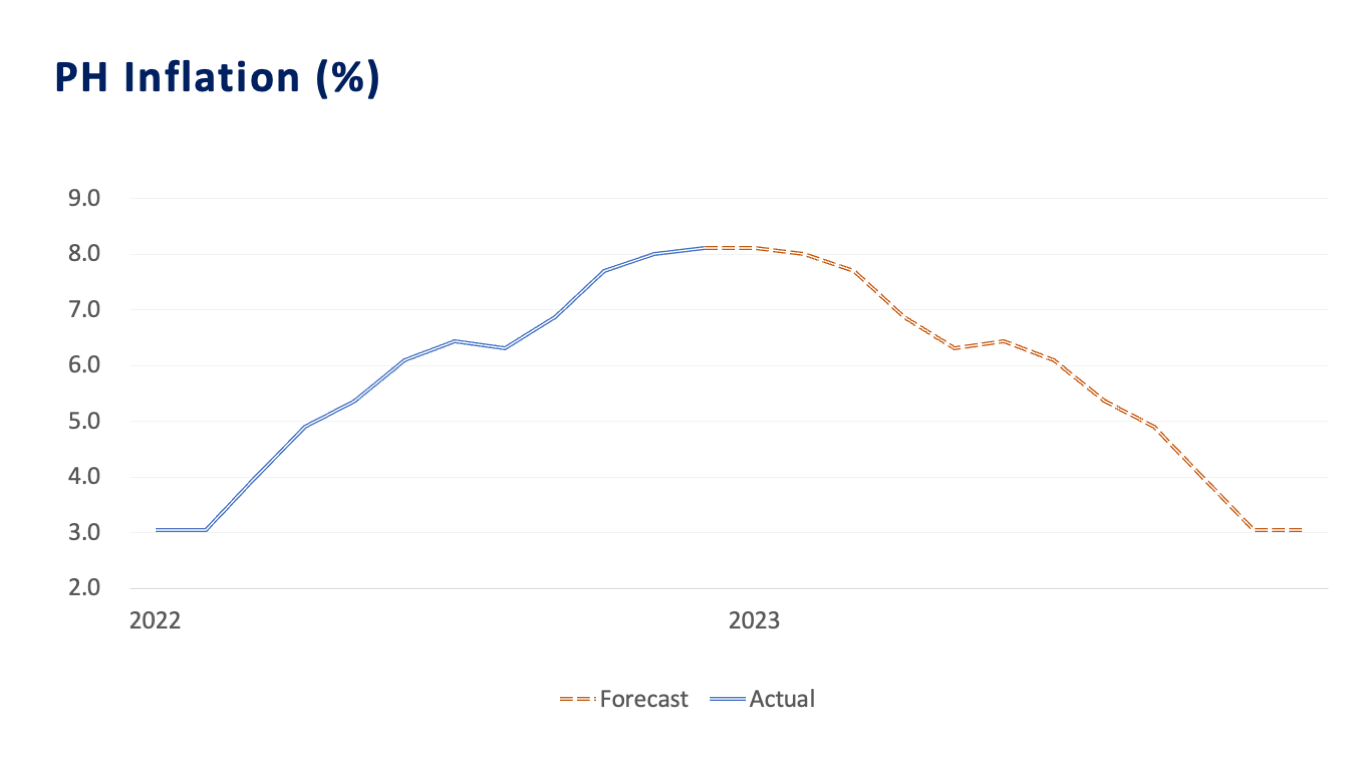

In the near term, high inflation is expected to persist, but it will likely ease throughout 2023 and 2024 because of monetary tightening and an easing of supply chain disruptions. The 2023 inflation scenario would likely mirror that of 2022, but in reverse (see graph below).

Thus, inflation is expected to settle at the 5.0% to 6.0% range this year, and 4.5% to 5.5% in 2024. Consequently, borrowing costs are seen to peak this year at 6.0% and come down to 5.0% in 2024 based on inflation expectations.

Inflation is expected to settle in the 5% to 6% range in 2023.

For the dollar-peso exchange rate, markets are already pricing in rate cuts even if the Fed is still on hike mode, but the peso is still projected to weaken towards yearend to around PHP 57 as a potential recovery in China’s demand may rally oil prices up in Q2, and the Philippines will likely be importing a lot in Q3 due to continued growth.

Nevertheless, due to expected lower inflation and interest rates in 2024, the peso is forecasted to strengthen to PHP 56.6 by yearend 2024.

Growth from rising domestic demand

Robust growth in 2023, which we estimate to be at around 6% to 7%, is still expected, driven by domestic demand and consumer spending amid further easing of COVID-19-related restrictions as well as increased infrastructure spending, among others.

However, this year’s growth is assumed to be lower than the previous year’s on account of the following: external headwinds such as the continued conflict between Russia and Europe, which may likely continue to lead to supply chain bottlenecks; the second-round effects of inflation; the effects of the BSP’s policy rate hikes on spending; and potential acceleration of prices due to a rebound of China’s demand stemming from its zero-COVID policy pivot.

This acceleration in demand from China will likely push central banks to continue raising interest rates to arrest rising prices while reining in consumption and therefore growth. Consequently, the slowdown of advanced economies, such as the US and Europe, may pull down the Philippines’ growth this year.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her Bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano