Examining inflation at its core

Core inflation rose to its highest level in over two years in March 2023, despite headline inflation slowing to its lowest clip in six months. Why does this occur, and what are the implications?

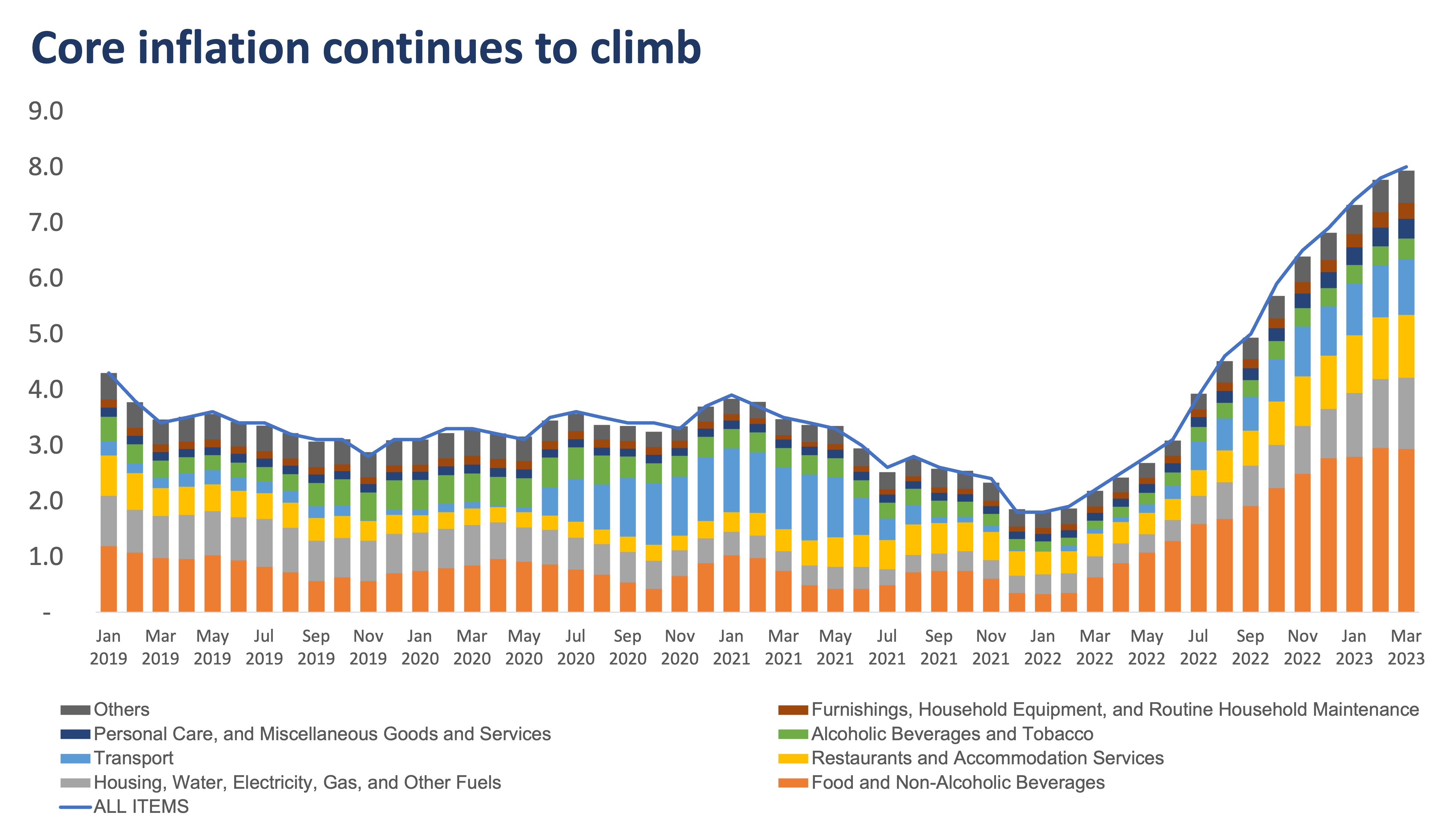

Core inflation recently climbed to its highest level in over two years, to 8.0% in March 2023, from 7.8% the previous month and 2.2% in the same period last year, despite headline inflation already decelerating to its lowest level in six months.

The highest contributors to core inflation in March were food commodities—particularly milk and other dairy products as well as sugar and desserts—housing, water, electricity, gas, and other fuels, particularly housing rentals, restaurants and accommodation services, and transport (see below).

Food commodities and other necessities such as housing, water, electricity, gas, and other fuels continue to contribute the most to inflation.

If headline inflation measures the year-on-year movements in the overall consumer price index (CPI), which is the average price of a basket of goods and services that is commonly consumed by a Filipino household, what does core inflation measure?

Headline vs core

Core inflation also calculates the changes in the average prices of a certain basket, but this basket excludes commodities with volatile prices such as rice, vegetables, meat, and petroleum and fuels for personal use, among others.

A common misconception is that core inflation excludes food and energy commodity prices altogether. But this is not the case, as only certain food and energy commodities are removed from the calculation of core inflation. As seen in the graph above, food commodities and other energy items are still the top contributors to core inflation.

Headline inflation is affected by factors that are historically volatile and are usually beyond the scope of economic policy. Because of this, core inflation is used as a side-by-side measure as it depicts underlying, or long-term, trends of price movements, stripping away the effects of temporary shocks and disturbances, such as a shortage in agricultural inputs or a surge in global oil prices.

Why is core inflation still up?

The still-elevated and still-increasing core inflation in the Philippines is due to broadening price pressures. It is also influenced by the impact of second-round effects. The higher prices of volatile groups have affected and have seeped into other commodity groups.

For example, a shortage in food commodities may elevate the prices of restaurants and accommodation services since the former are used as inputs for the latter.

The effects of higher transport fares and above-average wage adjustments in 2023 (second-round effects) have also started to spill over to other commodity groups, particularly non-volatile groups. Note that transport is usually the fourth-highest contributor to core inflation, while higher wages encompass different commodity groups, ultimately translating to higher prices of various products and services to make up for the higher labor expenses.

Core inflation is still seen to be elevated, given the continued impact of the second-order effects of inflation. Particularly, prices of non-volatile items may remain sticky as inflation becomes more entrenched despite headline inflation slowing.

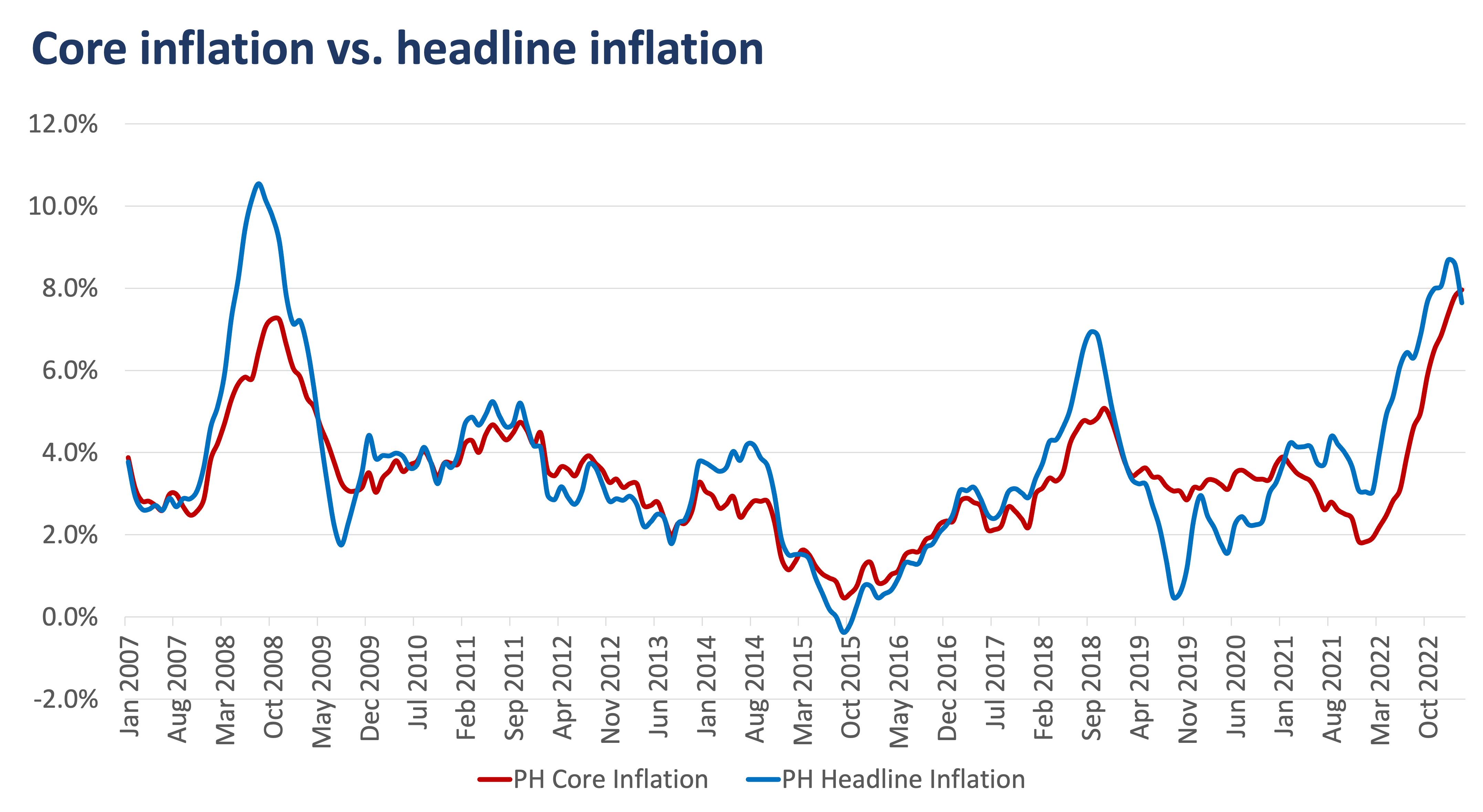

Nevertheless, core inflation is expected to decelerate as headline inflation is already easing, but at a later time and at a more gradual pace, similar to the behavior of both measures in 2008-2009 and 2018-2019, where core inflation declined at a more muted pace than headline inflation.

Core inflation eases more gradually than headline inflation.

The Bangko Sentral ng Pilipinas (BSP) looks at core inflation as a complementary measure to headline inflation, as the former represents the more permanent trend in the behavior of consumer prices, while the latter involves short-lived price disturbances in the Philippines.

Thus, monetary policy may help alleviate core inflation, just like it does with headline inflation. However, remember that core inflation is not intended to replace headline inflation. The two should be taken together to assess the overall state of the inflation environment.

Outlook

Because of the still-high core inflation, rate hikes may still be on the table. The overnight reverse repurchase (RRP) rate may further peak at 6.5% (from 6.25% at present), but headline and core inflation are expected to trend downwards towards year-end, which could give way to rate cuts.

That is to say that the local inflation environment is expected to improve, especially in the second half of this year, barring any further supply shocks and should the interest rate hikes prove to be effective.

Despite faster core inflation still on the cards in the next few months, overall, we expect the RRP rate to end at 6.0% this year in light of lower inflation expectations toward year-end.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano