Don’t miss out on these tactical GS trades

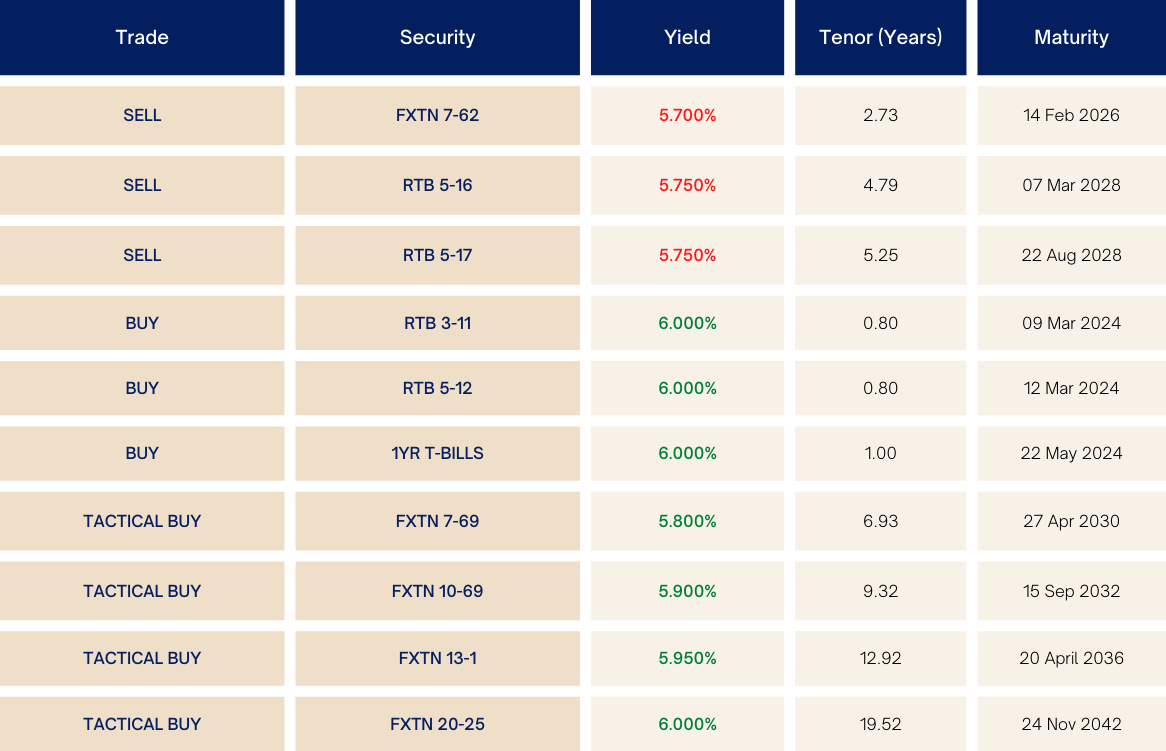

If you followed our recommendation to take profit from long-term peso government securities (GS) last month, good for you. Now we believe it’s time to reinstate your positions with the upcoming auctions in June.

Access this content:

If you are an existing investor, log in first to your Metrobank Wealth Manager account.

If you wish to start your wealth journey with us, click the “How To Sign Up” button.

Good news: Our recommendation to take profit from long-term peso government securities last month has proven favorable to investors, as prices of peso government securities (GS) have cheapened in the past week, following the recent sell-off.

Even better news: As peso yields now trade higher by some 15 basis points (bps), we see a good opportunity to reinstate GS positions in the upcoming auctions in June, at more attractive entry levels.

The best part? We anticipate decent trading gains for investors who can hold for up to six months, given our clear view of falling peso interest rates in the near term.

Exhausted rally

Earlier this month, the peso GS market saw a notable rally, with yields across all tenors trading lower by around 30 bps ahead of the BSP’s widely expected decision to keep

Read More Articles About:

DOWNLOAD

DOWNLOAD

By Patty Membrebe

By Patty Membrebe