Asia’s top 2 economies move to ease tariff storm’s blow

China and Japan face trade war challenges in 2025, with tariffs disrupting exports and supply chains amid growing economic and geopolitical risks. Read more here.

Countries take steps to shield their economy as US President Donald Trump’s tariff policy fuels global trade uncertainty.

In Asia, China’s bolstering consumer subsidies while Japan pursues wage growth to brace for economic challenges amid rising trade tensions.

China’s consumer focus

The Chinese government introduced a string of subsidies to boost consumer spending and economic growth. These form part of a strategy to cushion risks, including heightened trade tensions.

A consumer-trade-in goods policy, initially introduced in 2024, got more funding. This year, China plans to channel CNY 300 billion (USD 41 billion) into the initiative, which covers goods from home appliances to cars. Industrial production has seen notable growth since the program began.

Related article: As China faces high tariff risk, less US reliance may soften its blow

Some 30 policies aimed at boosting household spending were also unveiled such as wage increases to pension and insurance subsidies. While these will support consumption, achieving the 5% economic growth target this year could still be a challenge.

China strategy: Shift from underweight to neutral

Upgraded earnings expectations for Chinese firms provide a significant tailwind. Still, volatility is expected in the near term, as investors assess the impact of trade policies. Investors will remain uncertain until there’s progress in US-China trade negotiations.

China is expected to pursue negotiations with the US over the medium term or implement robust fiscal stimulus, consistent with its approach of economic support through decisive policy.

Japan’s pay hike

Japan already faces the 10% baseline tariff imposed by the US, while the 24% reciprocal tariff remains a threat – only postponed for trade negotiations.

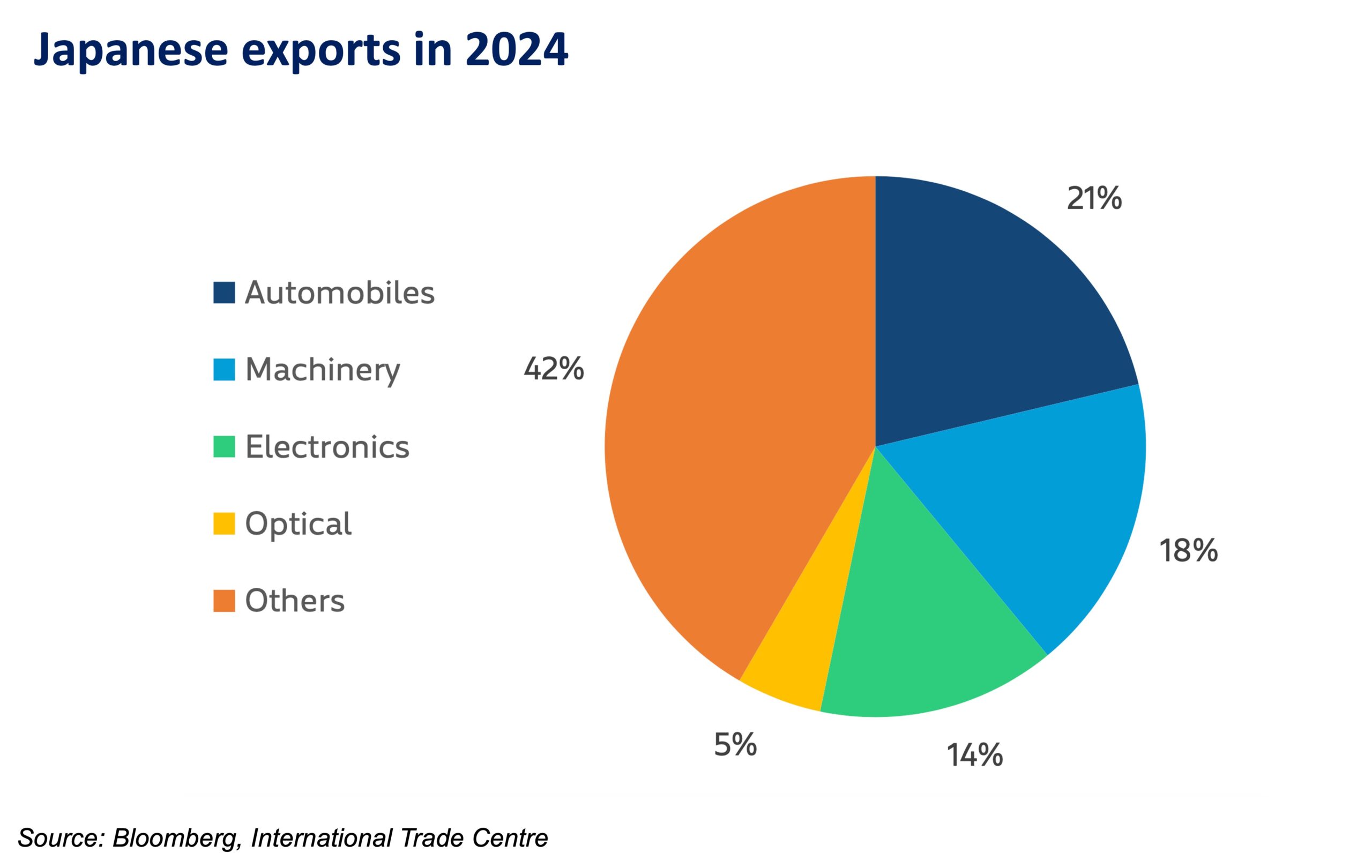

One of Trump’s first moves was a 25% tariff on automobile, steel, aluminum, and chip shipments to the US. Automobiles comprise about a fifth of Japan’s exports, with the US its top destination. Analysts expect Japan’s GDP to face significant impact. In response, Japan’s automobile industry showed interest in shifting production to the US.

Yearly, the “shunto” wage negotiations allow labor unions and companies to set compensation, typically leading to wage hikes that outpace inflation and strengthen consumer confidence. For 2025, the agreed average pay increase is at 5.37%, still considerably high.

Japan’s household consumption is seen following a steady and gradual improvement. With higher wages, consumers are expected to spend more and support economic growth.

Japan strategy: Remain neutral

As wage hikes support the economic outlook and business environment, Japan sees some bright spots.

However, the overall strategy is to remain cautious and maintain a neutral stance on Japan. Data have yet to show growth prospects materializing and expectations of more tariffs are on the horizon.

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses.)

ANNA DOMINIQUE CUDIA, MBA, CSS, is the Head of Markets Research at Metrobank’s Trust Banking Group, spearheading the generation and presentation of financial markets insights to clients. She used to be with Metrobank’s Investor Relations, where she brought in international awards and took part in various multi-billion peso and dollar capital raising activities. She holds a Master of Business Administration (Finance) degree, with distinction, from the University of London, and industry certifications in finance. She is a naturally curious person and likes to travel here and abroad.

SOPHIA THERESE “PIA” BONIFACIO is a Markets Research Analyst at Metrobank’s Trust Banking Group, covering local and offshore macroeconomic research. She obtained her Bachelor’s degree in Economics with a Specialization in Financial Economics, cum laude, from the Ateneo de Manila University and is a Certified UITF Sales Person (CUSP). Pia enjoys long road trips and is a self-proclaimed milk tea connoisseur.

TRISTAN JAMIL “TRISTAN” AGUSTIN is a Markets Research Analyst at Metrobank’s Trust Banking Group, covering local and offshore macroeconomic research. He obtained his Bachelor’s degree in Management Economics with a Specialization in Financial Economics, from the Ateneo de Manila University and is a Certified Treasury Professional. Tristan tries to stay active by going to the gym and playing basketball.

DOWNLOAD

DOWNLOAD

By Sophia Bonifacio, Tristan Agustin, and Anna Cudia

By Sophia Bonifacio, Tristan Agustin, and Anna Cudia