Consensus Pricing

DOWNLOAD

DOWNLOAD

Inflation Update: Lower June inflation aligns with the BSP’s dovish signals

DOWNLOAD

DOWNLOAD

Sector Update: Fired up or parched down? A look on earnings indications as El Niño fizzled out

DOWNLOAD

DOWNLOAD

Yields rise on inflation, US jobs data

YIELDS on government securities (GS) edged up last week as headline inflation hit a new 14-year high in December.

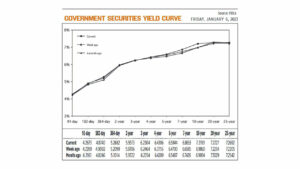

GS yields, which move opposite to prices, went up by an average of 6.85 basis points (bps) at the secondary market week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Jan. 6 published on the Philippine Dealing System’s website.

Yields on the 91- and 364-day Treasury bills (T-bill) increased by 4.04 bps and 5.83 bps to 4.2673% and 5.2682%, respectively, while the 182-day T-bill went down by 2.62 bps to 4.8740%.

At the belly, rates of the two- and three-year Treasury bonds (T-bond) declined by 1.33 bps (to 5.9573%) and 1.60 bps (6.2304%).

Meanwhile, yields on the four-, five-, and seven-year T-bonds climbed by 5.51 bps (6.4306%), 12.44 bps (6.5944%), and 20.68 bps (to 6.8653%), respectively.

Likewise, rates of the 10-, 20-, and 25-year papers went up by 22.59 bps, 4.93 bps, and 4.87 bps to 7.2119%, 7.2727%, and 7.2692%, respectively, to close the first trading week of the year.

Total GS volume on Friday reached P7.897 billion, higher than the P7.227 billion recorded on Dec. 29.

Analysts said the December 2022 inflation data and positive economic reports in the United States are what drove yields higher last week.

Inflation picked up to a fresh 14-year high last month, as prices of food, particularly vegetables, surged during the holiday season, the Philippine Statistics Authority (PSA) said on Thursday.

Preliminary PSA data showed annual inflation quickened to 8.1% in December, from 8% in November and 3.1% in December 2021. This was the fastest since the 9.1% print in November 2008.

Inflation was below the 8.3% median estimate in a BusinessWorld poll of 11 analysts and within the 7.8-8.6% estimate given by the Bangko Sentral ng Pilipinas (BSP).

Full-year inflation averaged 5.8%, matching the BSP’s forecast but faster than its 2-4% annual target and the 3.9% average posted in 2021. It also marked the highest since 2008’s 8.2%.

Meanwhile, the latest US jobs report showed wage growth slowed in December, fueling investor bets that inflation is easing and that the Federal Reserve need not be as aggressive as some feared, Reuters reported.

Friday’s data showed the US economy added jobs at a solid clip in December, pushing the unemployment rate back to a pre-pandemic low of 3.5% as the labor market stayed tight, while average hourly earnings rose 4.6% in December from a year earlier, down from 4.8% in November.

Even though the data showed a still-robust labor market, investors read it as a sign that the US economy might be poised for a “soft landing” amid rising rates. A cooldown in wage inflation, an indicator the Fed also monitors when addressing price pressures, added to the optimism.

In another set of data, US services activity declined for the first time in more than 2-1/2 years in December as demand weakened, with more signs of inflation easing.

With the start of the new year, the bond trader said rates may continue to go up amid expectations of more monetary tightening by the BSP and the Fed.

“Near term, upward pressure on yields shall persist given that BSP and Fed hikes are not yet done until probably the first half of the year,” the bond trader said.

“However, long-term PHP BVAL yields and Treasury bond yields would still correct lower, especially if US/global/local interest rates ease further in the coming months of 2023 and… central banks raise policy rates in an effort to better manage inflation and inflation expectations as part of their price stability mandate,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in an e-mail. — B.T.M. Gadon with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld