Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Yields on gov’t securities inch up on high bond supply

Yields on government securities (GS) traded in the secondary market ended mostly higher last week following the results of the Treasury’s 10-year bond auction, which partly offset the rally caused by expectations of a Bangko Sentral ng Pilipinas (BSP) rate cut as early as August.

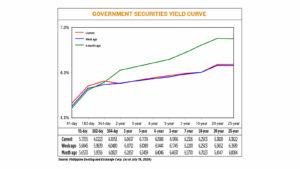

GS yields, which move opposite to prices, went up by 2.11 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of July 19 published on the Philippine Dealing System’s website.

Rates of the 91-, 182-, and 364-day Treasury bills (T-bills) increased by 5.10 bps, 3.84 bps, and 5.73 bps week on week to 5.7355% and 6.0223%, and 6.1053%, respectively.

At the belly, yields on the three-, four-, five- and seven-year Treasury bonds (T-bonds) went up by 0.5 bp (to 6.1139%), 1.47 bps (6.1588%), 2.11 bps (6.1956%) and 1.25 bps (6.2326%), respectively, while the two-year T-bonds inched down by 0.55 bp to fetch 6.0657%.

At the long end, the 20-, and 25-year debt papers saw their rates increase by 1.76 bps (to 6.3828%) and 2.03 bps (6.3822%), respectively, while the 10-year bond’s yield was flat at 6.2503%.

GS volume traded was at PHP 8.06 billion on Friday, lower than the PHP 41.7 billion recorded a week prior.

“[Last] week, bond yields remained largely range-bound as optimism surrounding the BSP’s guidance on potential interest rate cuts in August was tempered by an unexpectedly high bond market supply. The Bureau of the Treasury’s (BTr) issuance of P60 billion in 10-year bonds led to market resistance against further downward pressure on yields due to supply indigestion,” ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said.

“Market players initially pushed the 10-year bond yield lower early in the week, but the larger-than-expected bond award later caused yields to rise, resulting in yields remaining range-bound,” he said.

Dino Angelo C. Aquino, vice-president and head of fixed income of Security Bank Corp., likewise attributed recent GS yield movements to the dovish comments made by the central bank chief, coupled with the possibility of lower inflation in the next few months.

“Lower inflation, [can be attributed] to the implementation of Executive Order 62, where the import on rice tariffs will be cut from 35% to 15%,” Mr. Aquino said.

“Economic growth forecasts from the IMF (International Monetary Fund) and ADB (Asian Development Bank) for the Philippines suggest a clear path towards a soft landing, indicating that monetary policy cuts could occur while growth remains well managed,” Mr. Ulpo added.

BSP Governor Eli M. Remolona, Jr. last month said the Monetary Board may deliver its first rate cut in over three years at its Aug. 15 review — the only policy meeting scheduled in the third quarter — as they expect inflation to continue easing this semester.

The Monetary Board could reduce borrowing costs by 25 bps in the third quarter and by another 25 bps in the fourth quarter, he said.

The BSP last month kept its policy rate at a 17-year high of 6.5% for a sixth straight meeting after raising interest rates by 450 bps from May 2022 to October 2023.

Meanwhile, the BTr on Tuesday made a full award of the reissued 10-year T-bonds at lower rates as the offer was met with robust demand amid expectations of monetary easing by the BSP.

The Treasury raised PHP 30 billion as planned via the bonds as total bids reached P96.605 billion, or more than thrice the amount on the auction block. The bonds, which have a remaining life of nine years and six months, were awarded at an average rate of 6.212%. Accepted yields ranged from 6.18% to 6.223%.

The average rate of the reissued seven-year bonds dropped by 54.2 bps from the 6.754% fetched for the series’ last award on June 11 and was 3.8 bps lower than the 6.25% coupon for the issue.

To accommodate the strong demand seen for Tuesday’s bond auction, the BTr opened its tap facility window, from which it accepted another PHP 30 billion in bids. This brought last week’s total award to PHP 60 billion, and the total outstanding volume for the series to PHP 201.9 billion.

For this week, GS yield movements will likely be driven by the results of the Treasury’s bond auction on Tuesday, Mr. Ulpo said. The BTr will offer PHP 25 billion in reissued 20-year T-bonds with a remaining life of 19 years and 10 months.

“We anticipate that the upcoming 20-year auction will serve as a key indicator of the Bureau of the Treasury’s auction strategy and the market’s capacity to absorb additional bond supply. While the guided issue amount is P25 billion, a repeat of an aggressive tap award could push yields higher,” he said.

“Key driving factors will include market reactions to the auction results, investor sentiment regarding bond supply absorption, and any additional guidance from the BSP on monetary policy,” Mr. Ulpo added.

For his part, Mr. Aquino said the market may consolidate as GS yields are already around 40-60 bps lower for the month, with investors continuing to price in BSP rate cut expectations.

“As we speak, given where the levels are, the market is already pricing in two rate deductions for 2024,” he said. “We’re going to see some sticky price movements in the next few sessions, probably up until the next few weeks, as we approach the BSP meeting. So, we do expect range-bound movements.” — Abigail Marie P. Yraola

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld